- Bitcoin addresses holding 10-10,000 BTC have accumulated 133,300 coins in the past month amid market uncertainty.

- Public companies’ Bitcoin holdings have surged nearly 200%, from $7.2 billion to $20 billion, in the past year.

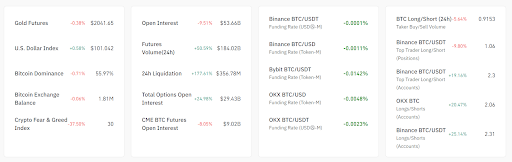

- The Crypto Fear & Greed Index shows fear at 30, while Bitcoin dominance slightly drops to 56%, indicating cautious sentiment.

BTC whales and sharks (addresses holding 10 – 10,000 BTC), are snapping up Bitcoin even as the overall market grapples with indecision. On-chain analytics firm Santiment reports these whales and sharks have collectively accumulated an additional 133,300 coins over the past month. Meanwhile, smaller traders have been selling off their holdings, transferring them to these larger wallets.

Publicly listed companies have also substantially boosted their Bitcoin reserves. Over the past year, Bitcoin holdings among these firms have surged by nearly 200%, increasing from $7.2 billion to $20 billion.

Data from Bitbo indicates that 42 publicly traded companies currently hold around 335,249 Bitcoins, valued at approximately $20 billion. This translates to a 177.7% increase in the value of their Bitcoin reserves compared to a year ago, according to Nickel Digital Asset Management.

Despite the whale accumulation and institutional interest, market sentiment remains mixed. The Crypto Fear & Greed Index at 30, indicating fear. Bitcoin dominance has slightly decreased to 56%. Furthermore, a 137.9% spike in 24-hour liquidations highlights significant futures and options activity.

While Bitcoin-Tether (BTC/USDT) funding rates hover near neutral across exchanges, long/short ratios paint a different picture. This disparity highlights the diverse strategies employed by traders on various platforms. Additionally, the U.S. Dollar Index has risen by 0.56%, potentially impacting crypto and gold prices, with gold futures slightly down at $2,041.65.

Moreover, open interest and trading volumes continue to be high in the futures and options markets, pointing to ongoing volatility. The market remains highly active, with divergent trader sentiment across different exchanges and financial instruments.

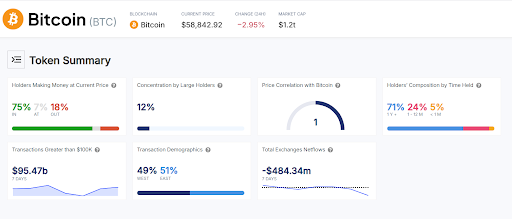

The Token Summary chart reveals key cryptocurrency market dynamics, showing that 75% of holders are currently profitable, and 71% of them have been holding for over a year. Additionally, the token shows low concentration among large holders, at 12%, suggesting a more distributed ownership structure. Consequently, the token’s price correlates perfectly with Bitcoin, indicating it closely follows broader market trends.

Transaction data shows notable activity, with $95.47 billion in large transactions over the past week, evenly divided between Eastern and Western markets. Furthermore, a negative exchange netflow of -$484.34 million over seven days suggests a trend of accumulation as tokens move off exchanges.

Overall, the data paints a picture of a volatile crypto market with uncertain direction, high trading activity, and diverse trader sentiment across various exchanges and instruments.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.