- VeChain shows strong investor interest with 93.39% of its supply actively traded.

- Current price action indicates volatility, with key support at $0.0216 for VET.

- Trading volume rose 2.72%, signaling bullish sentiment and potential upward momentum.

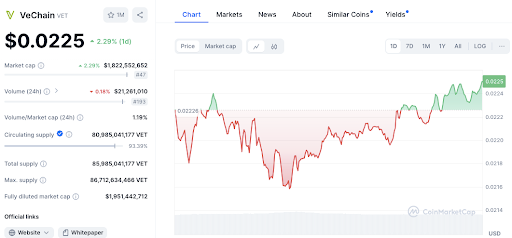

VeChain (VET) is currently trading at $0.02242, up 0.70% in the last 24 hours. With a market capitalization of approximately $1.81 billion and a trading volume of around $21.61 million, VeChain continues to attract investor interest.

VeChain’s price has fluctuated in the short term. Earlier today, VET dipped below $0.0220 but rebounded to its current level of $0.02242. These fluctuations show a market that is actively responding to various factors.

The recent dip to approximately $0.0216 has become a crucial support level, with the price bouncing back from this point. This suggests that investors see this level as a buying opportunity.

On the upside, VeChain is currently testing minor resistance around $0.0224. If this level breaks, the next significant target could be around $0.0226, where the price last peaked. Watching these technical levels is vital for anticipating potential price movements in the near term.

Analyzing Market Sentiment and Indicators

Market sentiment appears increasingly bullish for VeChain, as shown by a 2.72% increase in trading volume over the last 24 hours. This uptick in volume indicates growing market activity and heightened buying interest, suggesting that investors are eager to push the price above current resistance levels.

Read also: VeChain Price Surge: 5-Wave Impulse Pattern Signals $1 Target

Moreover, with 93.39% of the total supply currently in circulation, VeChain has a solid foundation for price stability. This circulation level indicates robust investor interest, as a majority of tokens are actively traded, which can help prevent significant price fluctuations. Furthermore, VeChain has a Total Value Locked (TVL) of $486,086, further highlighting its appeal in decentralized finance.

Key Indicators: RSI and MACD Analysis

The 1-day Relative Strength Index (RSI) is 44.74, showing that VeChain is neither overbought nor oversold. Therefore, the asset appears to have room for further price movement without facing immediate correction. However, the 1-day MACD is trading below the signal line, suggesting potential short-term downward momentum.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.