- Bitcoin shows a consolidation between $18,800 and $20,200.

- The mining and accumulation of bitcoin show an improvement.

- Bitcoin accumulation also reached a seven-year high.

Bitcoin reportedly underwent significant changes in its price, accumulation, mining, and hash rate during the last weeks amid the crypto winter, indicating a bullish tendency. Bitcoin, along with all other cryptocurrencies, was exposed to the harsh realities of the crypto winter from November 2021.

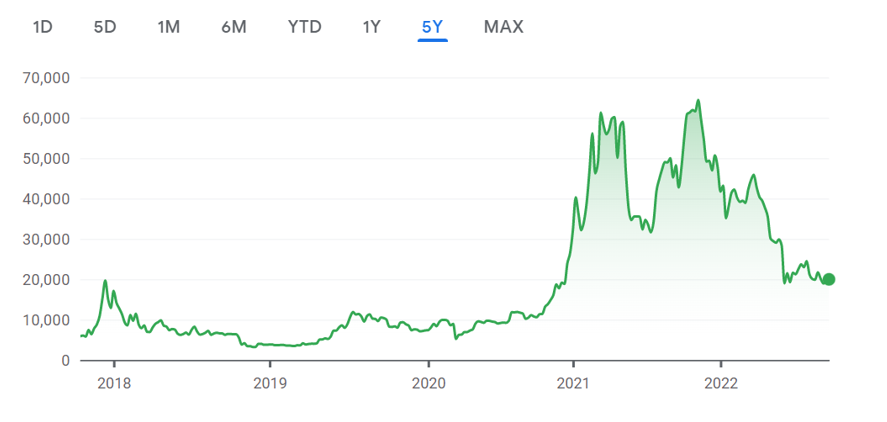

The cryptocurrency had been showing a consolidation between a narrow range of $18,800- $20,200 for the past few weeks after the price fall in mid-September.

Interestingly, the current price of Bitcoin resembles both the pre-crash November 2018 and pre-rally March 2019. In 2018 and 2019, Bitcoin showed a similar kind of price range between $18000 and $20000.

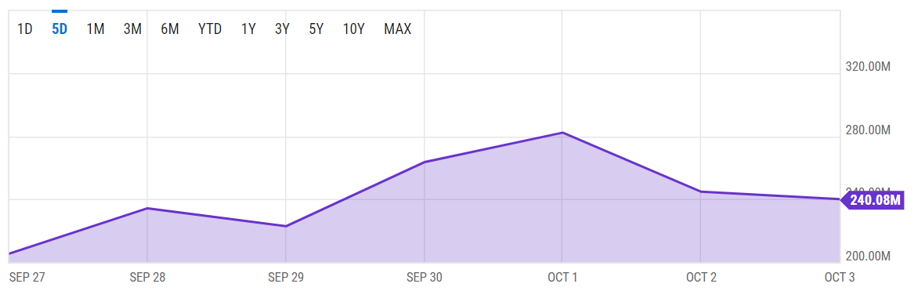

Despite the fall in price, the mining and accumulation statistics are improving. The current hash rate of bitcoin is 244.75 M, up from last year’s 177.54 M.

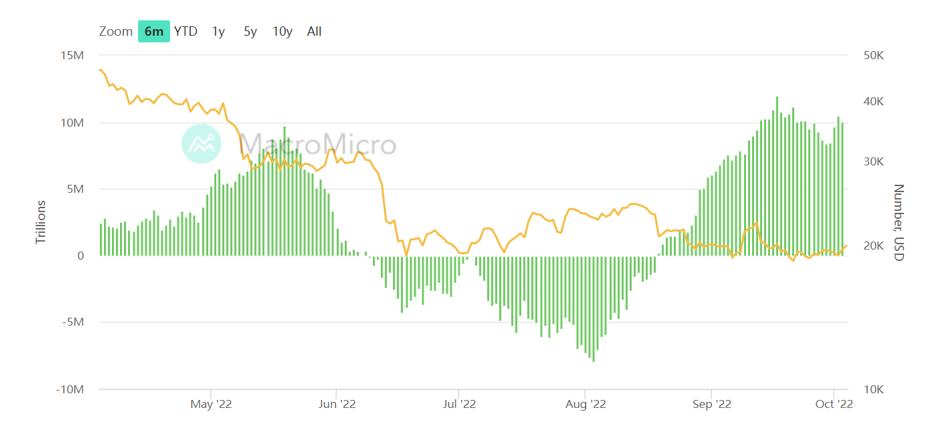

Similarly, the mining conditions had also improved since August. From the chart, it is understood that bitcoin’s slower hash ribbon was overtaken by the faster ribbon which indicates the improvement in mining.

It could be estimated that an increase in the number of efficient hardware and efficient mining rigs resulted in a rise in the hash rate.

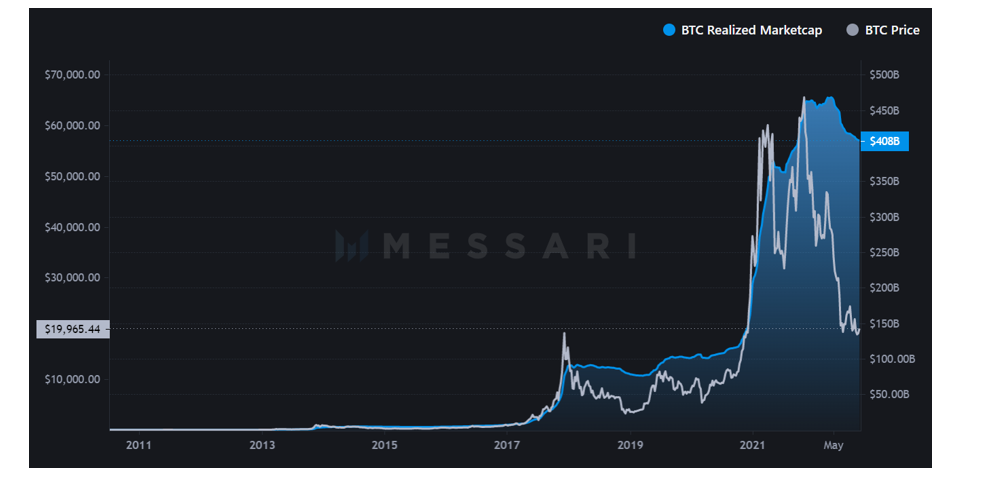

Additionally, bitcoin accumulation had also reached a seven-year high, with 74% of the realized cap. During 2019 and 2015 bottoms, the scores were at 70% and 77% respectively.

Lastly, the percentage of supply in loss has increased by almost 50%. According to the daily analysis, the highest percentage of loss is 52%. Analyzing on a 7-day basis, the loss percentage is 50.4% and on a monthly basis, the percentage is 48%.

All the above analyses indicate a tendency for bitcoin to move to the bearish period. The consolidation of prices is very rare in cryptocurrencies and such rare consolidation directs toward a bullish hike. Similarly, the other aspects also point out such a possibility.

Disclaimer: The views and opinions, as well as all the information shared in this price prediction, are published in good faith. Readers must do their research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.