- The Shiba Inu team is keen to expand SHIB’s utility across Asia.

- The Shiba Inu ecosystem has grown over the years, with over 1.5 million on-chain holders.

- Crypto experts believe the SHIB price will record a bullish breakout if the Fed leads in rate cuts this month.

Shiba Inu (SHIB) is currently flashing major bearish signals, but the project’s team is telling the market to look ahead to a bullish fourth quarter. While the price is stuck below key moving averages and derivatives data looks negative, the team is pointing to a major market expansion in Asia and a classic bullish chart pattern as the catalyst for a “crypto Autumn” rally.

The Bear Case: Why the Current Chart Looks Weak

The short-term picture for SHIB is not pretty. The token has been in a downtrend since February 2024 and key metrics are signaling continued weakness.

What is the price action telling us?

SHIB is trading below its 50-week simple moving average, a key long-term trend indicator. On the four-hour timeframe, the price is trapped below a falling logarithmic resistance trend. A break above this line is required to invalidate the current bearish sentiment.

What is the derivatives market saying?

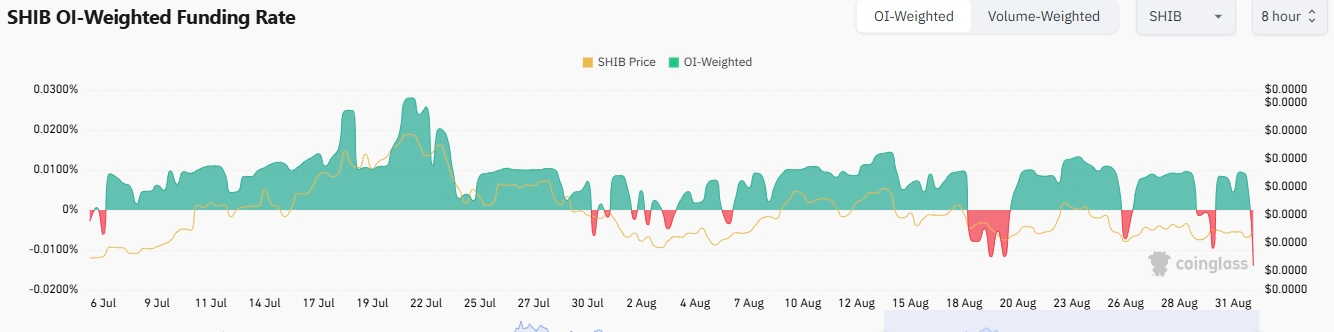

Shiba Inu’s midterm bearish sentiment has been exaggerated especially after its Open Interest (OI)-weighted Funding Rate recently turned negative.

Historically, a negative OI-weighted funding rate in the crypto derivatives has been associated with midterm bearish sentiment and vice versa.

Related: Shiba Inu Price Prediction: SHIB Consolidates Near $0.00001240 as Traders Watch Breakout Signal

The Bull Case: An “Inverse H&S” and a Major Asian Expansion

Despite the weak data, the Shiba Inu team is signaling that a major turnaround is on the horizon.

What is the bullish technical pattern?

From a technical perspective, the SHIB/USD pair has established a major bull support level around $0.00001. In the weekly timeframe, SHIB price has been forming a potential inverse head and shoulder (H&S) pattern, coupled with a rising divergence of the Relative Strength Index (RSI).

What is the SHIB team’s roadmap for Q4?

Shiba Inu’s marketing lead, Lucie, is telling the “Shibarmy” to focus on a planned market expansion in Asia, specifically in Korea, Japan, and China.

Related: Shiba Inu’s Lucie Warns SHIB Army Against Engaging Critics, Points to Reeves’ Philosophy

As such, Lucie urged the Shibarmy not to focus on token burns as the sole driver of a bullish outlook, but also to consider the planned market outreach in Asia to enhance the meme’s utility. For context, a total of $219,849 worth of SHIB was burnt during the last 24 hours, up 57% from the previous day.

The Bottom Line: Can a Fed Rate Cut Ignite the Breakout?

The ultimate catalyst for SHIB may come from the broader market. Crypto experts believe a major altcoin rally will be triggered if the U.S. Federal Reserve delivers the expected rate cut on September 17.

Lower interest rates typically make risk assets like memecoins more attractive to investors. For SHIB, this influx of liquidity could be the spark needed to confirm its bullish chart patterns and kick off the rally the team is predicting for Q4.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.