US President Donald Trump recently penalized India by imposing a 50% tariff on goods imported from the Asian country. Trump took this harsh stance following allegations that India purchased oil from Russia, indirectly funding the war against Ukraine. That move appears to be shaking the foundations of the Indian economy, including the IT sector, considering that 60% of India’s IT revenue comes from the US.

Trump’s Sanctions Threaten the Indian IT Sector

More directly, Trump’s recent sanctions have threatened the Indian IT sector through visa restrictions, sparking fears of increased operational costs due to the need for local recruitment in the US or neighboring regions. Meanwhile, Trump is pressuring local IT companies to reverse the current trend of outsourcing from India and focus on local labor.

Besides the above measures, the US President, in line with his “America First” agenda, is pushing for “Made in America” tech services. The push became more intense since the latest sanction, with Trump planning to ban the use of tech services of Indian origin. These actions have complicated the situation for an already challenged industry that is struggling to survive competition from the growing adoption of AI and Automation solutions that are reducing the reliance on outsourcing services from India.

Blockchain as an Escape Route

Although the challenges are real, with potential consequences greater than anything the Indian IT sector has ever experienced, there could be an escape route for the beleaguered industry. Crypto and blockchain, with their dynamic structure and flexibility, have the potential to become the saving grace for India’s IT sector amid Donald Trump’s sanctions.

The novel blockchain technology, alongside associated cryptocurrency elements, can help India counter America’s significant influence on its IT economy. Blockchain and crypto can enable India to reduce its reliance on the US and capture new global demand without geographical restrictions.

How can India break the stranglehold?

Some of the ways that India can explore the blockchain and crypto sector and potentially break free from the current stranglehold include exploring a decentralized work market. Blockchain technology can enable the bypassing of the USA’s restrictive VISA system. To achieve this, the Indian IT sector can focus more on Decentralized Autonomous Organizations (DAOs), explore the benefits of the novel technology, and avoid the compulsion to operate locally.

Besides enabling decentralized operations that would overcome visa restrictions, Indian IT companies can adopt crypto payments for IT professionals. That would solve another potential pain point and allow the industry to bypass US payment rails, helping the sector to avoid censorship.

Can India seize the opportunity?

Optimistically, President Trump’s sanctions on India have come during a revolution in the IT sector. A new industry is emerging in the technological ecosystem that revolves around cryptocurrency, Web3, and DApps on public chains. India can capitalize on the ongoing revolution and pivot from being an IT outsourcing hub in Web2 to an IT development hub in Web3 infrastructure.

As a vibrant sector with a massive talent pool, the Indian IT industry can leverage opportunities in smart contract development, blockchain integrations, layer-2 scaling, and DeFi solutions to become a leader in Web3. Instead of focusing on the American market, India can widen its net and build solutions that will serve the global market. Polygon, a blockchain protocol that provides a framework for scalable solutions on Ethereum, is an example of an Indian product that serves the world. It highlights the region’s capacity to go beyond outsourcing to the US to serve a global audience.

Top Blockchain Technology Companies in India

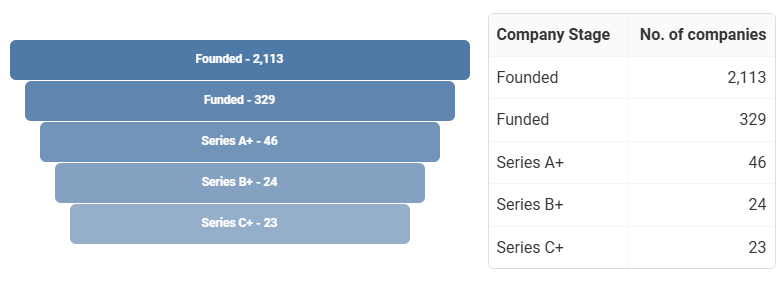

India boasts over 2,100 blockchain technology companies, including more than 320 funded entities that have raised nearly $2 billion in VC funds. Data shows that almost 50 of the entities are Series A+ funded, and three have achieved unicorn status.

There have been 18 acquisitions and 1 IPO so far in the Indian blockchain sector, covering Web3 development, distributed ledger technology, decentralized ecosystems, and other areas of blockchain development. Meanwhile, it is worth noting that Polygon ranks as the top blockchain company in India. Other highly recognized firms in the Indian blockchain sector include Mudrex, Hike, CoinSwitch, and CoinDCX.

Opportunity in adversity

A deeper inquest into the current sanction-based challenges in India reveals an opportunity in adversity. Turning to crypto and stablecoin payments could enable a financial hedge for the Indian economy, especially the IT sector, which is in focus. When Indian firms normalize receiving payments in Bitcoin and stablecoins, they will protect against currency volatility and avoid US banking restrictions. That would fulfill one of Satoshi Nakamoto’s earliest goals of creating cryptocurrency, which is to discourage centralization in the payments industry.

We have proposed a system for electronic transactions without relying on trust. We started with the usual framework of coins made from digital signatures, which provides strong control of ownership, but is incomplete without a way to prevent double-spending.

– Satoshi Nakamoto

India can begin the process of redefining its IT sector with a change of philosophy. It can move away from the prevailing narrative of being a service provider to becoming the product owner. The Indian IT sector can steer away from a low-margin industry that depends on clients and dictate the pace from a position of authority. India can move away from being recognized as a workforce to a region of crypto projects with recognized tokenized models.

Besides creating and owning native decentralized products, the remote work opportunities that decentralized products enable can promote talent retention for the Indian IT industry. IT experts and developers can operate from their local bases in India and earn Silicon Valley-level compensation, changing the narrative about Indian talent migrating to the US to earn decent pay.

Related: How the Fast-Growing Indian Economy Is Leading The Way in Crypto Adoption?

Target areas and government participation

India can focus on a few areas to overcome its exposure to foreign economies, including training engineers to join DAOs like Aave, Uniswap, Arbitrum, and Solana. The Indian government can play a crucial role by developing a clear regulatory framework for the crypto industry, alongside engaging in partnerships with the private sector to develop the local blockchain and crypto industry. It could further engage in immediate tax reforms for the IT sector to cushion the effects of elevated tariffs by the US government.

Additionally, the Indian government can embark on a well-structured initiative to develop its blockchain and crypto sector, including the inclusion of industry-focused courses in local colleges, launching India-led blockchain protocols and layer-2 solutions, and encouraging participants in the IT sector to accept payments in stablecoins. That would reduce India’s dependence on SWIFT and other payment solutions of US origin.

Related: SWIFT to Trial Digital Asset Transactions with Major Banks

Notably, India’s reliance on the US is significant, and adopting blockchain and cryptocurrency solutions would not address the current challenges overnight. However, it would open a parallel channel that would allow India to break the shackles of foreign influence on its burgeoning economy. Being able to operate without external influence will allow the Indian IT sector to thrive without being constrained by American policies. Hence, India can shift from being a global outsourcing hub to a sovereign builder of a decentralized internet.

Related: Bitcoin Dumps 2.8% to Below $110K After Trump’s 50% India Tariff Over Russian Oil

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred from utilizing the content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.