- Santiment tweeted that the number of BTC shark and whale addresses has been rapidly growing.

- BTC’s price is up more than 11% over the last 24 hours.

- A medium term technical bullish flag was recently triggered on BTC’s daily chart.

As prices in the crypto market post significant gains over the last week, investors and traders are still searching for key indications that the market is transitioning out of a bear cycle and into a bull run. The blockchain analysis firm, Santiment, tweeted a key metric relating to the crypto market leader that has historically been an early sign of an upcoming bull run.

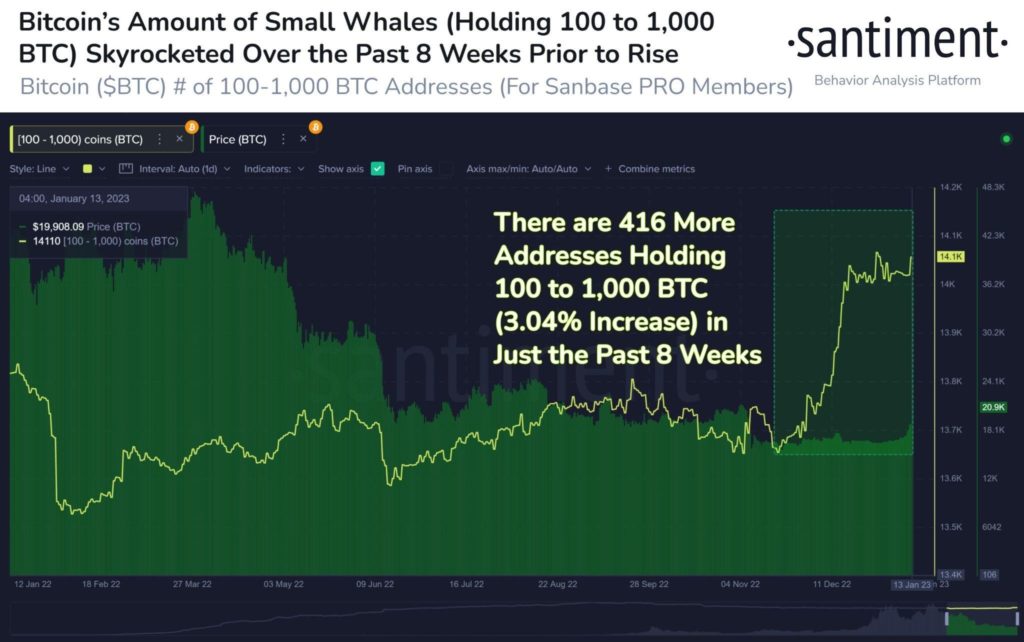

According to the tweet, the amount of Bitcoin (BTC) addresses holding between 100 and 1,000 BTC has been rapidly growing. The tweet added that price pumps generally occur marketwide when whales accumulate BTC.

The chart shared in Santiment’s tweet shows that there are more than 416 addresses holding between 100 and 1,000 BTC. This is a 3.04% increase in just the past 8 weeks.

The accumulation of BTC has resulted in the market leader’s price rising more than 26% in two weeks. CoinMarketCap shows that BTC’s price is up more than 11% over the last 24 hours. This has added to its positive weekly performance, taking BTC’s weekly price movement to +23.61% at press time.

BTC’s trading volume has also risen 31.91% over the last 24 hours. This has taken the total volume for Bitcoin to approximately $40,957,277,701.

A medium bullish flag has been signaled on BTC’s daily chart, with the 20-day EMA crossing above the 50-day EMA line recently. BTC’s price is, however, trading at a major resistance level. This has resulted in the daily RSI line sloping slightly less negative, which is a bearish sign.

Disclaimer: The views and opinions, as well as all the information shared in this price prediction, are published in good faith. Readers must do their research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.