- ZRO consolidates above $1.95 support, preserving higher lows despite rejection near $2.40.

- Momentum cools as RSI stays neutral and MACD flattens, signaling a pause not reversal.

- Derivatives recover cautiously, but negative spot flows show accumulation remains limited.

LayerZero’s ZRO token enters late January trading in a cooling phase after a strong multi-week advance. The asset recently retreated from a local peak near $2.40, yet broader structure remains constructive. Market participants now assess whether consolidation will support continuation or invite deeper downside tests.

Price Structure Shows Controlled Consolidation

ZRO trades within a narrowing range after its rally stalled below $2.40. Significantly, price continues to form higher lows above mid-range supports.

This structure signals that buyers still defend pullbacks. The $1.95 to $1.94 zone now acts as a balance area. Holding this range keeps price positioned within a bullish framework.

However, upside progress requires stronger confirmation. The $2.15 level stands out as the first technical barrier. A decisive four-hour close above that zone would likely revive bullish momentum. Consequently, traders continue watching the $2.30 to $2.40 region, where supply previously capped price expansion.

On the downside, $1.81 remains the most important trend level. A sustained break below that mark would weaken the higher-low structure. Further losses could expose $1.67 and eventually $1.50. Hence, price action near $1.81 will likely define short-term direction.

Momentum indicators align with the consolidation narrative. RSI hovers near neutral levels, reflecting balance rather than exhaustion. Earlier bearish divergence explained the rejection from $2.40. However, current readings no longer show expanding downside pressure.

Additionally, MACD momentum remains negative but continues flattening. This shift suggests selling pressure fades rather than accelerates. As a result, traders interpret the setup as a pause within a broader trend, not a confirmed reversal.

Derivatives and Spot Data Add Caution

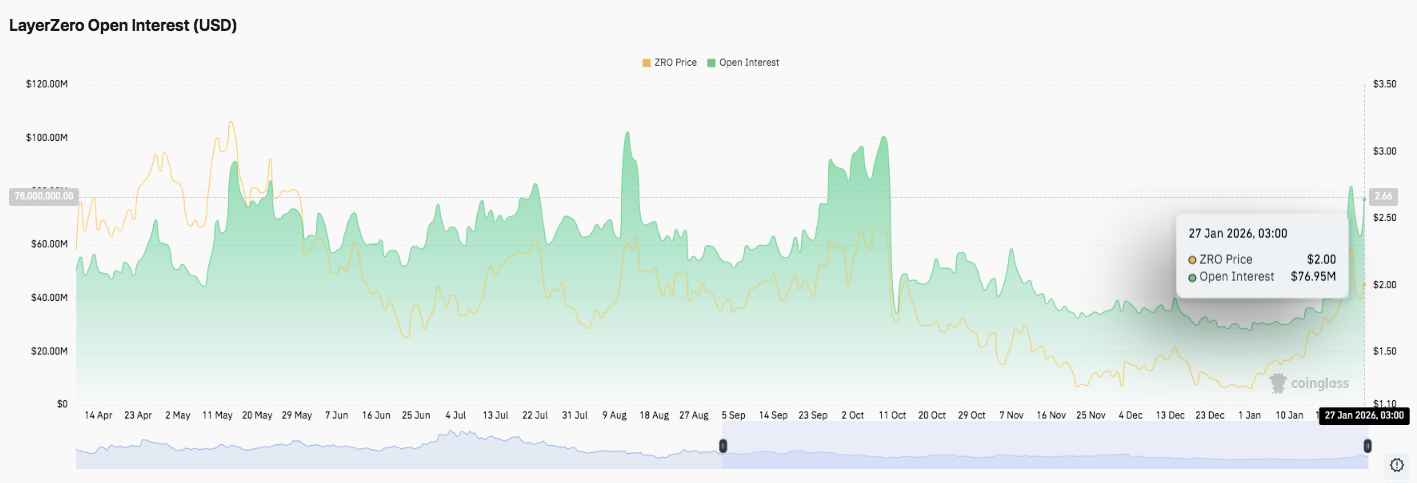

Open interest trends reveal shifting speculative behavior. After peaking above $90 million earlier in the cycle, leverage unwound sharply during mid-year volatility. January data now shows open interest recovering toward $77 million. This rebound suggests renewed participation, although positioning remains cautious.

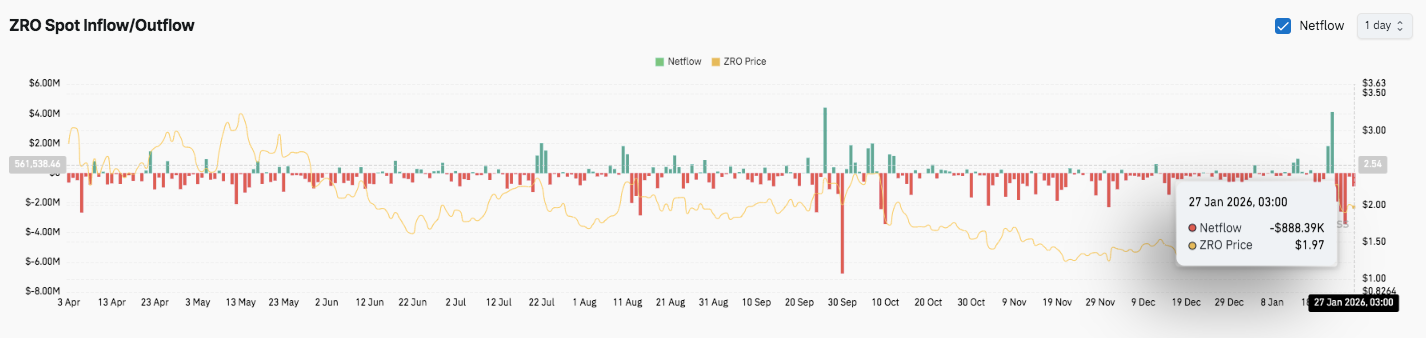

Spot flow data tells a more restrained story. Netflows stay mostly negative, pointing to continued distribution. Short-lived inflow spikes fail to trigger sustained upside. Moreover, deeper outflows align with sharper price drops. Late January readings near negative $0.9 million reinforce limited accumulation interest.

Technical Outlook for LayerZero (ZRO) Price

Key levels remain clearly defined as ZRO heads toward the end of January.

- Upside levels: $2.15 stands as the first resistance, aligned with the 0.786 Fibonacci retracement. A confirmed break above this level could open the path toward the $2.30–$2.40 zone, where prior supply capped the last rally. A successful reclaim of that range would signal renewed bullish momentum and trend continuation.

- Downside levels: Immediate support sits at $1.95, which continues to act as the short-term balance zone. A sustained loss of this level would likely push price toward $1.81, the 0.5 Fibonacci retracement and a critical trend support. Below that, $1.67 represents deeper pullback support, while $1.50 remains the last major bullish defense if volatility expands.

- Resistance ceiling: The $2.30–$2.40 region remains the key ceiling to flip for medium-term upside continuation. Price previously rejected sharply from this area, confirming heavy supply.

The broader technical picture suggests ZRO is consolidating after a strong rally rather than entering distribution. Momentum indicators support this view. RSI remains near neutral, reflecting compression rather than reversal. MACD stays negative but continues to flatten, indicating selling pressure is fading. This structure points toward a pause before the next directional move.

Will LayerZero Move Higher?

LayerZero’s near-term outlook depends on whether buyers can defend the $1.95–$1.81 support band. Holding this range keeps the bullish structure intact and increases the probability of another attempt at $2.15. A clean break above that level could reintroduce momentum and set up a retest of $2.30–$2.40.

However, failure to hold $1.81 would weaken the structure and shift focus toward $1.67. Spot flow data continues to show distribution pressure, which tempers upside expectations. Meanwhile, recovering open interest suggests traders are cautiously returning, not chasing aggressively.

For now, ZRO trades in a pivotal zone. Consolidation dominates the narrative, while technical compression points to a larger move ahead. Direction will depend on support defense, leverage behavior, and confirmation above resistance.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.