- RWA on-chain value rose 5% to $21.35B in early 2026, signaling renewed growth.

- Ethereum leads RWAs with $13.1B, holding the majority market share.

- Tokenized Treasuries dominate RWAs at $9.2B, leading institutional adoption.

The real‑world asset market entered 2026 with clear acceleration as on‑chain distributed asset value rose from $20.33 billion to $21.35 billion in early January, a 5% increase that followed a correction in late 2025.

Since the November 19 low near $19.22 billion, the sector has added roughly $2.13 billion in net value. Capital returned before hype, a pattern typical of institutional‑led markets.

Meanwhile, RWA holders climbed from roughly 620,000 in mid‑December to nearly 638,000 by late January, an 8-9% increase in just over a month. Growth remains steady rather than explosive.

Also, monthly active addresses peaked near 100,000 roughly a year ago and have cooled since, yet total value continues to rise. RWAs are behaving like balance‑sheet assets, not trading tokens.

Chain Distribution Shows Infrastructure Lock‑In

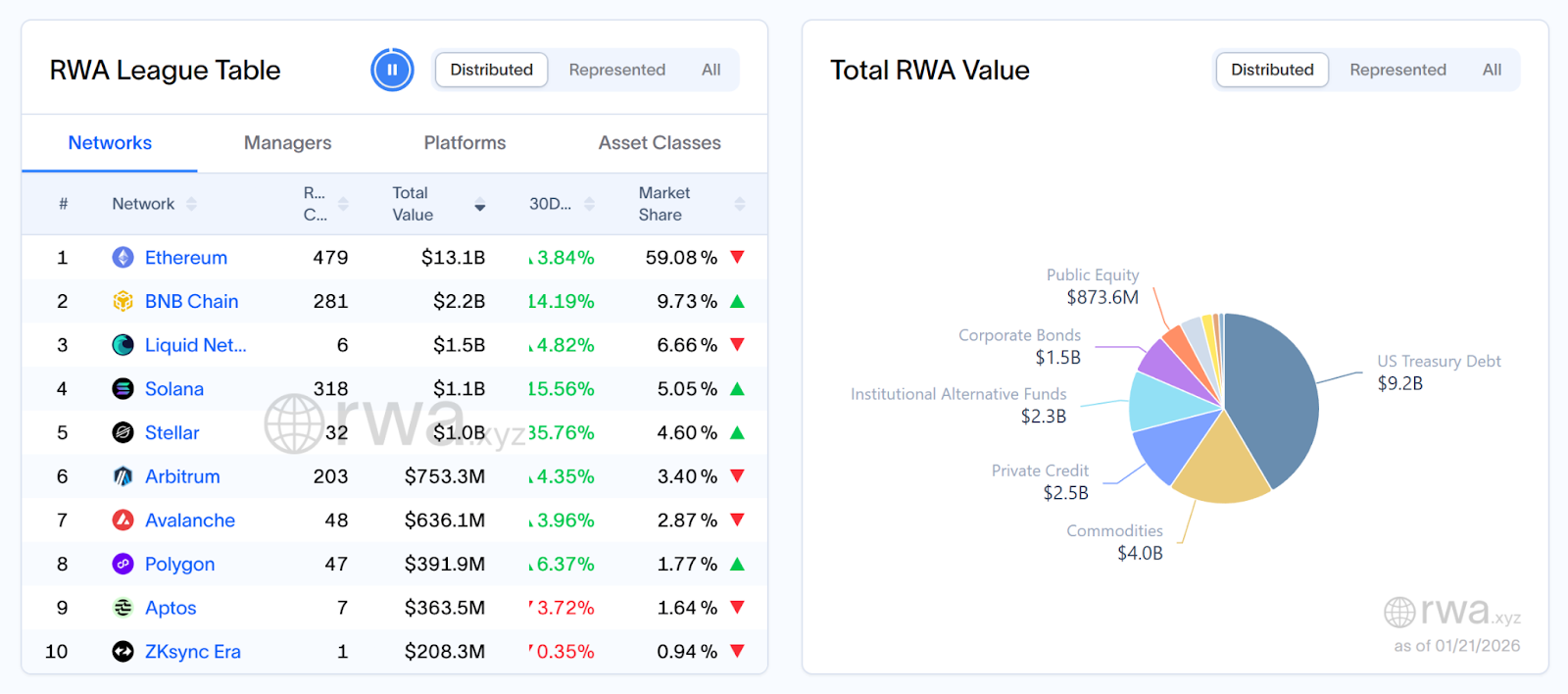

According to the data, Ethereum holds the dominant position, with approximately $13.1 billion in RWA, accounting for well over half of the market.

BNB Chain follows with about $2 billion, while Solana and Liquid Network each sit at $1.1 billion and $ 1.5 billion, respectively. Stellar rounds out the major group at roughly $1 billion.

It is clear that RWAs favor chains with predictable execution, regulatory tooling, and institutional custody support. New chains may attract users, but value stays where settlement risk is lowest.

Asset Mix: Treasuries Still Lead, Rotation Underway

US Treasury debt remains the core RWA product. At $9.2 billion, Treasuries represent the single largest category and the primary entry point for institutions moving on‑chain.

Commodities rank second at $4 billion, led by gold‑backed tokens. Private credit follows at $2.5 billion, while institutional alternative funds account for roughly $2.3 billion.

Corporate bonds sit near $1.5 billion. Public equities total approximately $873.6 million, while non‑US government debt stands near $830 million.

Smaller segments include private equity around $423 million, actively managed strategies at $200 million, and structured credit at under $4 million.

Weekly data into January 20 shows that distributed asset value rose 4.1% week‑over‑week to $216.6 billion, while the broader RWA market expanded 23.8% to $350.1 billion.

US Treasuries grew from $89 billion to $91 billion, but commodities jumped from $37 billion to $40 billion. Public equities rose nearly 7% in one week. In 2026, capital is slowly rotating away from pure duration exposure toward assets with higher return potential.

Growth Expands Beyond Treasury Products

Treasuries brought institutions on‑chain, and yield demand will push them further. As interest rates trend lower, users are moving into private credit, commodities, energy assets, mineral rights, infrastructure claims, and real‑asset cash‑flow products. These assets carry higher risk but offer better returns than tokenized bills.

Platforms focused on RWAs report strong user growth. Several ecosystems recorded 10x increases in holders over the past year, with projections calling for materially higher adoption in 2026 as minimum investment sizes fall and compliance tooling improves. Capital is spreading across more users, not concentrating into a few large wallets.

Crypto entrepreneur Stacy Muur has forecasted that the total RWA value could be near $50 billion by the end of 2026 if current trends hold.

Institutions and Emerging Markets Set the Pace

Institutional participation continues to build quietly. Tokenized funds, private debt instruments, and structured products are rolling out with a compliance‑first design. Interestingly, issuance is increasing without marketing noise, a sign of real adoption.

Private credit already shows early recovery, rebounding to $2.5 billion after consecutive weekly declines. Commodity RWAs added $3 billion in a single week. Public equity RWAs continue to gain share.

Emerging markets may move faster than developed ones. With fewer legacy systems to unwind, these regions can deploy on‑chain capital rails directly. Real estate and commodity‑backed RWAs dominate there, while developed markets remain focused on Treasuries and money‑market style products.

Top RWA Tokens

The top five RWA cryptocurrencies, as per CoinMarketCap data, include Chainlink (LINK), Stellar (XMR), Avalanche (AVAX), Hedera (HBAR), and Ondo Finance (ONDO). While all the coins have faced double-digit losses in the past week, HBAR is up more than 2% in the past 24 hours.

Meanwhile, Ondo’s distributed asset value shot up almost 10% in the past 30 days, while holders grew 24.6% in the same period. Ondo’s stablecoin market cap is also up 23.5% in the past month.

RWAs in 2026 are no longer experimental. Capital is accumulating, asset diversity is expanding, and infrastructure is solidifying. Value builds first, while liquidity and velocity are expected to follow later.

Related: China Classifies RWA Tokenization as Illegal Finance in Seven-Association Joint Warning

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.