- Goldman Sachs ranked BTC above US Treasury, Gold, and 22 other assets.

- CoinGecko believes Bitcoin was the worst-performing investment in 2022.

- Litecoin outperformed DeFi tokens with a landslide margin of 79% growth from 2022.

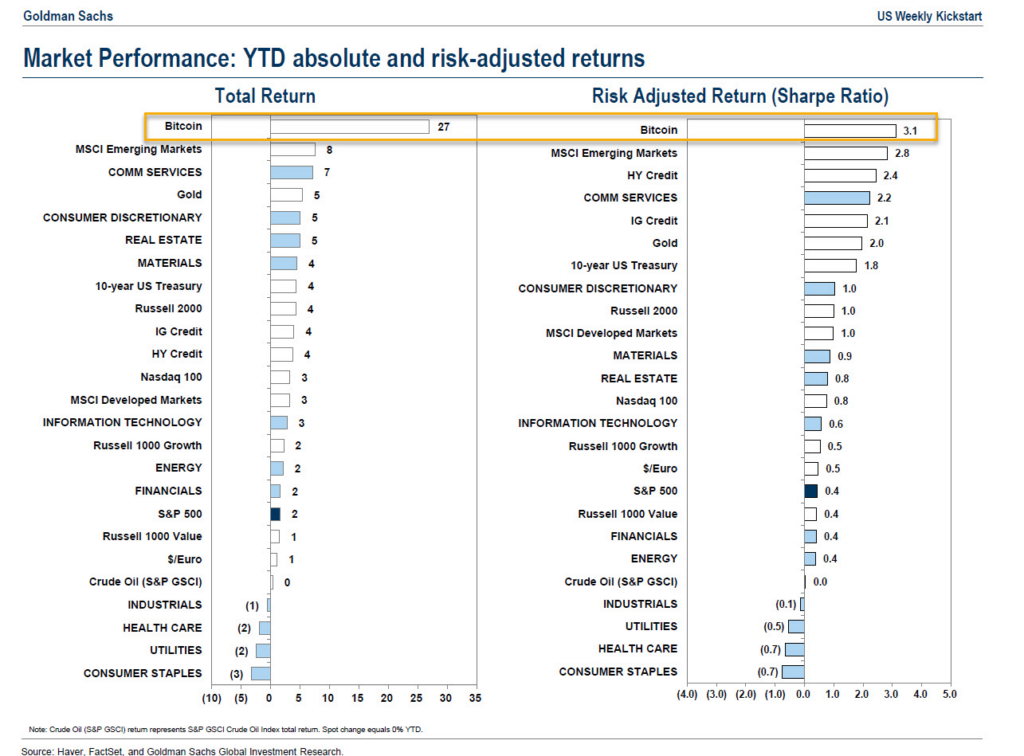

According to the year-to-date asset return of Goldman Sachs, one of the most prominent financial institutions in the United States, Bitcoin (BTC) was the best-performing asset in the world.

Goldman Sachs ranked Bitcoin above gold, real estate, 10-year US Treasury, energy, Nasdaq 100, and twenty other investment instruments. Notably, Goldman Sachs added Bitcoin to its ranking of assets barely two years ago.

Interestingly, the market tracking platform, CoinGecko, believes Bitcoin was the worst-performing investment in the 2022 calendar year. In its recent annual crypto industry report published last week, CoinGecko highlighted significant assets which performed poorly across the board, except Crude Oil and the US Dollar. However, BTC performed worst with a 64.2% drop.

Recently, Tom Dunleavy, a researcher at Messari, a data analytic firm, highlighted that the Litecoin token LTC outperformed BTC and its closest rival, Ethereum (ETH), over the past three months and one-year timeframes.

Dunleavy shared a chart illustrating that LTC investors saw over 31.% and 23.2% return on investment (ROI) more than BTC and ETH investors, respectively, from January 2022. Under the three-month window, the figures were more than double the one-year value. Litecoin also outperformed DeFi tokens with a landslide margin of 73% growth from 2022.

Nonetheless, Bitcoin traded at $48,086.84, 52 weeks ago, and its lowest price within the same period was $15,599. Over the last 30 days, BTC has grown by over 27%, as per CoinMarketCap. It currently trades at $22,918.78, with a market share of over $441 billion.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.