- HYPE forms recovery channel, testing key resistance near $50 for next breakout move.

- Golden-cross EMA alignment suggests short-term bullish momentum is strengthening.

- Elevated open interest and $4M net inflows highlight renewed investor accumulation.

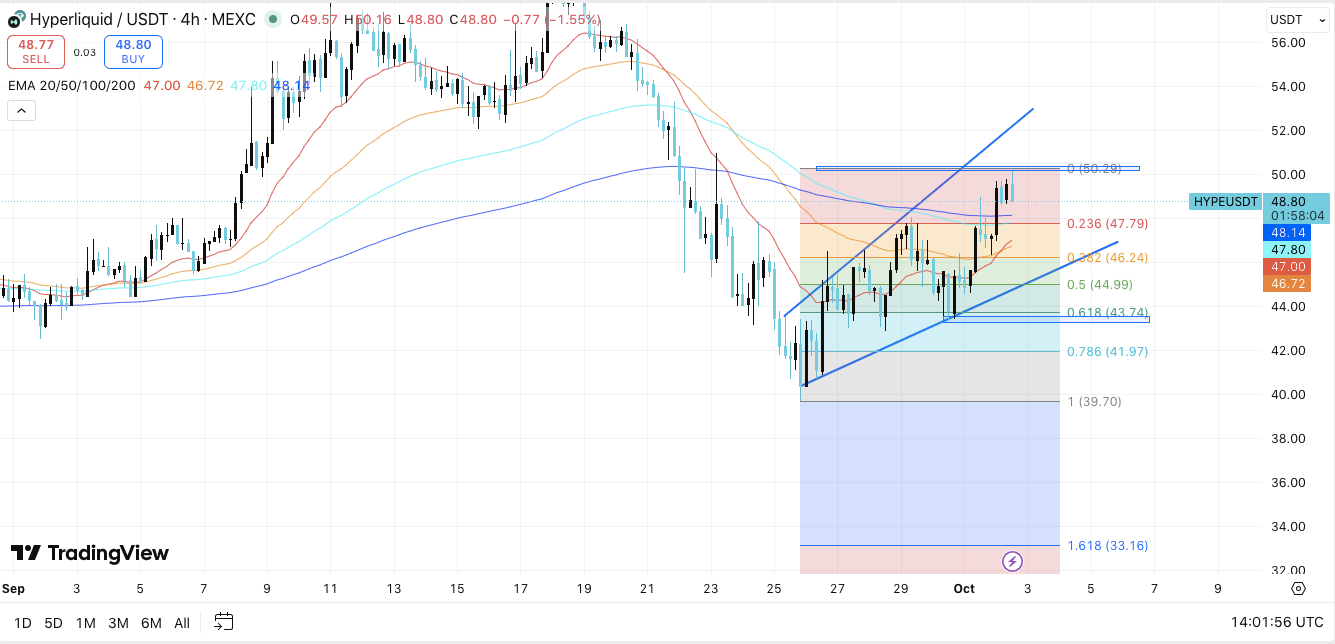

Hyperliquid (HYPE) has shown renewed strength in recent sessions, with technical signals and on-chain flows pointing toward growing bullish momentum. After correcting sharply from the $56 region to a low near $40, the asset has managed to form a recovery channel. This uptrend is now being tested at a key resistance level near $50, where price action and market positioning will determine the next leg forward.

Price Structure and Key Technical Levels

The asset is currently trading above its major exponential moving averages, with the 20 EMA at $47.00 and the 200 EMA near $48.14. This alignment resembles a golden-cross structure, suggesting short-term momentum is shifting upward.

Importantly, the recovery has also respected multiple Fibonacci retracement levels. The 0.236 retracement at $47.79 recently acted as support, while the 0.382 level at $46.24 remains the next line of defense if the price weakens.

Immediate resistance is positioned at $50.29, which coincides with a psychological round number and a key Fib level. A decisive breakout above this point could open targets between $52 and $56. Conversely, failure to clear this zone may lead to another pullback toward $46 or deeper support near $44.99.

Related: Hyperliquid Faces a New Challenger – YZi-Backed Aster (ASTER) Rallies 400%; $0.50 Next

Open Interest and Market Activity

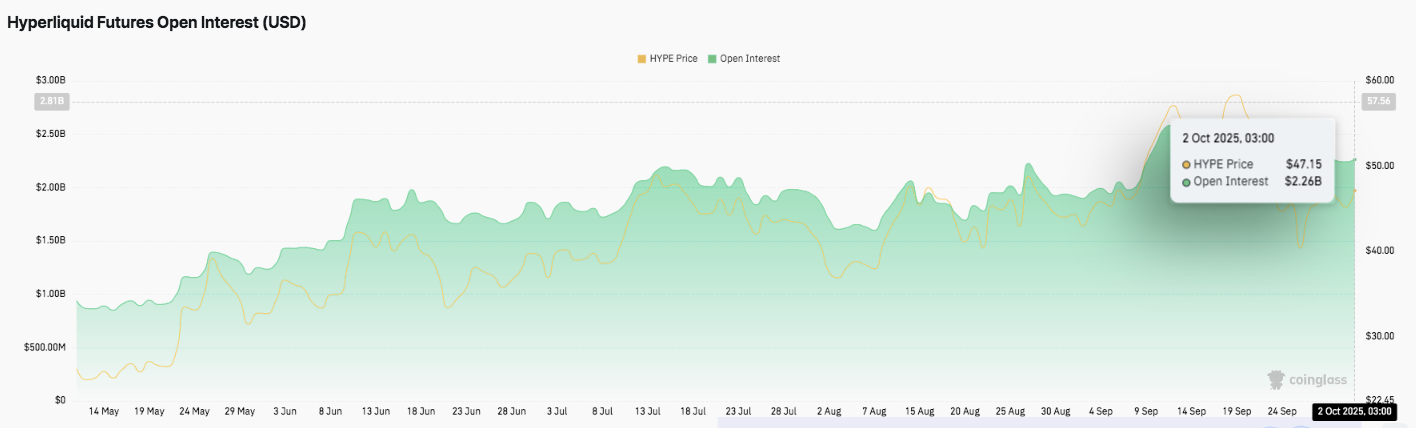

Beyond the price chart, open interest in Hyperliquid futures has shown consistent growth. From mid-May through July, open interest rose steadily and peaked near $2 billion. By late September, activity surged further, briefly surpassing $2.8 billion, reflecting heightened participation.

As of October 2, open interest remains elevated at $2.26 billion, while HYPE trades around $47.15. This sustained level of engagement highlights continued investor appetite for exposure, often signaling strong conviction.

Net Flows Signal Renewed Accumulation

Alongside open interest, spot netflows offer an important perspective. Earlier months were dominated by persistent outflows, highlighting profit-taking and weak accumulation. However, late September brought a sharp shift as inflows returned.

On October 2, net inflows exceeded $4 million, signaling renewed buying interest. This shift aligns with the price rebound from the $35 range and reflects growing investor confidence.

Technical Outlook for HYPE Price

Key levels remain clearly defined as Hyperliquid enters October trading within a recovery channel.

- Upside levels: $50.30 is the immediate hurdle, followed by $52.00 and $54.00. A breakout above these could open the door toward retesting the $56 high.

- Downside levels: $47.80 acts as the first support, aligned with EMAs. Below that, $46.20 and $44.99 are deeper retracement supports. If selling pressure intensifies, $43.70 and $41.97 mark the next significant levels.

- Resistance ceiling: The $50.30 zone remains the key line to flip for medium-term momentum, sitting at Fib resistance and a strong psychological barrier.

The technical picture suggests HYPE is compressing inside a recovery channel, where a decisive move above or below $50 could drive volatility expansion.

Related: Hyperliquid’s USDH Stablecoin Vote Sparks $55 HYPE Price Breakout

Outlook: Will HYPE Go Up?

Hyperliquid’s price prediction for October hinges on whether buyers can sustain control above $47.80 and challenge the $50–52 zone. Strong inflows and elevated open interest support the bullish argument.

If confirmed, HYPE could retest $54 and extend toward $56. Conversely, failure to defend $47.80 risks a retreat to $46 or even $44. For now, the asset remains in a pivotal zone where participation and conviction flows will dictate the next leg.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.