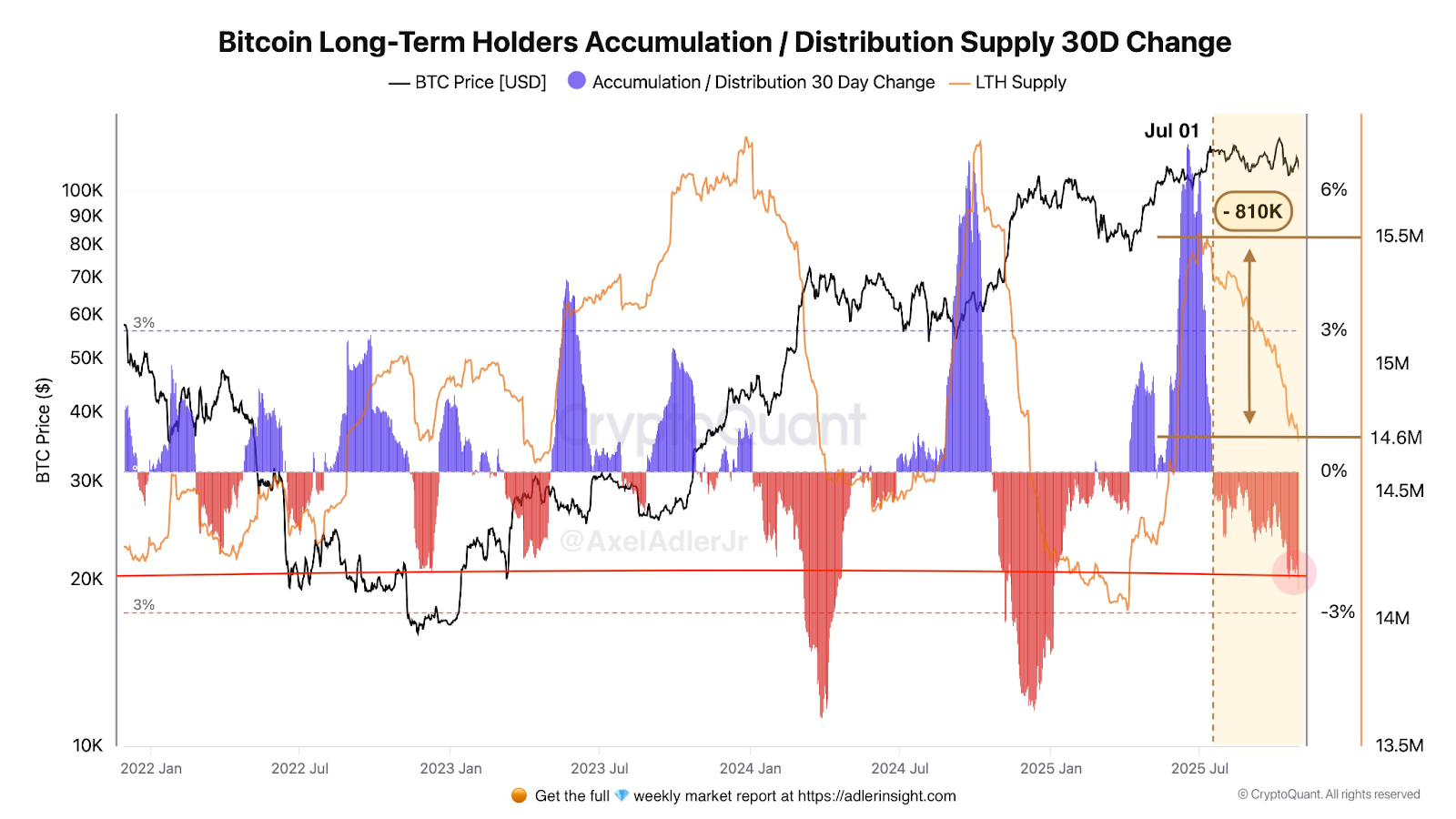

- Bitcoin’s rally is meeting resistance as long-term holders (LTHs) have sold 810,000 BTC since July 1

- On-chain analyst Axel Adler Jr. notes this profit-taking is limiting BTC’s upside momentum

- Despite the selling, robust market demand has absorbed the supply, allowing BTC to hit two new ATHs

Bitcoin’s latest rally is hitting significant resistance. According to on-chain analyst Axel Adler Jr., this price ceiling is caused by long-term holders (LTHs) taking profits.

Adler pointed out that LTHs have been actively selling since July 1. The total distribution volume from this cohort has now reached 810,000 BTC. During this same period, their combined holdings dropped from 15.5 million to 14.6 million BTC.

Despite this sustained selling, Bitcoin managed to reach new all-time highs twice. Adler notes this proves the market’s robust demand has successfully absorbed most of the sell-side pressure.

However, he warned that as long as LTHs keep taking profits, Bitcoin’s upside momentum will remain limited. “Eventually, the distribution will end, a price discount will emerge, and we will see a new phase of LTH accumulation,” Adler added.

Related: Bitcoin Exchange Outflows Rise As Former White House Advisor Says Sellers Will Regret

Here’s Why LTH Distribution Is a Normal Market Cycle

Historically, Bitcoin’s major bull runs coincide with periods when LTHs shift from distribution to accumulation. The recent sell-off suggests a typical market cycle phase. In this phase, profit-taking temporarily halts price expansion.

Once this distribution wave cools, a new accumulation phase often creates a strong foundation for the next major rally.

The chart shared by Adler shows LTH supply dropping sharply since July, while price volatility remains contained. This implies that demand from institutional buyers, ETFs, and new retail entrants continues to offset the selling pressure.

BTC Price Analysis: Consolidation Under LTH Supply

Bitcoin is currently consolidating near a strong support range around $107,000–$105,000, as seen on the daily chart, trading slightly above $109,900, with resistance forming near the descending trendline around $111,000–$115,000.

A breakout above this range could open the path toward $120,000–$123,000, while failure to hold above support may trigger a retest of $102,000.

The MACD remains slightly negative, signaling a weakening bullish momentum, while the Chaikin Money Flow (CMF) near -0.08 indicates mild outflows. However, the Balance of Power (BoP) sits at 0.75, suggesting buyers still have the upper hand in the short term.

On the other hand, the Bollinger Bands show narrowing volatility, hinting that Bitcoin may be preparing for a decisive move soon.

Related: SpaceX Moves $268 Million in Bitcoin as BTC Holds Above Key Support

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.