- The U.S. government shutdown has ended, but Bitcoin (BTC) is failing to rally, as this “good news” is seen as a bearish catalyst.

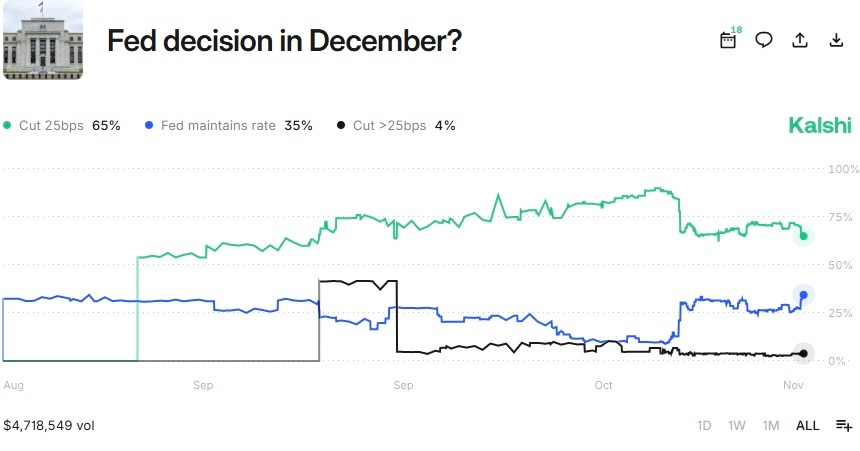

- The reopening unlocks delayed BLS economic data, causing Kalshi traders to lower their odds of a December Federal Reserve rate cut.

- This has triggered a clear capital rotation: Bitcoin is struggling near $103,500, while traditional hedges like Gold have surged to $4,212.

Bitcoin (BTC) is struggling to find footing, failing to rally with equities and gold. This bearish divergence is a direct result of the end of the historic 43-day U.S. government shutdown. President Donald Trump has signed the bipartisan 60-40 bill to reopen the government. This “good news,” however, has been met with caution, as Bitcoin struggles to hold $103,500.

Related: No Inflation Data, No Confidence: When Will the Crypto Market Recover Its Lost $408 Billion?

‘Good News is Bad News’: Market Fears Delayed Fed Data

The market’s bearish reaction stems from what the reopening unlocks. The end of the shutdown means that key economic data, which the Federal Reserve relies on for its monetary decisions, will now be released. Fed Chair Jerome Powell had previously stated that December’s FOMC decision would be hampered by the lack of this crucial data.

With the government reopening, the delayed September Bureau of Labor Statistics (BLS) data is now imminent. This has caused Kalshi traders to lower their odds of a Fed initiating a rate cut next month. The market now fears this hot, delayed data will give the Fed justification to remain hawkish.

The Great Rotation: Bitcoin Lags as Gold Rallies

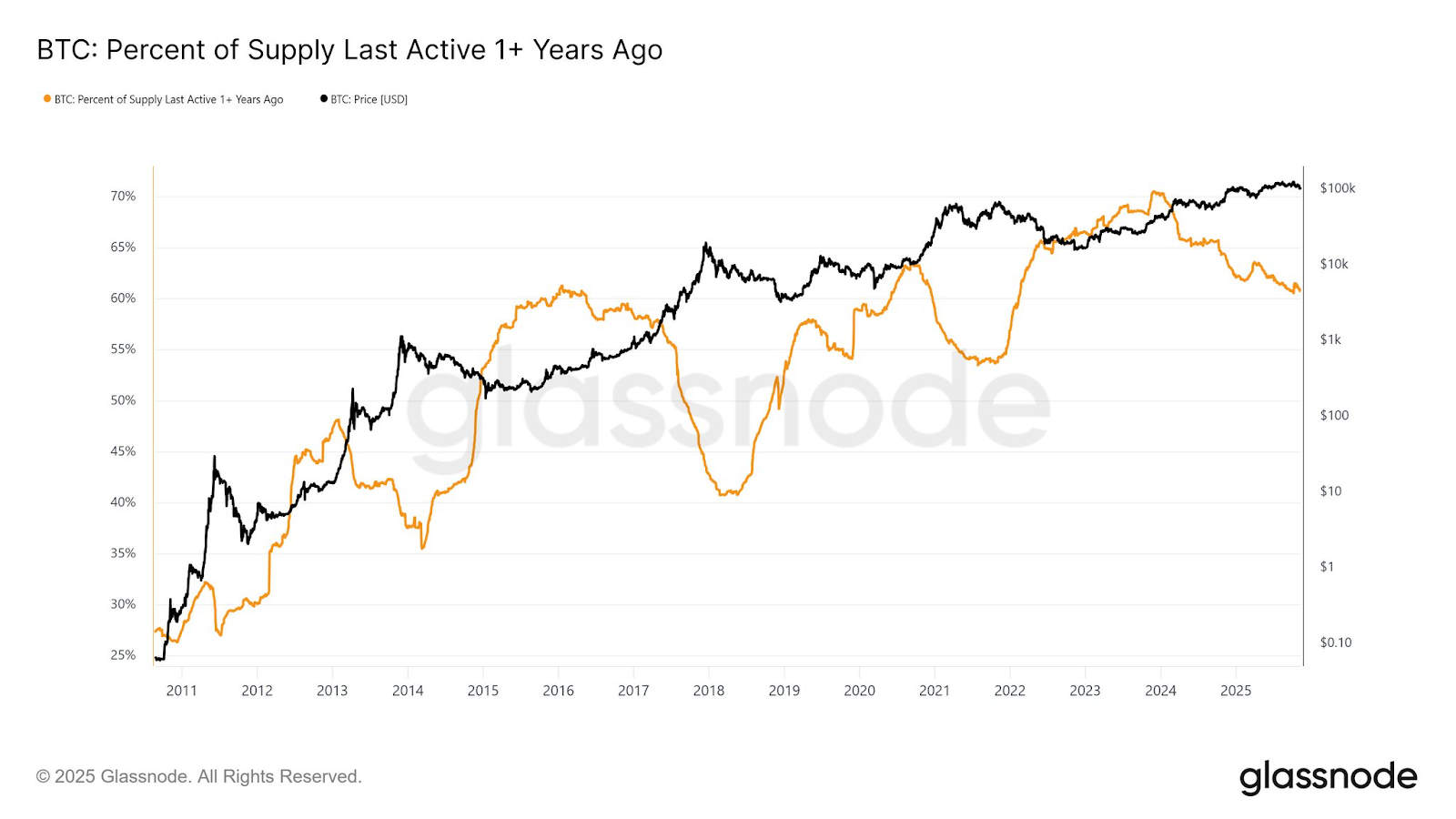

This fear of a “higher-for-longer” Fed has put immediate downward pressure on Bitcoin (BTC). The asset, which is highly sensitive to liquidity conditions, has suffered from low capital inflows, and this macro-shift is exacerbating the weakness.

This has triggered a clear capital rotation. The 4-year correlation between Bitcoin and the NASDAQ 100 Index has recently broken. The S&P 500 has rallied on the reopening news, while BTC continues to signal weakness.

This divergence is most stark when compared to Gold. In the past four days, Gold price has rebounded from $3,979 to $4,212. Bitcoin, in contrast, has dropped from its $106,000 high to $103,500.

Market Now Pins Hopes on Structural; Not Macro, Catalysts

Altcoin market on the edge

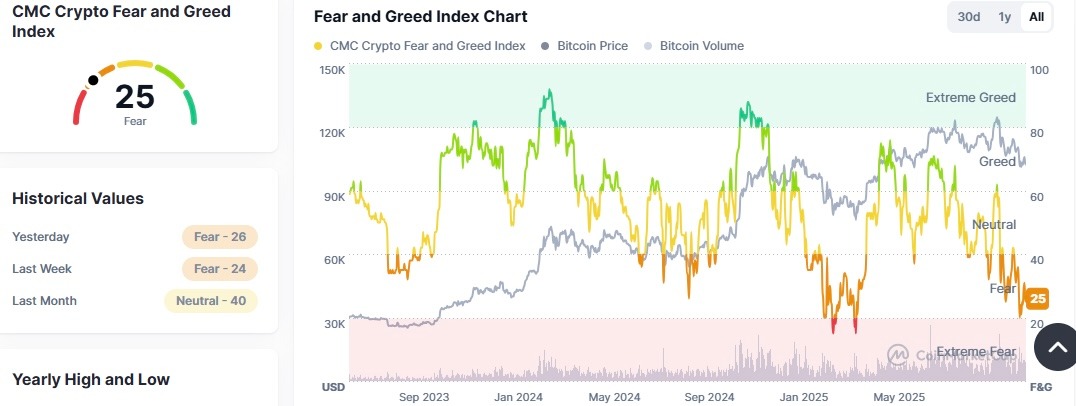

This bearish sentiment has heavily impacted the wider altcoin market. The CoinMarketCap Fear and Greed Index is hovering at 25/100, signaling “Extreme Fear.”

With the primary macro-catalyst (a Fed pivot) now in doubt, the crypto market’s hopes are shifting to structural catalysts. The reopening of the government means the Clarity Act is now well-positioned to be passed before the end of this year.

This regulatory clarity, in turn, is expected to accelerate the approval of 155 pending spot altcoin ETFs. The SEC is now expected to resume processing these filings, which could trigger a new, institution-led influx of capital.

Related: 61% of Institutions Plan to Increase Crypto Allocation by EOY, Sygnum Bank

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.