- Ripple won its lawsuit and XRP ETFs launched, but prices remain flat in 2026.

- Supply lockups and exchange reserves are reshaping what drives XRP’s value.

- Slow global adoption is delaying the breakout many investors expected.

Ripple’s 2024 court victory and the launch of XRP ETFs in 2025 were expected to boost XRP’s price and attract major investors. Yet even now, in 2026, the price has barely moved, contradicting earlier optimistic predictions.

Some commentators attribute this to several structural issues and external market pressures that are shifting the goalposts on what truly drives XRP’s value.

The Reality of Slow Adoption

Many XRP supporters expect 2025 to be the breakout year for real-world usage, but adoption is moving much more slowly than hoped. Analysts like Zach Rector say progress has been especially slow in areas involving global regulations and central bank digital currencies.

While XRP now has legal clarity in the U.S., the global payment systems that could drive large-scale adoption are still years away. Central banks and international institutions are moving cautiously, pushing widespread adoption closer to 2027–2030.

This slow pace has frustrated many XRP holders. In short, regulatory clarity alone has not led to rapid growth, reinforcing the idea that adoption is a long-term process rather than an overnight event.

Related: XRP Analyst Urges Holders to Reset Adoption Expectations as Central Banks Lag

Supply Lockup Shift

Some analysts argue that XRP’s price is now influenced more by supply dynamics than hype. They say more XRP is being locked up and removed from active trading than ever before.

For instance, Ripple-backed projects such as Evernorth, Flare Network, and mXRP plan to lock away billions of XRP over the next few years—more than $15 billion worth in total.

With less XRP available to trade, prices could rise if demand stays the same or grows. However, not everyone agrees this will lead to higher prices anytime soon.

Critics note that major exchanges like Binance and Upbit still hold billions of XRP. This large available supply means XRP remains easy to trade, which could limit any short-term price increases driven by scarcity alone.

Related: Factors That Could Become XRP’s Price Catalysts for 2026

Spot XRP ETFs

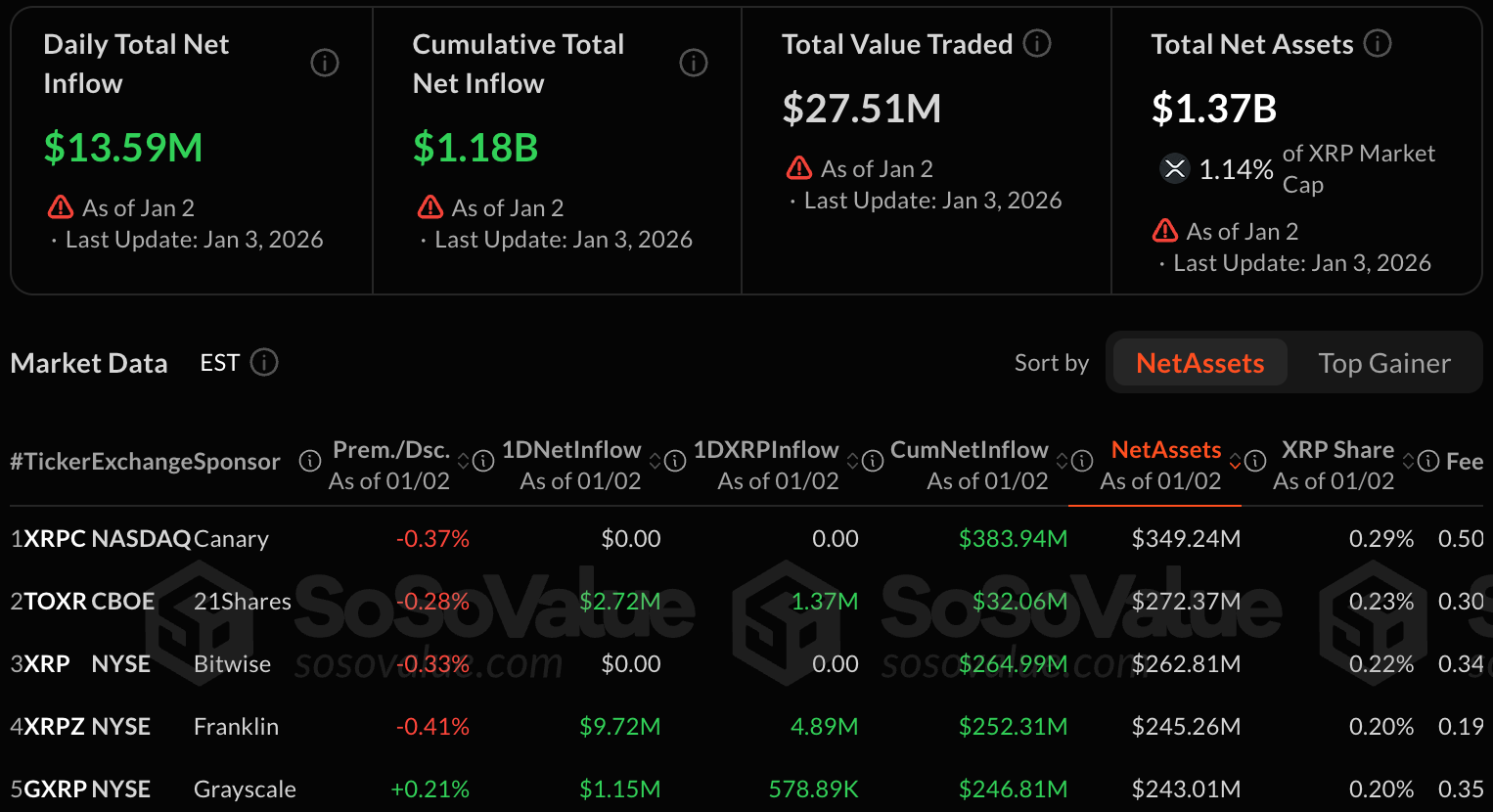

Despite the lackluster price movement, interest from large investors has grown. Since spot XRP ETFs launched in late 2025, they have attracted more than $1.18 billion in inflows, signaling strong institutional confidence.

Large asset managers now hold over $1.37 billion worth of XRP, quietly building positions despite the weak price performance.

Still, this has not been enough to push prices higher. XRP is trading around $2.04, more than 30% below its early 2025 highs. This has led some analysts to question why the price has not reflected the stronger fundamentals and clearer regulations XRP has gained over the past year.

2026 Price Predictions: Can XRP Reach $10?

Despite these challenges, some analysts remain optimistic about XRP’s price in 2026. At around $2, XRP is still far below the levels some predict.

Analysts such as Charting Guy and Matt Hughes continue to target $8, citing XRP’s overall upward trend since 2023 and its history of rebounding after periods of consolidation. A few even suggest a potential move toward $20.

Related: Is XRP Price Rally Sustainable While Whales Pull Tokens Off Exchanges?

That said, reaching $10 or higher would require a major catalyst, such as a sudden surge in demand or a significant breakthrough in cross-border payments. Without that, ambitious price targets remain speculative rather than guaranteed.

Ripple IPO Speculation: Will It Happen?

Looking ahead to 2026, there is also growing speculation about a possible Ripple IPO. While Ripple has repeatedly stated it has no short-term plans to go public, some analysts continue to debate what an IPO could mean for XRP. Supporters believe it could attract more institutional capital and increase XRP’s visibility.

However, CEO Brad Garlinghouse has downplayed the idea, saying Ripple is already financially strong and does not need an IPO to raise funds.

As a result, many see IPO rumors as hype that distracts from the more important factors actually influencing XRP’s value.

The Bottom Line: Patience, Not Hype

XRP remains a major player in the crypto market, but how high its future price could be remains uncertain. The narrative around XRP has shifted away from rapid transaction growth toward tighter supply dynamics and long-term utility.

As 2026 progresses, XRP’s price will depend less on hype and more on real adoption, regulatory clarity, and its role in global payments.

For holders, 2026 may bring slow, steady progress rather than a dramatic breakout. As analysts like Zach Rector point out, long-term success will come from patience and real-world utility, not speculation.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.