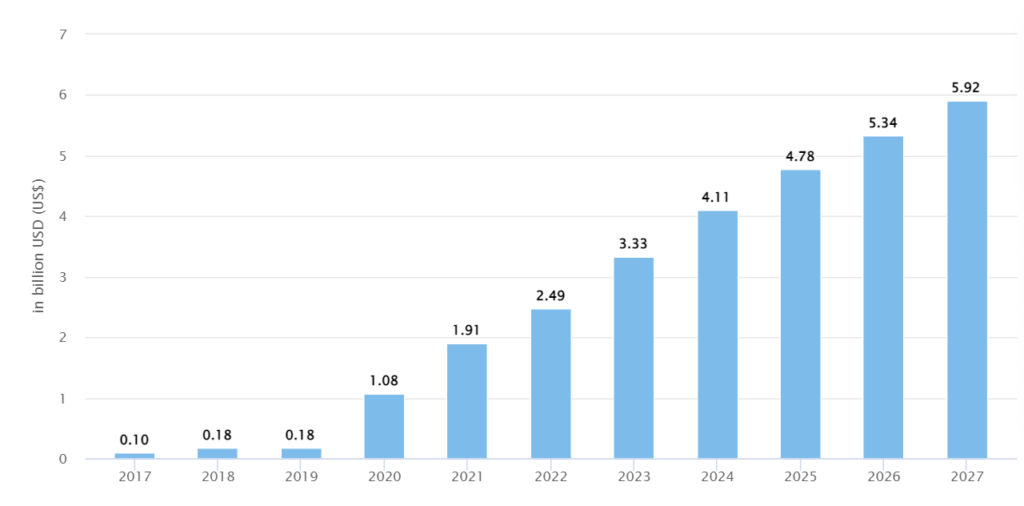

- India’s crypto revenue will reach $3.33 billion by 2023, as per the reports by Statista.

- The current position of India in crypto adoption is second, with the US in the first position.

- In the coming years, India will surpass the leading countries including the US, the UK, Japan, and Russia, predicts the report.

According to a recent analysis, India’s cryptocurrency revenue is expected to reach $3.33 billion in 2023, with the adoption of crypto by almost 156 million users.

Notably, as per the findings of the online crypto analytical platform Statista, India would overpower major countries such as the United States, the United Kingdom, Japan, and Russia this year in terms of crypto adoption.

According to the yearly revenue graph provided by the platform, since 2017, India had substantial growth in its crypto revenue, from 2017’s $0.10 billion to 2022’s $2.49 billion. As per the reports, the revenue that is expected to reach $3.33 billion by the end of 2023, would escalate to $5.34 billion in 2026 and $5.92 billion in 2027.

In detail, the annual growth rate of the Indian crypto revenue is anticipated to be 15.49%, having a definite increase in the revenue on a yearly basis.

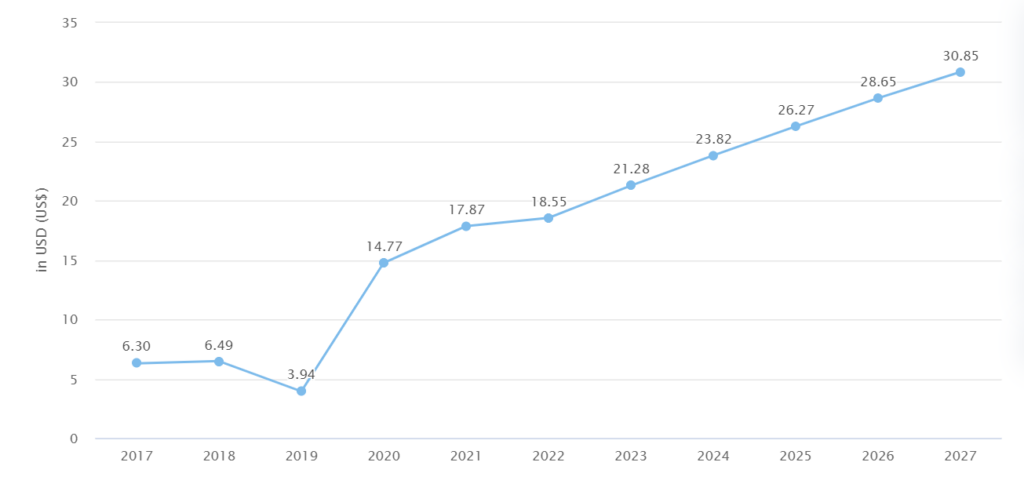

As per calculation, in 2023, the average revenue collected from each crypto user in the Indian crypto segments is $21.28.

Significantly, the current position of India in crypto adoption is second to the United States, which secured the highest revenue of $22,710,000,000, with other powerful countries like Japan, the UK, and Russia placed at the third, fourth, and fifth position respectively.

In a recent report by the crypto exchange KuCoin, it was noted that India has almost 115 million crypto investors which constitute only 15% of the country’s total population.

Further, the report added that the lesser public investment into India’s crypto market resulted from the factors such as difficulty in managing risk factors, trouble in understanding and predicting the crypto market, the threat of crypto hacks, and many more.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.