- A Trump-induced flash crash triggered over $64 million in losses for four traders on Hyperliquid, each losing more than $13 million.

- Despite the extreme volatility, Hyperliquid’s decentralized platform remained fully operational.

- Binance lagged while Hyperliquid’s on-chain system ran flawlessly.

The flash crash hit both stocks and crypto after President Donald Trump announced new tariffs on China. The news caused a wave of panic selling, wiping out $1.65 trillion from the U.S. stock market and over $19 billion from crypto.

Big Losses for Hyperliquid Traders, but Platform Holds Steady

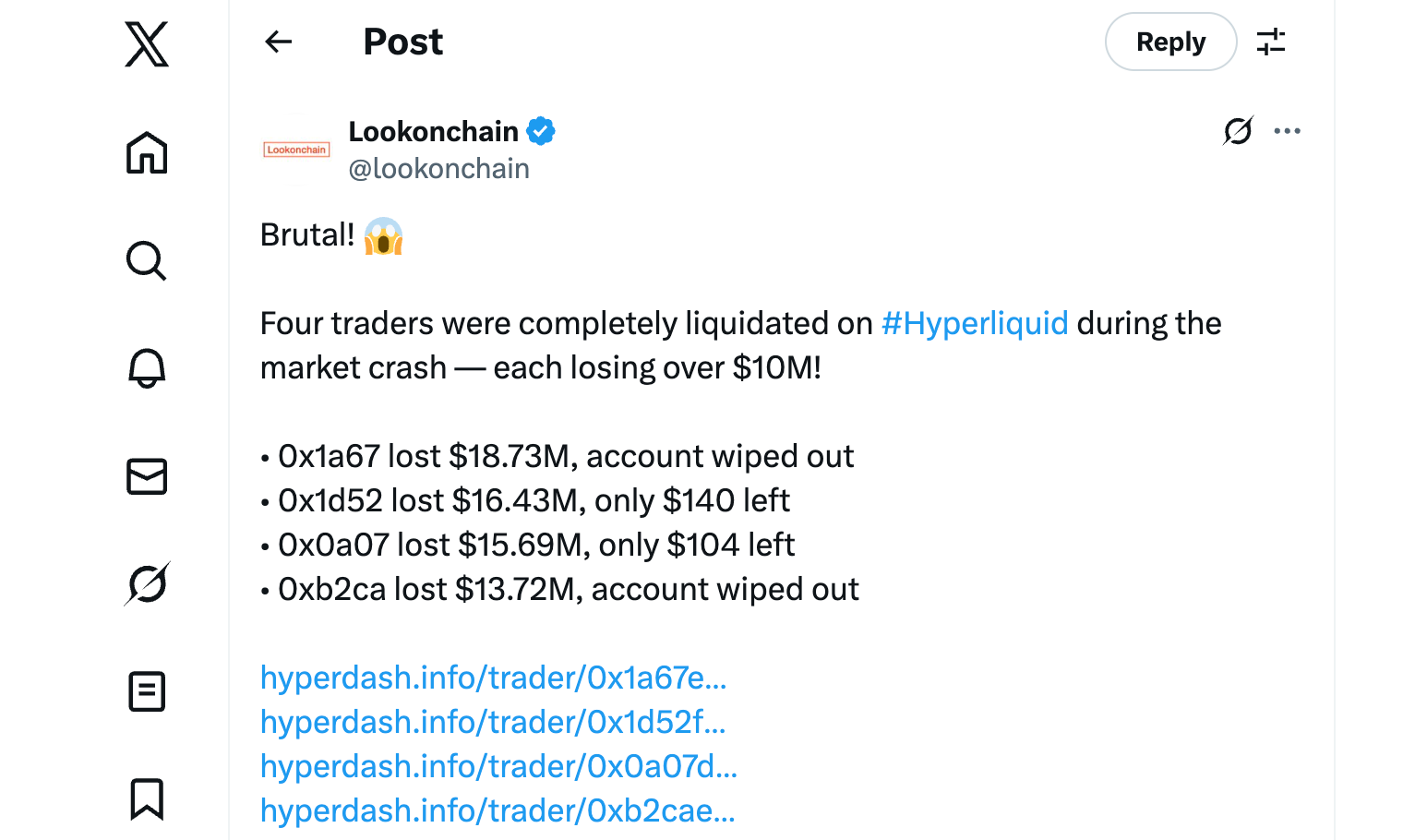

On the decentralized exchange Hyperliquid, four large traders were completely wiped out. According to Lookonchain, one lost $18.73 million, another $16.43 million, the third $15.69 million, and a fourth $13.72 million — some were left with just over $100.

Even with these major losses, Hyperliquid’s network stayed fully operational. There was no downtime or lag. Its consensus system, HyperBFT, handled a record number of transactions smoothly, showing it can scale and remain reliable even during extreme volatility. Hyperliquid said its risk and margin systems worked as intended, keeping the platform safe.

Validator Vet (@Vet_X0) called it “a technical milestone,” noting that nearly $10 billion in liquidations were cleared on-chain without disruption — proof that decentralized execution can match Wall Street-level throughput.

<embed> https://twitter.com/Vet_X0/status/1976901890580660591 </embed>

Centralized Exchanges Struggle to Keep Up

While Hyperliquid performed well, Binance and other centralized exchanges faced delays and display glitches as liquidation traffic surged.

Binance confirmed “heavy load” conditions, causing delays and display problems. However, they assured users that funds were safe and the team was watching the situation closely.

Meanwhile, in its latest update, Binance said its system is now working optimally.

XRP and Bitcoin Bounce Back After Flash Crash

Crypto prices mirrored stock turbulence but rebounded sharply once panic cooled. XRP dropped from $2.83 to $1.25 in just hours, before bouncing back to $2.45. That’s a 56% drop followed by a strong recovery.

Bitcoin also fell sharply, from $122,550 to $102,000. Ethereum and SUI saw even steeper drops, with SUI briefly falling 95% to $0.55 after being over $3 earlier in the week.

The quick rebound showed how fast buyers can return to crypto markets once the panic fades. Interestingly, on-chain data showed that large investors, or “whales,” were stepping in to buy the dip.

Whales and Institutions Buy the Dip

While many smaller traders took big losses, larger players were quietly buying. Lookonchain reported that the “7 Siblings” wallet group borrowed $40 million in USDC from Aave and used $5 million to buy 1,326 ETH at $3,771 just hours after the crash.

Big institutional wallets tied to Bitmine also made moves, pulling over $126 million worth of ETH from FalconX and Kraken. Another large buyer picked up $55.5 million in ETH across multiple platforms including Coinbase and Wintermute.

Whales were also active in smaller tokens. One address withdrew 657.8 billion PEPE tokens (worth $4.4 million) from Binance, then deposited $8.67 million USDC into Hyperliquid to buy HYPE. Another bought nearly 600 billion PEPE, and a third went long on both BTC and HYPE.

Ultimately, the crash highlighted a key difference in crypto infrastructure. While centralized exchanges like Binance struggled, Hyperliquid’s on-chain model kept running without a hitch.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.