- Lawyer Bill Morgan says the judge’s decision on the Daubert motion focused on expert evidence for XRP’s secondary market trading.

- The relisting of XRP on exchanges depends on addressing whether it is inherently classified as a security.

- Ripple could seek agreement from the SEC to exclude secondary sales explicitly in the Final Judgment.

In a recent tweet, lawyer Bill Morgan says that in the Daubert motion decision, Judge Analisa Torres provided a clear stance on the specific matter she must resolve. The decision revolved around allowing or disallowing expert evidence pertaining to XRP’s secondary market trading, rather than XRP itself.

Morgan shares that he is hopeful that the judge will address the crucial question of whether XRP qualifies as a security, in continuation to his last Twitter thread on May 29.

In the thread, he highlighted the ongoing discussion regarding whether or how the “secondary market sales” of XRP will be addressed in the Ripple case. This aspect holds significance because the relisting of XRP on exchanges largely depends on whether the fundamental question of whether XRP is inherently classified as security is adequately addressed. Addressing this crucial issue is key to instilling confidence in the potential relisting of XRP on exchanges.

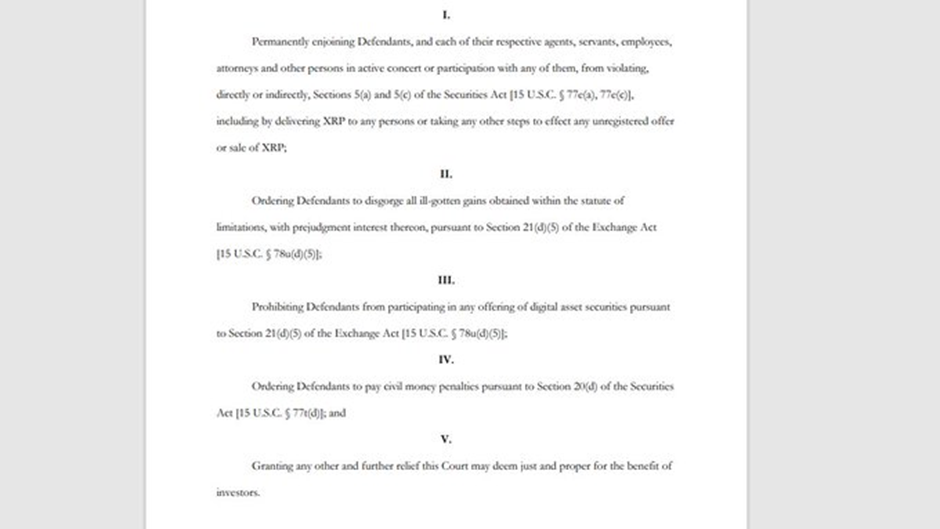

Despite the presence of language in the SEC’s lawsuit that implies XRP itself is considered a security, Morgan notes that the requests made by the SEC to the Court do not seek to confer such a status on the asset.

According to Morgan, several scenarios could address the issue of secondary sales in the Ripple case. Firstly, Ripple could seek agreement from the SEC to exclude secondary sales explicitly in the Final Judgment, following the successful approach taken by KIK Interactive.

Secondly, the lawyer mentions that the Judge might consider concerns raised by various parties, including XRP holders represented by attorney Deaton, regarding secondary sales. Given the LBRY case precedent, where secondary sales were addressed to some extent, a similar approach may be possible in the Ripple case.

Moreover, if Ripple loses the case, during the “penalties” stage when drafting a disgorgement order, the Judge may be compelled to address secondary sales. Ripple could argue that only direct purchasers from Ripple should receive their investment back, as established in the SEC vs. Wang case. Failing to do so would result in diluted disgorgement amounts for individual purchasers due to significant secondary sales.

Ultimately, such a ruling would implicitly address the issue of secondary sales and ensure a fair distribution of disgorged funds, as per Morgan.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.