India’s economy remains one of the fastest-growing in the world, with GDP growth projected at 7–8% in 2025, fueled by IT exports, manufacturing expansion, and a thriving services sector. Alongside this growth, India has quietly become the epicenter of global crypto adoption, according to the Chainalysis 2025 Global Crypto Adoption Index, where it ranked first across all four sub-indices.

Despite being a developing economy, India is leading in digital finance by actively participating from retail to DeFi. Yet, the high taxes, regulatory uncertainty, and currency volatility threaten to complicate crypto’s role in India’s financial landscape.

Why India Is Leading in Crypto Adoption

The latest Chainalysis 2025 Index highlights India’s dominance in crypto activity. Unlike many markets where institutional flows drive the narrative, India’s surge is grassroots-driven, with millions of retail traders using exchanges and decentralized apps everyday.

Key drivers include:

- Retail centralized service value received ranking: Indian users traded approximately $143 billion in crypto between July 2023 and June 2024, second only to Indonesia in the region.

- Other indexes include centralized service value received, DeFi value received, and Institutional centralized service value received ranking

But this growth is happening under a heavy tax regime: a 30% capital gains tax (CGT) and 1% TDS on every transaction, a policy that has pushed traders toward offshore platforms and peer-to-peer trading.

Despite strong adoption, risks cloud the horizon. Geopolitical tensions, including India’s ongoing tariff disputes with the U.S. and an uncertain policy environment raise questions about crypto’s long-term future.

Upcoming developments to watch include:

- Tax Overhaul: India has withdrawn its long-standing Income Tax Act of 1961, with a new draft law expected in August 2025. Industry insiders believe this could reshape how digital assets are taxed.

- Crypto Regulation Push: Parliament’s Home Affairs Committee and Finance Panel are urging regulation over prohibition, signaling a shift toward formal recognition.

Meanwhile, a string of scandals from a ₹630 crore unreported income case to India’s biggest crypto crime involving 750 BTC extortion highlight the urgency of clearer oversight.

In August, India’s tax authorities uncovered $124 million in concealed cryptocurrency assets as part of a $3.3 billion enforcement drive during the 2024–25 fiscal year.

Policy and Market Shifts to Watchh

India is also aligning with global frameworks. Starting April 2027, the country will adopt the OECD’s Crypto Asset Reporting Framework (CARF), part of a worldwide pact for tax transparency.

On the innovation front, Polygon co-founder Sandeep Nailwal predicts India could launch its own INR-backed stablecoin within three months, a move that could transform domestic settlements and strengthen financial sovereignty.

Other signals of change include:

- India’s first model crypto law: the COINS Act 2025, developed by Hashed Emergent & Blackdot Policy.

- The CBDT is seeking industry feedback on taxes and offshore migration.

- Parliament acknowledged crypto as a strategic sector to study in 2024–25.

These steps suggest that, rather than banning crypto, India may be preparing a structured framework that balances innovation with control.

Global Implications: BRICS, Rupee Pressure, and Bitcoin Holdings

India’s crypto awakening cannot be viewed in isolation. The country is playing a leading role in BRICS de-dollarization efforts, reportedly pushing partners to settle $100 billion in trade using rupees.

If successful, this shift could weaken the U.S. dollar’s dominance, while potentially elevating crypto as a neutral settlement layer.

- At the same time, the rupee has fallen past 88 per dollar, a record low. With currency debasement concerns rising, Bitcoin and stablecoins are increasingly viewed as hedges.

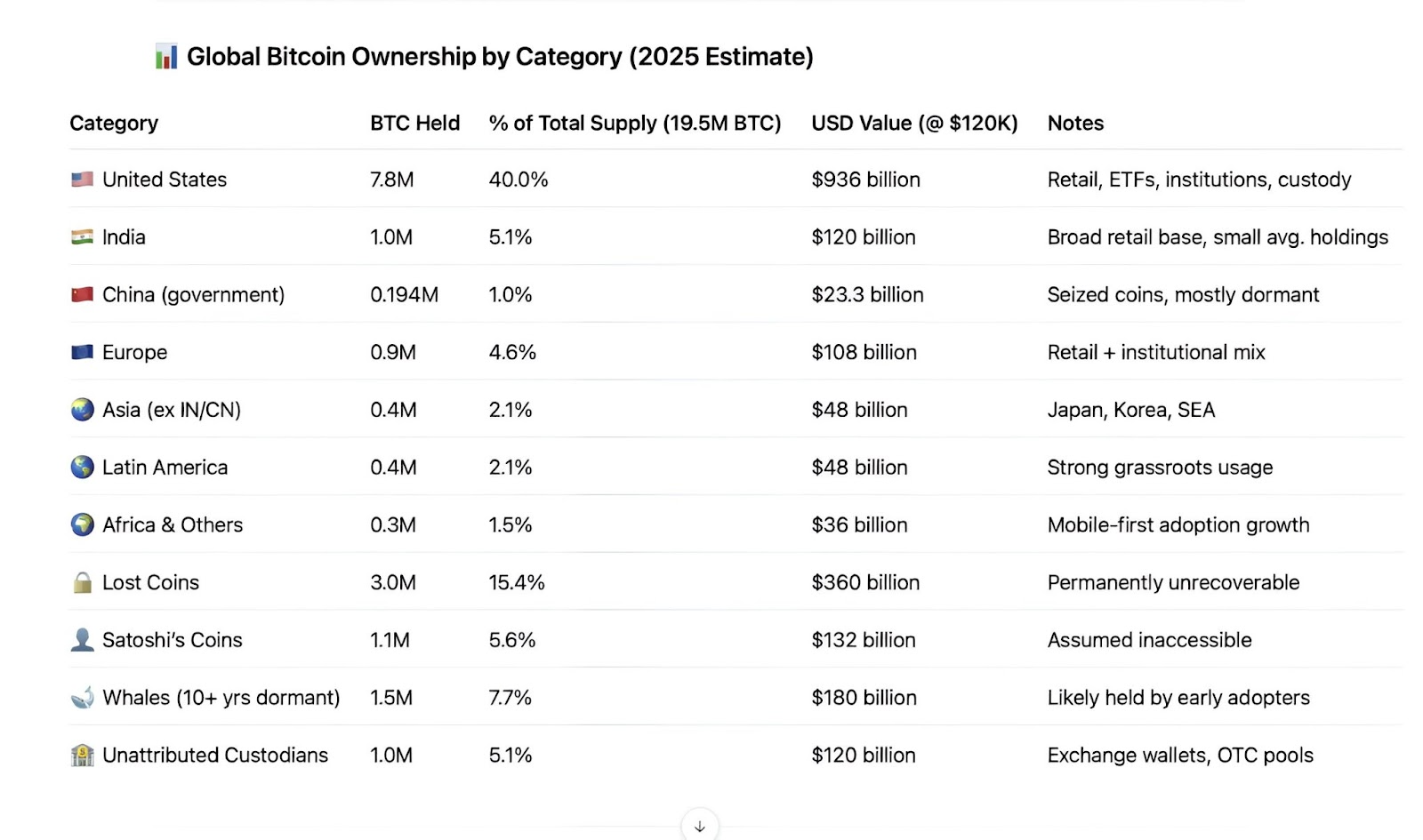

- Notably, India is now estimated to hold over 1 million BTC, about 5.1% of the global supply. This is due to the large retail exposure to Bitcoin in the country. It ranks just below the U.S. in global Bitcoin holdings.

Trump’s 50% Tariff on India and Crypto Reaction

In August, President Donald Trump imposed a steep 50% tariff on most Indian imports.

- Trump is punishing the country for buying discounted Russian oil, a move the administration says indirectly funds the Ukraine war.

- This follows an earlier 25% tariff hike earlier in the month, now doubled in response to India’s latest oil deal with Russia.

- As a result, the Indian rupee hit a record low against the U.S. dollar and triggered volatility in the crypto market as investors ditched riskier assets.

- Indian officials condemned the tariffs, warning of disruptions to global supply chains.

Related: Bitcoin Dumps 2.8% to Below $110K After Trump’s 50% India Tariff Over Russian Oil

India’s Reaction and BRICS Strategic Realignment

Amid U.S. tensions, Prime Minister Narendra Modi has strengthened ties with both China and Russia.

- It reaffirms a “special and privileged” partnership with Putin and reiterates bilateral engagement with Xi on the sidelines of the SCO.

- At the July 2025 BRICS Summit in Rio de Janeiro, India promoted the use of national currencies for intra-BRICS trade and the expansion of BRICS Pay systems.

- Notably, India will assume the rotating BRICS chairmanship in 2026 and host the 18th BRICS Summit. Prime Minister Modi has officially invited President Xi Jinping to attend.

Social and Market Sentiment

On X (formerly Twitter), India’s crypto debate is heating up:

- INR stablecoin hype: Enthusiasts speculate about an Ethereum-issued INR stablecoin, calling it a “game changer” for settlements. Kashif Raza sees it as an opportunity to strengthen the rupee against the U.S. dollar.

- Tax frustration: Many argue India’s 30% tax + 1% TDS is unsustainable and stifling innovation. Pushpendra Singh called against this exploitation.

- Rupee weakness: A trader highlights the rupee’s decline as a reason for BTC and ETH hedging.

- Trump factor: Some link Trump’s U.S. crypto policies, such as the Genius and Clarity Act, to open up liquidity for Q4 2025.

Overall, sentiment remains bullish yet cautious, with optimism for adoption and stablecoins tempered by concerns over taxation and regulatory uncertainty.

In Sum: India at a Crossroads

India is simultaneously the world’s fastest-growing economy and the largest crypto adopter, but its policies remain restrictive. The next 12–18 months could define whether India becomes a global crypto hub or pushes innovation offshore.

With balanced taxes, clear regulations, and an INR stablecoin, India could lead the digital asset era. Without reform, tax burdens, rupee volatility, and governance issues may stall its crypto growth.

Disclaimer: This article is based on the insights and forecasts shared by market influencers and analysts. While CoinEdition has synthesized and contextualized these views, readers should treat the content as informational rather than financial advice.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.