- Indian Finance minister announced plans to develop Crypto SOPs.

- Minister claims no single nation can regulate the crypto sector on its own.

- She emphasized the need for international cooperation.

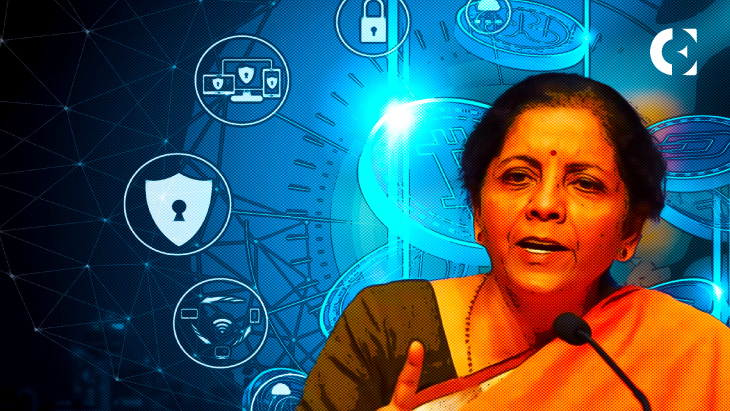

India‘s finance minister, Nirmala Sitharaman, has said that the country will create cryptocurrency Standard operating procedures (SOPs) during its G20 presidency starting December 1, 2022, through November 30, 2023.

Sitharaman has been skeptical about widespread crypto adoption due to concerns about its impact on financial stability, and she has previously urged for international cooperation to determine cryptocurrency’s future. However, in an interview with Indian media on October 15, she acknowledged that (crypto) will also be part of India’s thing (agenda during G20 presidency).

The Group of Twenty (G20) is an international organization comprising 19 member countries plus the European Union. Focusing on concerns like international financial stability, climate change mitigation, and sustainable development, it seeks to improve the world economy as a whole.

Sitharaman has stressed that no single nation can properly manage or control crypto in any form. “But if it’s a question of platforms, trading of assets which have been created, buying and selling making profits and, more importantly in all, these countries are in a position to understand the money trade, are we in a position to establish for what purpose it’s being used?” Sitharaman asked.

Sitharaman went on to emphasize the Enforcement Directorate of India’s findings about the usage of crypto assets in money laundering. She went on to say that the G20 has expressed similar worries and stressed the importance of international cooperation in regulating cryptocurrency, stating:

There is an understanding that we need to have some kind of regulation, and that all the countries will have to be true together on it, no one country is going to be able to singularly handle it.

In the meantime, India’s government has prioritized creating the digital Rupee. The Reserve Bank of India published a list of recommended features and reasoning for its in-development central bank digital currency (CBDC) on October 7.

The 51-page document explains the fundamental drivers for the digital rupee, including confidence, safety, liquidity, settlement finality, and integrity. India’s digital currency is driven in part by the need to lower operational costs and expand access to banking services.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.