- Ki Young Ju says Bitcoin is entering a strong long-term opportunity zone.

- Institutional holders may prevent a deep Bitcoin pullback, keeping the floor higher.

- Macro liquidity and on-chain data suggest Bitcoin could rebound sooner than many expect.

Bitcoin may be under pressure in the short term, but on-chain data shows the market is entering a strong long-term opportunity zone, according to Ki Young Ju, the founder of CryptoQuant. His comments come as Bitcoin attempts to recover from Friday’s sell-off, during which the BTC price fell to around $80,600.

Bitcoin Bull Cycle May Have Topped, but the Bottom Looks Higher This Time

Ki Young Ju noted that Bitcoin’s broader on-chain cycle technically peaked earlier this year when the asset touched the $100,000 region. In classic market cycle theory, a full retracement toward the realized price, currently around $56,000, would form the next cyclical bottom.

However, he believes that scenario is unlikely in this cycle. Large institutional players such as Strategy, whose holdings are effectively off the market, have removed a significant amount of Bitcoin from the circulating supply.

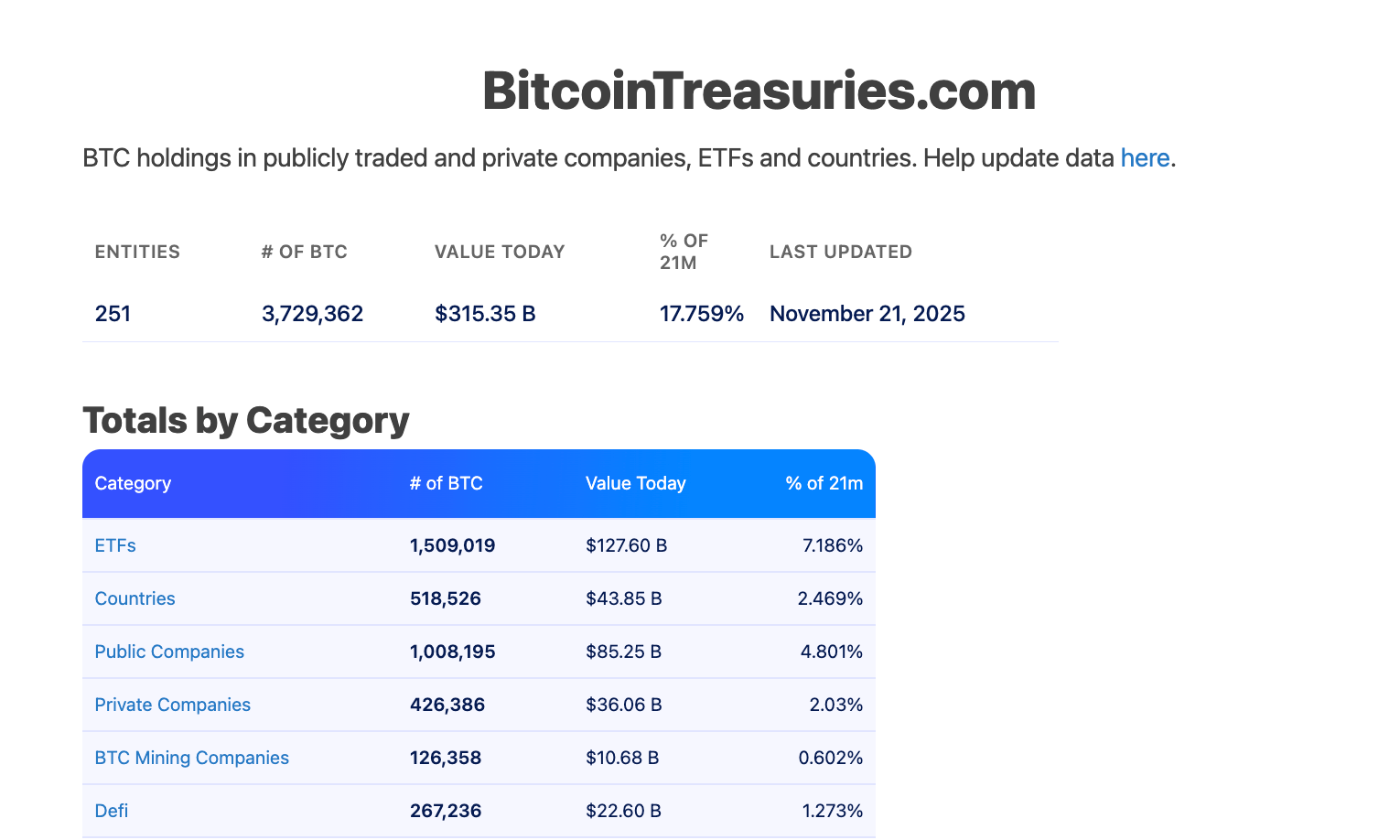

Specifically, Michael Saylor’s Strategy now controls 649,870 BTC. Public firms collectively hold over 1 million BTC, while governments and private firms hold over 518,526 and 426,386 BTC, respectively.

With such coins unlikely to be sold, Ju argues that the traditional cycle reset toward $56,000 “may not play out”. In other words, Bitcoin’s floor is much higher than in previous cycles.

Favorable Accumulation Zone for Long-Term Holders

For spot holders not using leverage, Ju believes the current region represents a “reasonable long-term accumulation zone,” even if price volatility continues.

While noting that he is not trying to time precise entries, he says he remains confident about the market’s long-term direction. He also warned traders considering short positions or panic selling, saying this point in the cycle is a “bad idea” to exit.

Notably, Bitcoin is currently down more than 32% from its October all-time high of above $126,000. Analysts like Ju believe the worst may be over, or that any subsequent drawdown will be minimal compared to what has already occurred. In other words, a rebound could happen at any time.

More Reasons a Rebound Could Trigger Soon

Beyond on-chain dynamics, the macro environment may support Bitcoin sooner than many expect. Ju highlighted that governments worldwide are likely to inject liquidity into financial markets until mid-2026 due to political considerations.

Liquidity injections typically provide relief to risk assets, including Bitcoin. This means sentiment could rebound “at any time,” even if the market’s current tone remains cautious.

Ju acknowledged that he no longer trades with leverage and does not focus on short-term timing. Still, he remains confident that the market is structurally bullish over the long run, despite the current correction and macro-driven volatility.

Related: US Jobs Report Flashes Warning Signs: What the Economic Slowdown Means for Bitcoin and Crypto

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.