- Kaiko highlighted key events that shaped the crypto market in 2023.

- According to Kaiko, Bitcoin led the crypto rally for the year amid ETF hype.

- Binance started 2023 with 70% market share but closed with 43.8% amid legal setbacks.

Kaiko, a financial data platform with analytics tools for cryptocurrency, has highlighted some of the significant events that shaped the crypto market in 2023. The analysis platform made a series of posts on X (formerly Twitter), referencing those events and noting how they impacted the crypto market in the year.

According to Kaiko, Bitcoin led the crypto rally for the year amid ETF hype, with the best risk-adjusted returns relative to most traditional assets. There were rumors on many occasions that the U.S. Securities and Exchange Commission (SEC) was about to approve multiple spot Bitcoin ETF applications. The crypto market surged with every rumor, expectations increased, and Bitcoin led the rallies.

Kaiko also noted that developments within Binance, the largest crypto exchange by volume, impacted the crypto market, albeit negatively, from an overall perspective. According to the analytics platform, Binance started 2023 with nearly 70% market share but closed with 43.8% after a series of legal setbacks.

Furthermore, Kaiko noted developments around FTX, with the Alameda Gap persisting. Using data from its platform, Kaiko showed that the BTC market depth is yet to recover to its pre-FTX levels. Another impactful metric from Kaiko is liquidity, which the platform noted to have become increasingly concentrated. According to Kaiko, the top eight exchanges account for nearly 90% of the volume and depth in the crypto market.

Other notable developments by Kaiko include that Bitcoin has become less correlated with traditional assets, while Solana has rebounded from the post-FTX lows. The platform also highlighted that stablecoins depegging became increasingly common in 2023, and FTX tokens rallied ahead of liquidations.

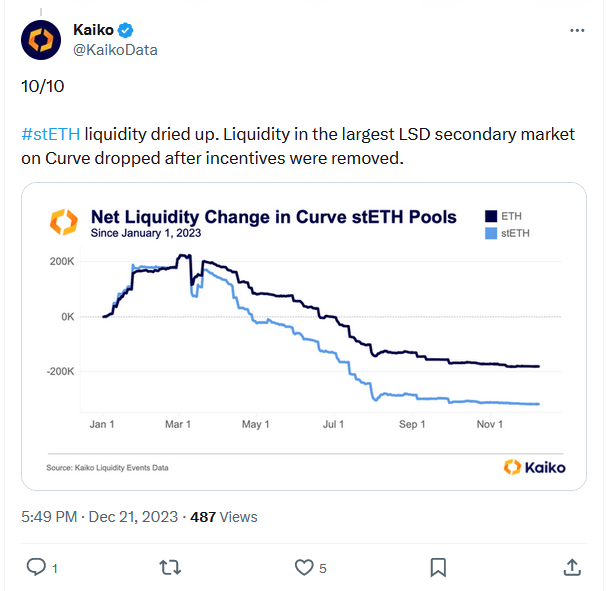

Kaiko noted that Curve suffered a crisis of trust following big loans by its CEO, while stETH liquidity dried up.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.