- Jeff Park said the proposed U.S. crypto bill would shift regulatory power from the SEC to the CFTC.

- He noted that Uniswap’s long-awaited fee switch marks a major milestone for DeFi innovation under clearer regulations.

- Park also highlighted Square’s Bitcoin payments, cautioning against micro-transactions.

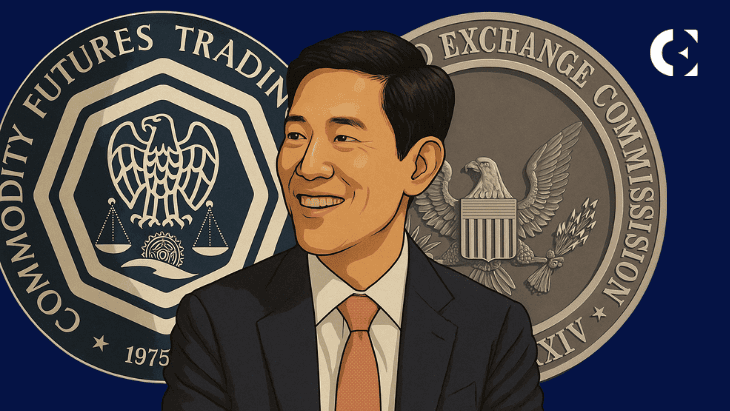

In a recent podcast with Anthony Pompliano, Jeff Park, Partner and Chief Investment Officer at ProCap BTC, weighed in on the proposed U.S. crypto market structure bill.

Park said the bill makes one thing clear: the CFTC would get more control over crypto, taking much of that power away from the SEC.

He explained that the CFTC’s mandate aligns more closely with the core functions of crypto, including capital efficiency, derivatives, leverage, and financial innovation. According to Park, crypto behaves more like a global commodity market than a domestic securities market, making the CFTC a more natural fit.

He added that this regulatory clarity will likely unlock new types of innovation across decentralized finance (DeFi). It will allow developers to move ahead with features that were previously stalled due to SEC pressure.

Related: SEC to Harmonize Crypto Rules with CFTC, Atkins Names Oversight His Top Priority

Uniswap Activates Fee Switch After Years of Regulatory Pressure

Furthermore, Park highlighted Uniswap’s recent announcement that it will finally activate its long-anticipated fee switch. This update allows the protocol to accrue fees to UNI token holders.

He called the move “momentous,” noting that Uniswap has settled trillions of dollars in value but has never been able to direct revenue to token holders due to regulatory concerns. Park said SEC Chair Gary Gensler’s stance on tokenholder economics previously made activation impossible.

With a shifting regulatory environment and clearer guidance pointing toward CFTC oversight, Park believes more proactive and transformative updates like this will soon follow across the DeFi sector.

Bitcoin Payments Expand Through Square—But Don’t Use BTC for Coffee, Says Park

Meanwhile, the conversation shifted to Square’s new feature that allows merchants to accept Bitcoin and stablecoins.

Park appreciated the move toward greater Bitcoin utility but cautioned against using BTC for everyday micro-payments, such as coffee, given the well-known regret stories of early Bitcoin spenders.

Instead, he argued Bitcoin shines in larger transactions, such as home purchases or major expenses, where its long-term value proposition makes more sense. He also pointed out that Lightning Network’s current design limits most merchant payments to around $600.

Stablecoins Dominate Payments

Pompliano suggested that stablecoins have effectively taken over the medium-of-exchange role that Bitcoin was originally created for. Park agreed, noting that most consumers prefer to spend depreciating dollars while saving appreciating Bitcoin.

Still, Park said Square’s integration creates a powerful secondary effect as merchants who accept Bitcoin may begin holding it on their balance sheets. This could turn thousands of businesses into micro-Bitcoin treasuries, enhancing long-term financial resilience if Bitcoin’s price continues rising.

Related: Stablecoin Dominance Jumps As Bitcoin Falls Below $96K And Traders De-Risk

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.