- A recent tweet by Santiment shows what’s needed for a crypto market turnaround.

- The recent FTX downfall may leave long-lasting shockwaves in the crypto industry.

- There are two bullish flags that may trigger on BTC’s daily chart.

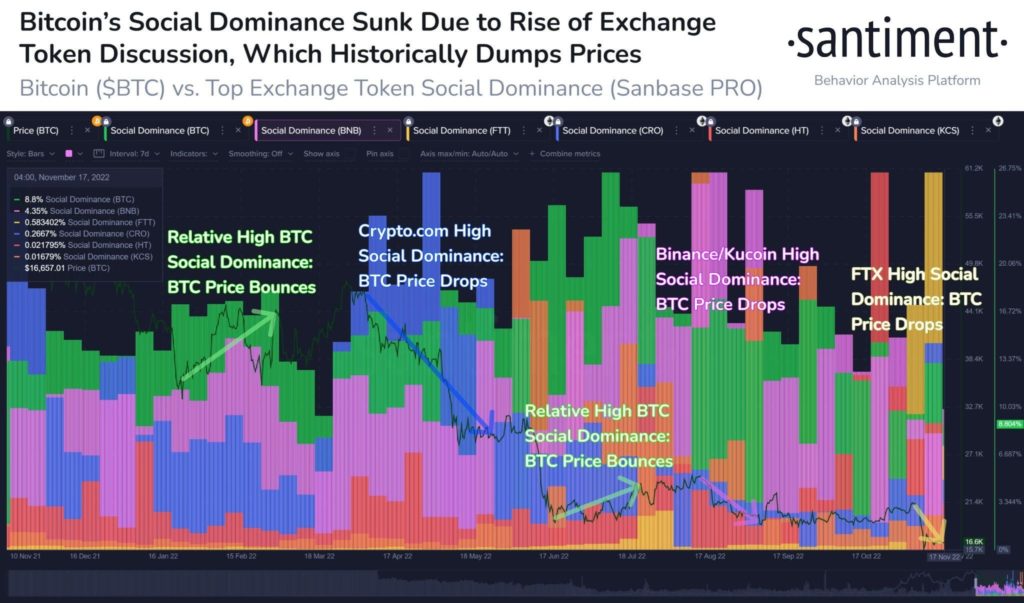

The blockchain analytics firm, Santiment, tweeted a chart yesterday that shows what’s needed for a turnaround in the crypto market in order to recover from the latest drama related to FTX and other exchange platforms.

According to the tweet, cryptos generally thrive when exchanges are not the focal point. Since the FTX collapse is considered to be one of the most impactful exchange collapses ever, the shockwaves of the collapse may leave “lasting shockwaves”.

The tweet added that the key turnaround for the crypto market will be when focus shifts away from exchange tokens and back toward the crypto market leader, Bitcoin (BTC).

As can be seen by the chart shared by Santiment on Twitter yesterday, the price of BTC has dropped historically in times when the social dominance of exchange tokens rises.

At press time, the price of BTC stands at $16,796.65 following a 1.43% rise in price over the last 24 hours, according to CoinMarketCap. In addition to BTC’s price strengthening against the U.S. Dollar, it was also able to strengthen against Ethereum (ETH) by 0.59% in the same time period.

BTC’s price is currently being held down by the daily 9 EMA line. BTC’s price did try to break above the 9 EMA line but was met with resistance which shut down the attempt, as can be seen by the wick of today’s candle.

Potential bullish flags that investors need to keep an eye on are the daily MACD line crossing the daily MACD signal line, and the daily RSI line crossing above the daily RSI SMA line.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.