- Charles Hoskinson criticizes Bitcoin maximalism as BTC holds above $60K, sparking debate amid growing market uncertainty.

- Bitcoin’s RSI suggests neutral-to-slightly bullish sentiment, while a bearish MACD indicates downward momentum.

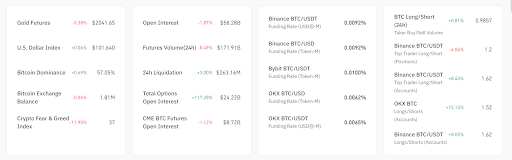

- Increased long positions and funding rates signal optimism, while rising liquidations suggest market caution.

Charles Hoskinson, founder of Cardano and a frequent critic of Bitcoin maximalism, recently sparked debate in the crypto community with an X post targeting Bitcoin advocates. In his post, Hoskinson criticized the intense focus on figures like Michael Saylor and expressed frustration with what he perceives as “cult-like” behavior in the Bitcoin space. This comes as Bitcoin maintains a price above $60,000 despite growing market uncertainty and mixed sentiment.

Bitcoin Holds Strong Despite Market Volatility

At the time of writing, Bitcoin’s price is $60,602.64, marking a 0.88% decrease over the past 24 hours. Its trading volume reached $41.6 billion, reflecting continued interest despite recent dips. With a market cap approaching $1.2 trillion, Bitcoin continues to dominate the cryptocurrency market, holding a 57.05% dominance over other digital assets. However, market sentiment remains cautious, as shown by a drop in the Crypto Fear & Greed Index to 37, indicating heightened fear among traders.

Beyond price fluctuations, other indicators show mixed signals. Futures open interest dropped by 1.87% to $58.28 billion, while options open interest surged by 117.28%, suggesting increased speculation and hedging activity. Funding rates are slightly positive, hinting at bullish sentiment in leveraged positions. Furthermore, Binance reports a rise in long positions, especially in the BTC/USD pair, as traders anticipate potential gains.

Read also: Bitcoin vs. Gold: BTC Loses Ground as Central Banks Drive Gold to Record Highs

However, exchange balances have fallen, and liquidations have risen, signaling caution among market participants. Traders are closely monitoring critical metrics like the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) to assess future price movements.

RSI and MACD Signal Potential Trend Shifts

Bitcoin recently saw a notable drop after nearing a high of $65,000. The candlestick patterns reveal smaller-bodied candles, indicating indecision and suggesting the potential for consolidation after the downtrend.

Also, a noticeable decline in trading volume below the price chart points to reduced market participation, highlighting a calm period compared to earlier spikes. This shift in volume reflects a lack of strong conviction from traders at the current price.

In terms of technical indicators, Bitcoin’s RSI (Relative Strength Index) currently reads 59.20, signifying a neutral-to-slightly bullish sentiment. Although above 50, it remains far from overbought levels, leaving room for potential upward movement.

However, the MACD shows a bearish crossover, with the MACD line at 676 and the signal line at 1,123, indicating ongoing downward momentum. The MACD line being below the signal line confirms this bearish trend, suggesting further caution for traders.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.