- Economist Peter say that Bitcoin failed to rally with the other risk assets.

- $940 million crypto was withdrawn and the transactions were split into 122 bitcoins.

- Bitcoin fails to make any significant moves since early June.

Citing Bitcoin’s (BTC) minute rise above $19k, Peter David Schiff, an American economist & global strategist, took to Twitter to explain the difficulty that Bitcoin would face if it can’t rise with other rising risk assets. Moreover he shed more light into the scenario by elaborating the difficult phase that BTC would go through when the risk assets starts declining.

According to sources, the first cryptocurrency, Bitcoin had reportedly failed to rally with the other assets. Significantly, on Tuesday, $940 million crypto was withdrawn and the transactions were split into 122 bitcoins. This followed a similar pattern to the 2021 bull run.

Alhough the CryptoQuant contributing analyst, Regterschot assured that the transactions wouldn’t affect the price of bitcoins, the coins traded at $19,233.71 on Tuesday, indicating a decrease of 1.5%.

Kaiko’s Research Director, Clara Medalie commented that bitcoin hadn’t made significant moves since June:

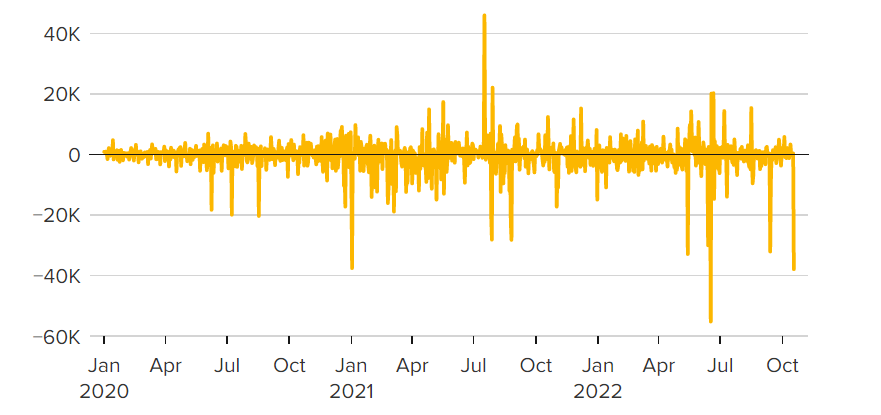

Bitcoin has failed to make any significant moves since early June, with prices bouncing between an increasingly narrow range. Considering bitcoin’s current low price levels, trade volumes have remained relatively resilient since last year’s all-time highs. There is no discernable decrease in volumes since September despite the increasingly low volatility.

In addition, the popular Twitter trader Alan tweeted that the BTC price level was similar to the price level exhibited during the 2014 and 2018 bear markets, indicating a macro bottom. However, bitcoin managed to stay higher than its all-time low price.

While bitcoin had fallen from its rally with the other risk assets, it still remains at historic heights and its price is largely driven by macroeconomic factors. To be specific, bitcoin’s lesser volatility serves as one of the major reasons for the position bitcoin holds in the crypto market.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.