- VP Kamala Harris overpowers Donald Trump in betting odds on the presidential election.

- Though Bitcoin dipped to a daily low yesterday, it recovered recently, marking nearly a 3% surge.

- Peter Schiff hints at a possible inflation if Kamala Harris wins the presidential election.

Bitcoin experienced a sharp drop after the U.S. presidential candidates’ debate and a shift in the betting markets. As VP Kamala Harris’ odds on Polymarket climbed to 56%, surpassing Donald Trump’s 48%, Bitcoin dropped to a daily low of $55,591. Economist Peter Schiff, commenting on Harris’ rising odds, predicted an impending inflation should she be elected.

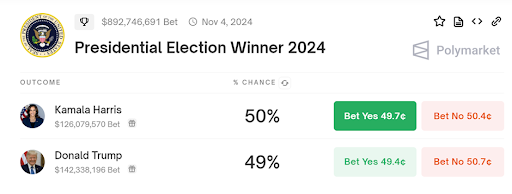

According to the latest data from Polymarket, Kamala Harris remains the leading candidate in the presidential race, even with minor fluctuations. Her odds dropped to 50%, while Trump’s odds rose to 49%.

Schiff suggested Harris may introduce government funding initiatives, implying the possibility of debt recovery under her leadership. However, he warned of inflationary pressures. Altcoins like Dogecoin saw significant losses as Harris gained ground in the betting markets, while the Japanese yen strengthened to 140.70 per U.S. dollar.

As of press time, Bitcoin is trading at $58,069, marking a notable rally from the recent low. Over the last 24 hours, the cryptocurrency has experienced a hike of 2.94%, with a 1.94% increase over the last week. Though Dogecoin marked a plummet of over 4% yesterday, it has recovered and surged by 2.75% over 24 hours.

Experts Weigh In on the Election

There are mixed views on how the election could affect the crypto market. Trump, who has openly expressed support for cryptocurrency and labeled himself the ‘crypto president,’ offers hope for a potential market revival.

Read also: Harris Skips Crypto Regulation as Trump Leads Polymarket with 52%

While Harris has not clearly outlined her stance on crypto, some fear she may align with the anti-crypto movement. However, others remain hopeful, believing her presidency could spark a bullish trend. The crypto community awaits the final outcome of the 2024 U.S. presidential election this November.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.