- Kaspa surges 32.10%, outstripping the broader market’s 6.70% gain.

- Investor confidence surges as trading volume rockets 186.50%, hitting $115M in 24 hours.

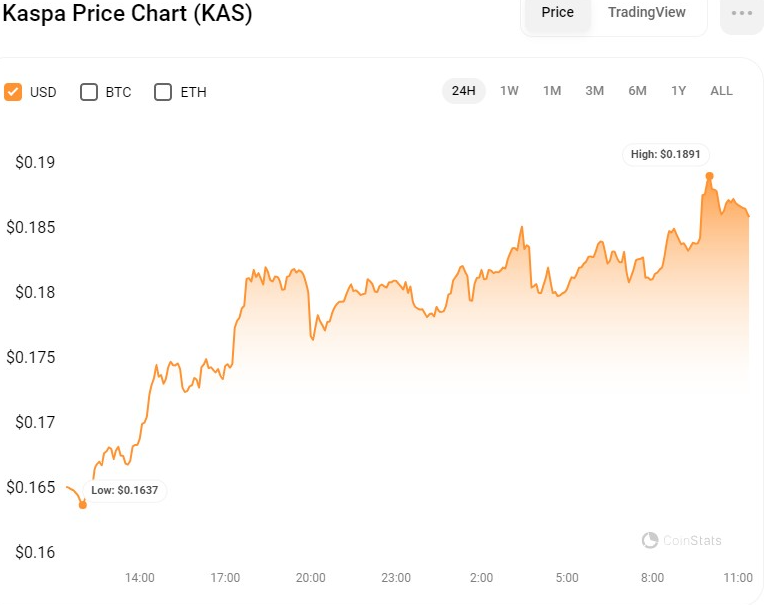

- KAS sets a new high at $0.1894, and the market cap soars to $4.27B.

Kaspa (KAS) has made headlines for its outstanding performance in the cryptocurrency market, especially after it set an all-time high. Moreover, in the last week, Kaspa has gained 32.10%, outperforming the broader cryptocurrency market, which rose by 6.70%, and L1 cryptocurrencies, which grew by 5.70%.

This rally is the most extended series of gains for Kaspa since its outstanding increase during October-November of last year. At press time, KAS was trading at $0.1858, a 12.84% surge from the intra-day low.

Kaspa Outperforms Market Expectations

During the rally, Kaspa’s trading volume skyrocketed by 186.50% in the last 24 hours, hitting $115,381,070. This increase in market activity indicates increasing demand for Kaspa, further confirmed by its most recent record high of $0.1894. Concurrently, the market capitalization soared to $4,277,352,844, a 14.55% surge.

The rally of Kaspa to its new all-time high has become the focus for investors and analysts. The token’s ability to overcome $0.18 has placed it in front of well-known competitors like Cosmos (ATOM) and Theta (TAO) in terms of the token price. However, some claim there is much room for growth in this market area, and Kaspa is expected to reach the top 10 currencies within the market cap.

The success of Kaspa is based on the unorthodox use of blockchain technology, which uses a combination of proof-of-work and GHOSTDAG protocol. The novel protocol allows blocks to be accepted simultaneously, eliminating the usual problem of orphan blocks and enabling faster transaction confirmation. Currently, a new block per second is created by Kaspa, the goal of this project is to reach ten and then even 100 blocks per second, thus revolutionizing the whole concept of blockchain efficiency.

Enhancing Network Capabilities

To help its fast growth, Kaspa has implemented several functionalities that allow for better network performance. These are reachability checks to guarantee network integrity, blockdata pruning for economical data management, and SPV proofs for transaction simplification. The subnetwork support also paves the way for improvements that can result in new security features and transaction-handling techniques.

KAS/USD Analysis

The Relative Strength Index (RSI) rating of 76.42 on the KAS/USD 4-hour price chart, which is heading downward, indicates that the asset is overbought and may be due for a correction. If the RSI continues to dip below 70, it may suggest a shift in market sentiment toward selling pressure.

Furthermore, the Moving Average Convergence Divergence (MACD) movement above its signal line with a rating of 0.009385 suggests positive momentum in the short term. The MACD histogram also shows an increase in positive momentum, implying that the price will continue to rise. If the MACD remains above the signal line and the histogram shows positive momentum, the asset will likely see more price increases.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.