- ICP stabilizes near $5 support as momentum slows after recent sharp November drop.

- Futures open interest hits $188M, signaling rising trader leverage and speculative bets.

- Spot inflows improve, hinting at early accumulation and potential recovery if sustained.

Internet Computer (ICP) continues to face pressure after its sharp reversal from the November peak. The token has now settled near a key mid-trend support zone, where price behavior shows early attempts to stabilize. Market activity around this level suggests that traders are watching for signs of a potential rebound, even as momentum remains weak.

The broader trend remains cautious due to repeated failures to hold above short-term averages. However, futures positioning and renewed inflows hint at increasing interest from traders expecting stronger movement ahead.

Price Holds Mid-Trend Support as Momentum Slows

ICP currently trades around the $5 region after rejecting the recent $9.83 swing high. Price has slipped through multiple retracement levels and now sits near the 0.382 Fib at $5.08. This zone acts as the first meaningful support after the breakdown from $6. Sellers continue to control the short-term structure, as price still trades under the EMA-9 at $5.40.

However, volatility has eased as the Bollinger Bands contract. This signals cooling momentum after weeks of heavy selling.

Price also remains close to the middle band at $5.23, suggesting the market is attempting to form a base. A move above that level could confirm early stabilization. Failure to do so keeps pressure toward the $5 mark, with a break opening room toward the $3.96 Fib level.

Futures Activity Climbs as Open Interest Hits a New Yearly High

Open interest in ICP futures has climbed steadily through recent months. Activity ranged between $40 million and $90 million early in the year. Conditions shifted from late September as traders increased their exposure while price declined. This sent open interest above $150 million.

By November 18, open interest reached almost $188 million. This marks the highest reading in more than twelve months. Price held near $5.50 during that period. This divergence signals stronger speculative behavior as traders anticipate sharper moves. Additionally, it suggests growing leverage in the market, which often results in wider price swings.

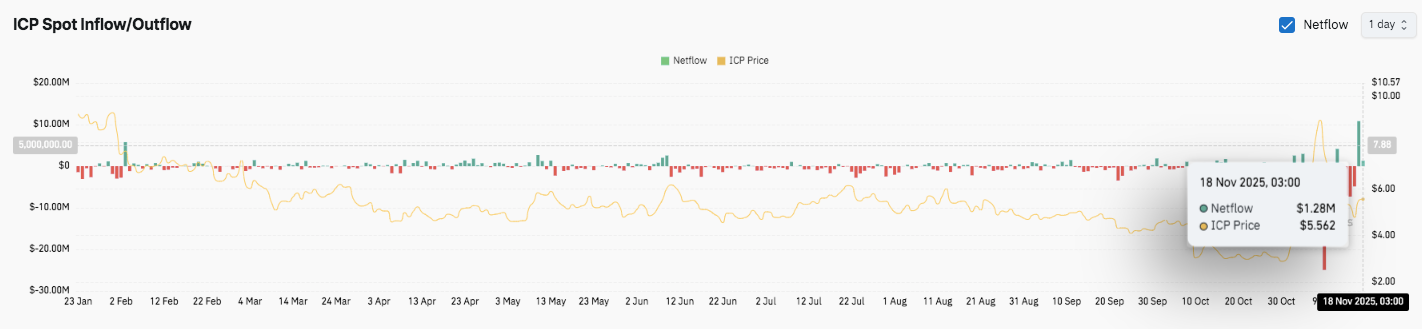

Inflow Data Shows Early Signs of Accumulation

Spot inflow and outflow data shows persistent selling pressure throughout the year. Most sessions recorded stronger red outflow bars, which kept momentum soft for months.

However, inflows have improved recently. ICP recorded a $1.28 million positive netflow on November 18 near the $5.56 level. This marks one of the largest accumulation phases in weeks.

Moreover, stronger inflows could support a shift in price behavior if they continue. Sustained accumulation remains crucial for any recovery.

Technical Outlook for Internet Computer (ICP) Price

Key levels remain well-defined as ICP trades inside a tightening structure near mid-trend support.

Upside levels sit at $5.40, $5.91, and $6.87, which form the immediate barriers on any relief attempt. A breakout above this range could extend toward $8.19 and the November swing zone near $9.00.

Downside levels include $5.08 at the 0.382 Fib, followed by $3.96 at the next retracement cluster. The 0.618 region near $6.87 remains the key level to flip for any meaningful momentum shift in the medium term.

The technical picture shows ICP compressing between the $5.00 support shelf and the declining EMA-9, forming a tight squeeze that often precedes stronger movement. Volatility continues to contract, and the latest sessions show price respecting the same support band after several retests. A decisive move outside this compression zone will likely dictate the next direction.

Will Internet Computer Rebound?

The price outlook hinges on whether buyers can protect the $5.08–$5.00 region long enough to attempt a break through $5.40 and $5.91. Holding this structure opens the door for a push toward the $6.87 Fib, where medium-term momentum would improve.

Additionally, rising open interest suggests positioning is building ahead of a larger move. However, conviction flows remain mixed, and spot accumulation must strengthen for a sustained recovery.

Failure to defend the $5.00 zone places $3.96 back in focus and risks extending the broader retracement. That level remains the next major support if selling pressure returns.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.