- ZRO’s break above $1.99 flips structure bullish as higher lows confirm momentum control

- Open interest near $122M shows fresh leverage, lifting upside while raising volatility

- Spot inflows and key partnerships reinforce accumulation as LayerZero’s narrative grows

LayerZero’s token ZRO trades near $2.38 after a strong four-hour breakout attempt. The move follows a decisive rebound from the $1.50–$1.55 demand zone. Buyers now target the recent swing high near $2.46.

Consequently, the broader structure has shifted from consolidation to expansion. Higher lows and rising momentum confirm growing bullish control.

Technical Structure Turns Firmly Bullish

ZRO reclaimed several key Fibonacci levels during the latest advance. Price first broke above the 0.382 level at $1.69. It then cleared the 0.5 level at $1.84.

Moreover, bulls pushed through the critical 0.618 pivot near $1.99. That level now acts as structural support. The token also surpassed the 0.786 retracement at $2.19 intraday.

Short-term moving averages now slope upward. Price trades above the 50, 100, and 200 EMAs. Hence, the trend alignment favors buyers. The Supertrend indicator flipped bullish near $1.60 earlier in the rally.

Key resistance stands at $2.46. That level marks the recent local high. Additionally, $2.50 presents a psychological barrier. A clean four-hour close above $2.46 could open a move toward $2.60 or higher.

However, support remains essential. The $2.20 zone now serves as near-term backing. Below that, $1.99 remains the critical pivot. A drop under $1.84 would weaken momentum and extend consolidation.

Open Interest and Flow Data Signal Renewed Risk Appetite

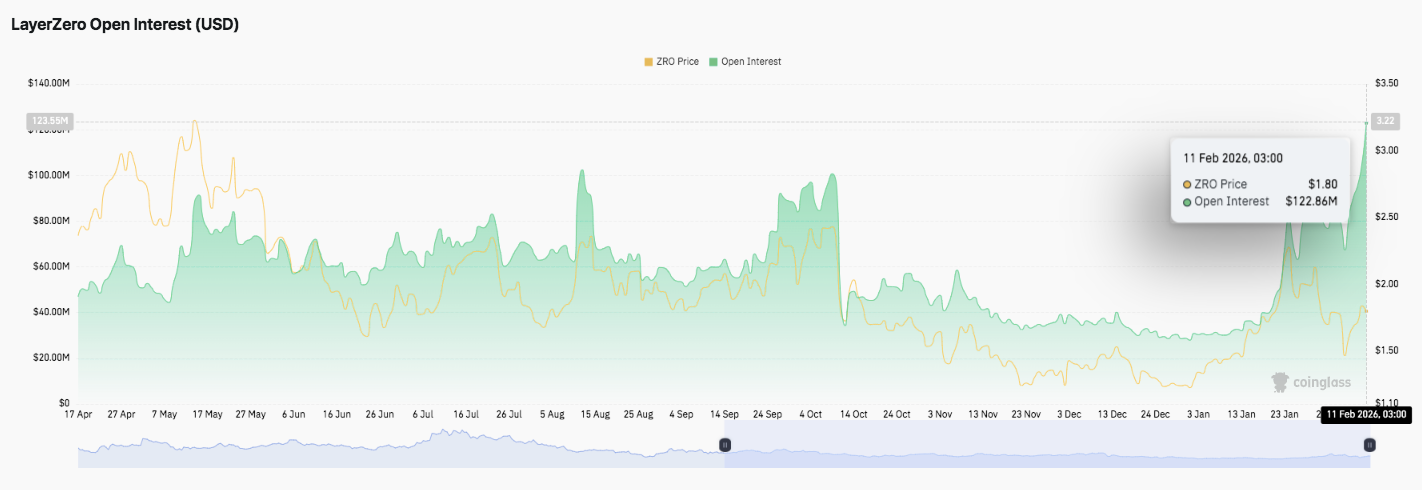

Derivatives data reflects rising speculative activity. Open interest climbed from roughly $50 million to over $80 million earlier in the cycle. Mid-cycle spikes approached $100 million during volatile phases. However, those expansions often preceded liquidations.

Related: Cardano Price Prediction: ADA Tests Multi-Month Lows as Open Interest Drops & Outflows Continue

Later, open interest declined toward $30 million as leverage flushed out. Recently, exposure surged to approximately $122 million. Significantly, this marks a new local high. Traders now deploy fresh capital with higher leverage. Consequently, volatility risk also increases.

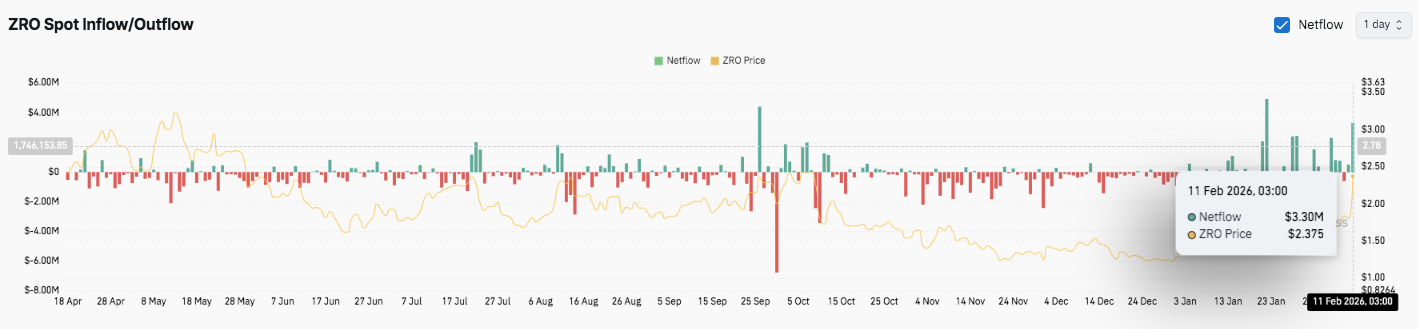

Spot flow data shows a similar shift. Outflows dominated between late spring and early winter. Red bars reflected steady selling pressure during price declines. However, early February brought strong green inflow spikes. A $3.3 million net inflow aligned with the rebound toward $2.37. Hence, accumulation appears to return.

Institutional Backing Strengthens Narrative

LayerZero continues to expand beyond trading metrics. The company partnered with Google Cloud to explore blockchain infrastructure for AI-driven economic activity. Additionally, DTCC aims to enhance asset tokenization using LayerZero technology.

Moreover, Intercontinental Exchange plans to evaluate how LayerZero’s Zero chain could support continuous trading. The network claims scalable architecture with multi-million transaction capacity.

Technical Outlook For LayerZero (ZRO) Price

Key levels remain clearly defined as LayerZero trades near the $2.38 region. Price recently reclaimed major Fibonacci levels and now presses against $2.46 resistance. The structure shows higher lows since the $1.50–$1.55 demand base, confirming a short-term trend shift.

Upside levels: $2.46 stands as immediate resistance and the recent swing high. A confirmed breakout could open room toward $2.50 and $2.60. Above $2.60, momentum may expand toward the $2.75 zone if volume strengthens.

Downside levels: $2.20 acts as first short-term support and the prior breakout zone. Below that, $1.99 (0.618 Fib) remains the key structural pivot. Deeper support sits at $1.84 and $1.69, where the broader bullish structure would face invalidation.

The 50/100/200 EMAs now slope upward, supporting bullish alignment. Moreover, price holds above the Supertrend support, reinforcing upside bias. However, momentum depends on holding $1.99 on any pullback.

Will LayerZero Break Higher?

LayerZero’s price outlook hinges on whether buyers can sustain pressure above $2.20 and challenge $2.46 decisively. A strong close above that level would confirm continuation and likely trigger volatility expansion. Additionally, rising open interest near cycle highs signals growing speculative positioning.

However, failure to hold $1.99 could shift momentum back into consolidation. A break below $1.84 would weaken the bullish thesis and expose $1.69.

For now, ZRO trades in a pivotal expansion phase. Sustained inflows and structural support will determine whether the next leg targets $2.60+ or returns to range conditions.

Related: River Price Prediction: Spot Listing Sparks 33% Rally As RIVER Tests Triangle Resistance

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.