- Gold soared to a record $3,812 amid US shutdown fears and Fed rate-cut bets.

- Silver and platinum rallied to decade highs as dollar weakness boosted metals.

- Bitcoin consolidates at $12K but analysts see Nvidia-like growth trajectory ahead.

Gold surged to record highs in Asian trading on Monday, showing why it is called the world’s premier safe-haven asset as uncertainty grips US politics and monetary policy.

Spot gold hit an all-time high of $3,812 an ounce, while December futures touched $3,839.05/oz, extending gains as investors sought shelter from a looming US government shutdown and positioned themselves for possible Federal Reserve rate cuts.

Silver and Platinum Join the Rally

Silver and platinum joined the rally, climbing to decade highs, as the dollar weakened. The last time US markets faced a comparable standoff was in late 2018 to early 2019, when a 35-day shutdown cut the GDP by an estimated $11 billion.

Related: Peter Schiff Says Bitcoin Is in ‘Stealth Bear Market’ When Priced in Gold

With funding set to expire at midnight on September 30, traders remain fixated on bipartisan negotiations in Washington, where leaders will meet President Donald Trump in a last-ditch attempt to avoid disruption.

Bitcoin Consolidates, Still Below All-Time High

While gold shines, Bitcoin is struggling to break free from consolidation around $12,000. The cryptocurrency is still about 10% below its all-time high of $124,000, but saw a 2.2% daily rise as trading volume spiked by over 75% in the past 24 hours.

Market analyst Jordi Visser argued that Bitcoin’s current price action mirrors the growth trajectory of Nvidia, noting that just as Nvidia endured multiple 20% corrections on its way to a 1,000% rally post-ChatGPT, Bitcoin too could face sharp pullbacks before reclaiming new highs.

Visser linked Bitcoin’s long-term growth potential to the rise of artificial intelligence. As AI adoption accelerates, he predicted that investors will increasingly view BTC as the ultimate store of value in the digital era.

On-Chain Resilience Backs Bitcoin’s Case

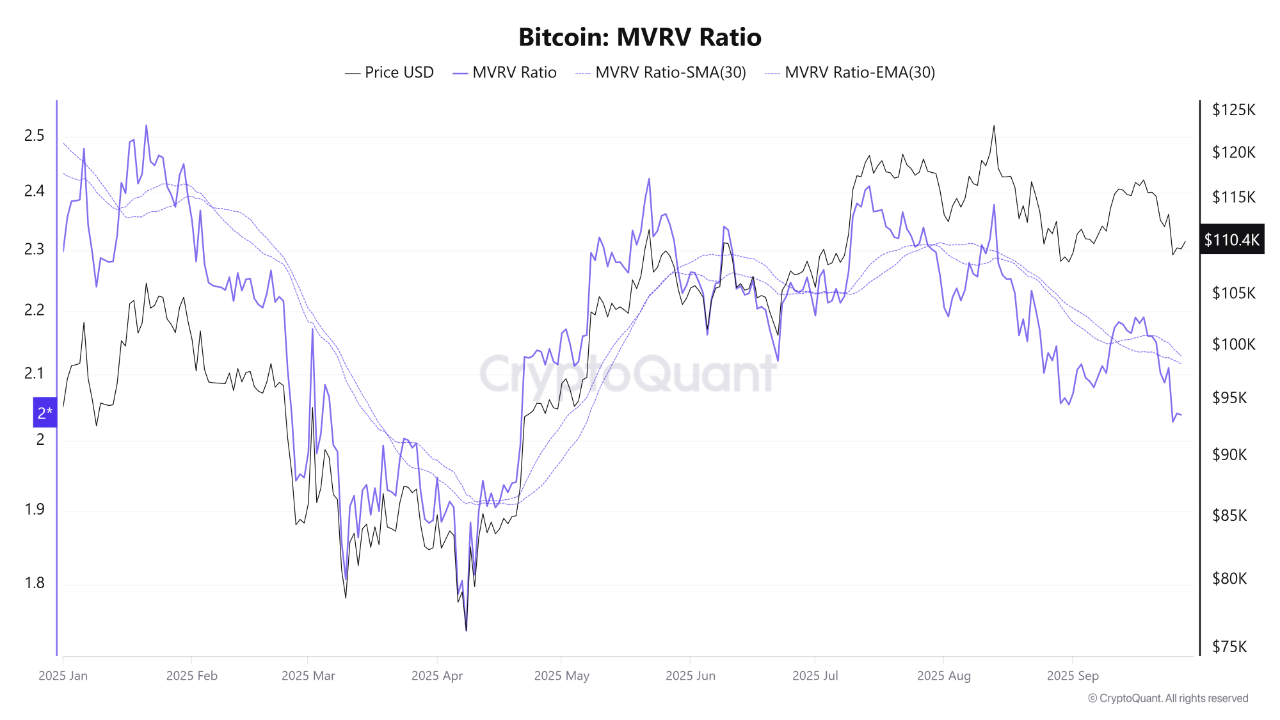

Analysts at XWIN Research Japan revealed that the MVRV ratio, which compares Bitcoin’s market value to the average cost basis of holders, has cooled to around 2.0, signaling neither excessive fear nor greed.

Historically, this mid-range consolidation has marked the reset phase before major expansions. Meanwhile, long-term holders remain steadfast, with profit-taking declining sharply.

The reduced supply pressure is similar to the patterns seen in 2017 and 2020, when reduced selling preceded powerful rallies.

Together, valuation resets and strong holder conviction suggest that Bitcoin is not at the end of its bull cycle, but rather pausing before its next upward surge.

Related: Bitcoin Price Prediction: BTC Holds $111K As Traders Eye $115K Liquidation Trigger

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.