- Grayscale introduces options trading for its Solana ETF (GSOL), expanding institutional access to Solana exposure.

- The ETF includes integrated staking rewards, a first for U.S.-listed crypto investment products.

- Solana price drops 5% amid broader market correction, but derivatives activity hints at renewed institutional demand.

Solana price fell by another 5% on Tuesday, November 11, 2025, aligning with widespread sell-offs across top altcoins. However, Grayscale’s latest initiative could mark a turning point for institutional participation in Solana markets.

In an official post on X, Grayscale announced the launch of options trading for its Solana ETF (GSOL), giving investors a new avenue to manage exposure and hedge positions in a regulated environment.

The GSOL ETF, listed on NYSE Arca, is the first U.S.-listed crypto investment product to integrate staking benefits, allowing investors to earn on-chain rewards while maintaining compliance with U.S. securities frameworks.

This expansion follows Grayscale’s introduction of staking-enabled trusts for both Solana and Ethereum earlier this year, marking a milestone in bridging decentralized network yields with traditional fund structures. Options trading is popular among institutional traders, and Grayscale’s move triggered positive reactions in Solana derivatives markets on Tuesday.

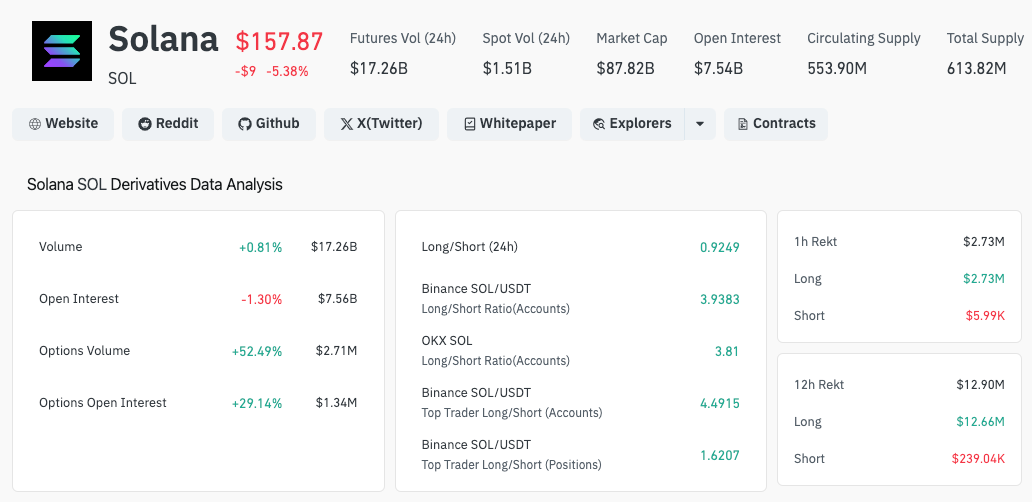

Following the announcement, Coinglass data shows SOL futures trading volume increased by 0.81% to reach $17.26 billion, while aggregate open interest slipped by 1.30% to $7.56 billion as traders rebalanced positions. Notably, options trading volume surged by 52.49% to $2.71 million, and options open interest rose 29.14% to $1.34 million, underscoring heightened speculative activity and hedging demand surrounding Solana’s price outlook.

The surge in derivatives engagement signals that institutional traders are actively positioning around GSOL’s new structure, suggesting a potential deepening of liquidity and interest in Solana-based ETF products over the coming sessions.

Solana Price Forecast: Can GSOL Options Fuel a Rebound Above $170?

Solana currently trades around $158.37, extending its 5.34% daily decline after facing rejection near short-term resistance. The 12-hour chart shows SOL fluctuating between the lower Donchian Channel support at $146.05 and midline resistance at $167.56, a range that has defined the asset’s sideways momentum over recent sessions.

From a technical perspective, the MACD indicator remains in negative territory, though its histogram bars are narrowing, hinting at fading bearish momentum. The MACD line at –5.79 and signal line at –7.04 are converging, suggesting the possibility of a bullish crossover if buyers regain traction. Meanwhile, the Relative Volatility Index (RVI) stands at 32.23, reflecting oversold conditions and potential for a short-term rebound.

If Solana manages to reclaim the 23.6% Fibonacci retracement level near $167.50, bullish momentum could extend toward $180, where the upper Donchian Channel aligns as a major resistance. However, failure to maintain the $155 support area could lead to further declines toward $146, the key defensive zone. A daily close below this threshold would invalidate the bullish reversal outlook and expose SOL to deeper correction risks toward $138.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.