- The number of active addresses for LINK surged last week.

- LINK’s price is up 3.36% over the last 24 hours.

- Current bullish support could see LINK’s price break above the daily 9 EMA line.

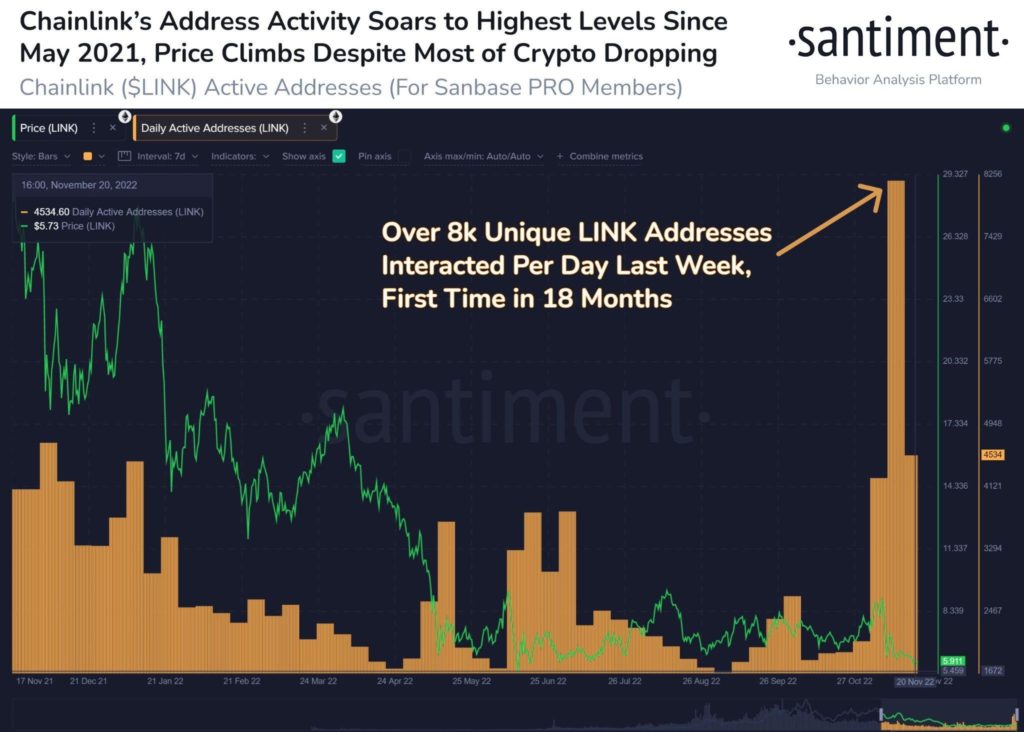

A recent tweet by the blockchain analytics firm, Santiment, revealed that the number of active addresses for Chainlink (LINK) has suddenly surged. The tweet added that the surge in active addresses started when the FTX fallout occurred. Active address activity for Chainlink remains at one-year high levels.

As can be seen by the chart shared by Santiment on Twitter today, the number of interactions between unique active addresses per day for LINK reached an average of more than 8k over the last week. This increase in address activity has taken LINK’s address activity to its highest levels since May 2021.

The increase in active address activity is accompanied by an increase in LINK’s price today. According to CoinMarketCap, the price of LINK is up 3.36% over the last 24 hours. As a result, the price of LINK is changing hands at $5.99 at press time.

Compared to the two crypto market leaders, Bitcoin (BTC) and Ethereum (ETH), the price of LINK has strengthened against both by 6.20% and 6.78% respectively. The 24-hour trade volume for LINK has also risen 21.09% over the last day, taking the total trade volume to $353,772,407.

The price of LINK attempted to break above the daily 9 EMA level today but was brought back down, as can be seen by the wick currently present on today’s candle. However, there is bullish support present that will likely ignite another attempt above the daily 9 EMA level.

The daily RSI indicator also supports the bullish thesis as the daily RSI line is positioned below the daily RSI SMA line but is positioned positively towards overbought territory and is looking to cross bullishly above the daily RSI SMA line, which will be a significant bullish flag that will take LINK’s price up to $6.429.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.