- Bitcoin is trading at $19,403 according to CoinMarketCap.

- A long-term historically accurate buy signal for BTC has been flagged.

- The total crypto market cap dropped 0.46% over the last 24 hours.

The crypto market tracking website, CoinMarketCap, shows that Bitcoin (BTC) is trading at $19,403 at press time following a 0.41% drop in price. With BTC’s price lingering between $19,200 – $19,700, has the crypto market leader established its bottom for this bear market?

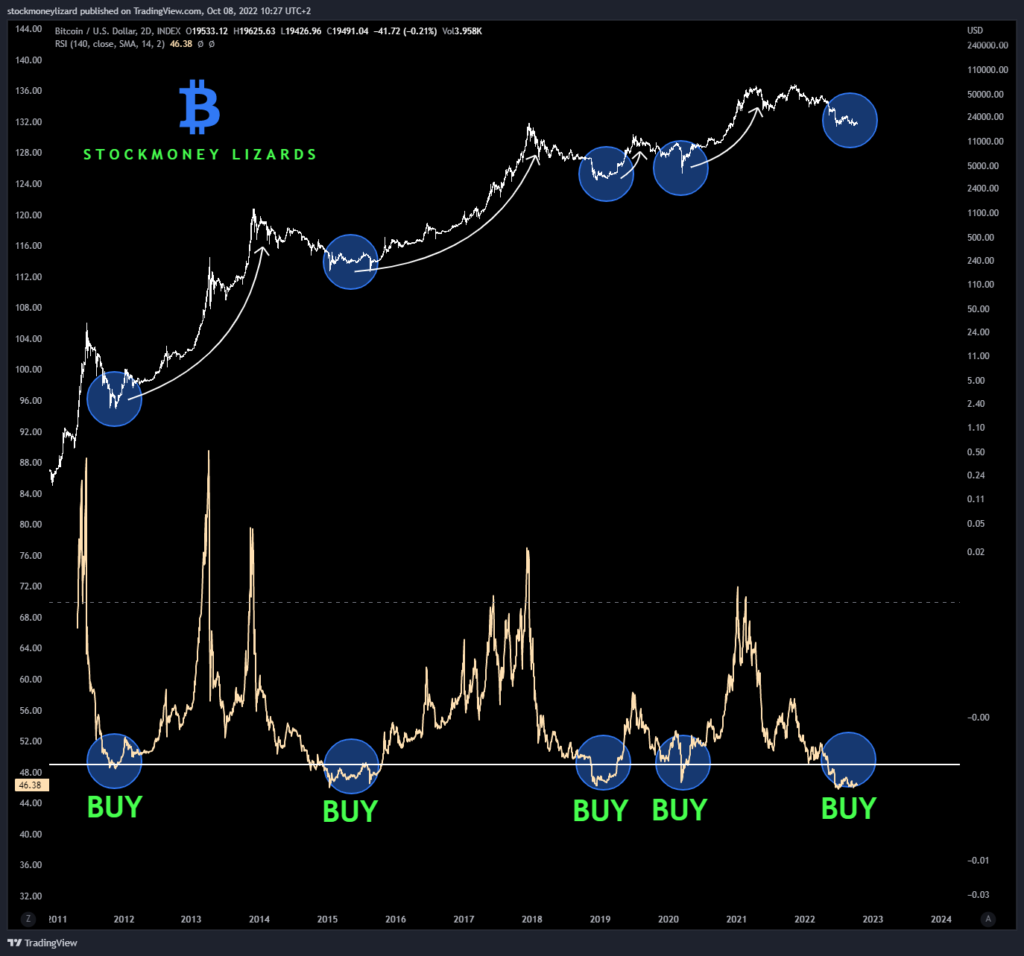

The Twitter account @StockmoneyL (Stockmoney Lizards) posted a tweet yesterday morning showing that a technical event, which has been historically accurate as a buy signal, has recently been flagged.

As can be seen from the chart above, the Relative Strength Index (RSI) indicator has dipped below the support line at 49.00, which has been an accurate buy signal on 4 separate occasions in the past. This could be an early indication of a bullish rally for the crypto king.

@IncomesSharks (IncomeSharks) also tweeted today that BTC’s bottom for this bear cycle may already be in. The tweet stated “#Bitcoin – Still think the bottom has been in since June. Hard to argue with these FIB levels (0.786). Things have only got worse since then and price has fought back harder than people are giving it credit.”

The posts by both Twitter users suggest that there may be a turnaround on the cards for BTC, which will inevitably spur a turnaround for the rest of the crypto market as altcoins will follow suit.

Despite the buy signal for BTC, the global crypto market cap is still down 0.46% over the last 24 hours. As such, the crypto market has a market cap of approximately $939.79 billion.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.