- Deaton urged leaders to reject any SBF pardon, citing scale of FTX fraud.

- DOJ, FBI, and SDNY kept the 25-year sentence and $11B forfeiture intact.

- Reports of a lobbying push for clemency kept scrutiny on the case.

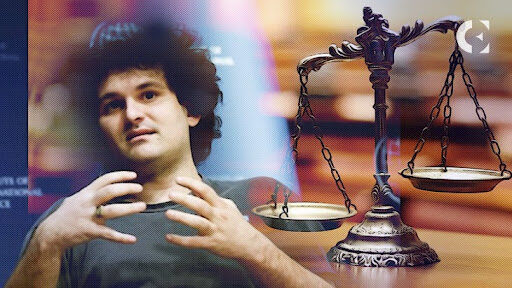

Attorney John E. Deaton has urged authorities and political leaders to reject any effort to pardon or commute the sentence of Sam Bankman-Fried, the former FTX chief convicted of arranging one of the largest financial frauds in U.S. history.

In a statement shared on X, Deaton described Bankman-Fried as “the Bernie Madoff of crypto” and called on Pam Bondi to reopen investigations into alleged campaign finance violations. He also accused Bankman-Fried’s parents, Joe Bankman and Barbara Fried, of participating in the fraudulent operations, citing their reported involvement in shell companies, political fundraising, and property acquisitions tied to FTX funds.

Reports of a Lobby Effort for Pardon

On March 11, 2025, political commentator Laura Loomer reported that a well-funded lobbying effort was underway to push President Donald Trump’s team to issue a pardon for Bankman-Fried. Loomer claimed that some political consultants and donors were coordinating a campaign to portray the FTX founder as a “victim” following his recent solitary confinement and media appearances. She alleged that his family members were involved in hiring a firm to lobby for the pardon.

Federal prosecutors, however, have argued that Bankman-Fried’s crimes caused extensive harm to investors, lenders, and customers. He was sentenced to 25 years in prison, three years of supervised release, and ordered to forfeit $11 billion in assets for defrauding billions from FTX users and investors.

Details of the FTX Fraud Case

According to the U.S. Attorney’s Office for the Southern District of New York, between 2019 and 2022, Bankman-Fried used FTX customer funds to make over $100 million in political donations, primarily to Democratic candidates, while also contributing to some Republican campaigns. He was convicted on seven federal counts, including wire fraud, securities fraud, commodities fraud, and money laundering.

Prosecutors stated that Bankman-Fried directed changes to FTX’s code to allow Alameda Research, his trading firm, to access and withdraw unlimited funds. He also provided investors and lenders with falsified financial records and used customer deposits to buy luxury real estate and fund political influence.

Related: FTX Top Creditor Activist Recounts Sam Bankman-Fried’s 25-Year Sentencing

Attorney General Merrick B. Garland said the case showed that “there are serious consequences for defrauding customers and investors.” In addition, FBI Director Christopher Wray described the outcome as a clear message to anyone seeking to exploit financial systems for personal gain. U.S. Attorney Damian Williams added that the sentence ensures accountability and that recovered funds will be used to compensate victims through court-approved restitution.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.