- The RWA sector has attracted significant attention from institutional investors.

- Chainlink and Ondo are top RWA altcoins expected to shine in 2026.

- Experts believe that the ultimate trigger for altseason 2026 will be the enactment of the CLARITY Act.

The altcoins focused on RWA tokenization, led by Chainlink (LINK) and Ondo (ONDO), are well-positioned to benefit from the imminent altseason 2026. Amid the easing geopolitical tensions and the expected passage of the CLARITY Act in the United States, institutional investors, led by BlackRock Inc. (NYSE: BLK), are seeking to tokenize more real-world assets.

Chainlink or ONDO for Altseason 2026?

Why Chainlink (LINK)?

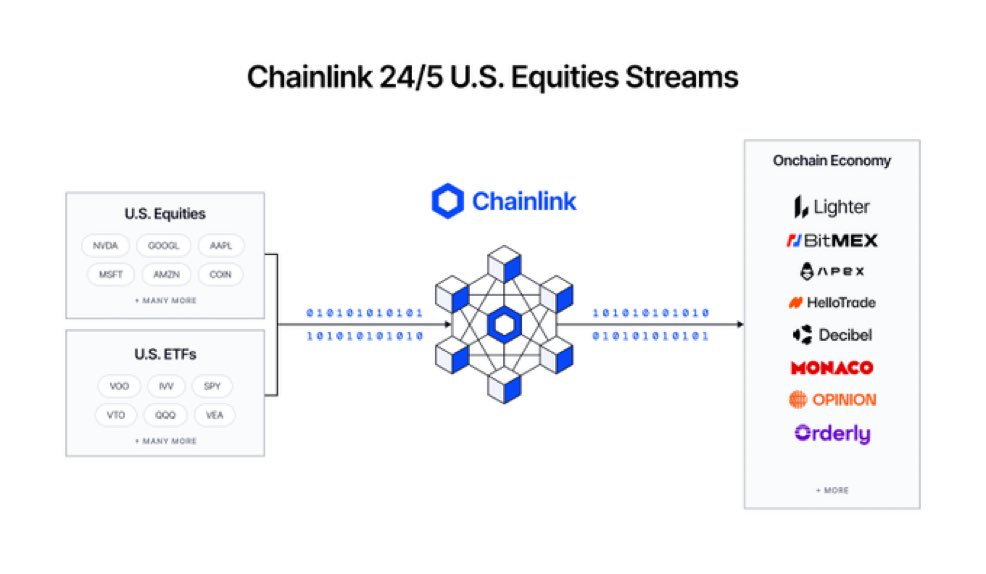

The global mainstream adoption of RWA has heavily boosted growth prospects for LINK and ONDO. Notably, Chainlink facilitates the seamless adoption of RWA assets across the Decentralized Finance (DeFi) ecosystem.

Essentially, Chainlink acts as the connective organ and backbone of data that bridges traditional finance and blockchain. As such, Chainlink is used by major financial institutions such as WisdomTree, ANZ Bank, and JPMorgan Chase.

With Chainlink having a strong global liquidity presence, through listings on major crypto exchanges and a recent approval of a spot exchange-traded fund (ETF), this altcoin is well-positioned to rally parabolically in 2026.

At press time, Chainlink’s LINK had a market cap of about $8.77 billion and a fully diluted valuation (FDV) of about $12.39 billion. This altcoin recorded a 21% surge in its daily average traded volume, bringing it to about $511 million at press time.

Why Ondo (ONDO)?

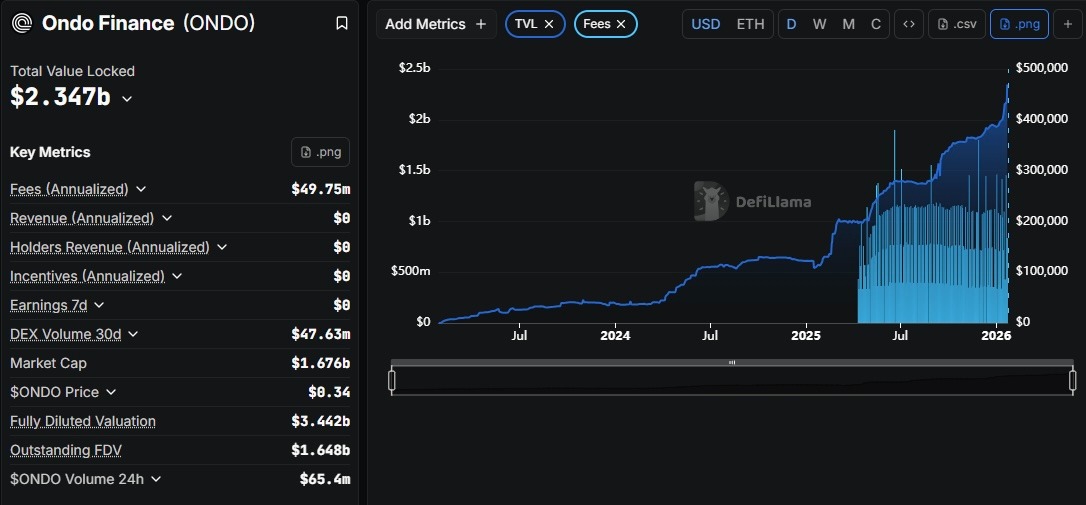

The bullish outlook for ONDO is supported by strong growth at the Ondo Finance protocol. According to market data from DeFiLlama, the total value locked (TVL) for Ondo Finance has grown from around $222 million in early 2024 to about $2.34 billion at press time.

The ecosystem has scaled to 10 supported blockchains, including Solana (SOL), and 150 integrated projects, with asset managers like BlackRock and Franklin Templeton leveraging its tokenization framework.

As such, the ONDO token has grown to a market cap of about $1.66 billion and an FDV of about $3.42 billion. During the past 24 hours, ONDO’s trading volume surged by around 8% to hover about $74 million.

What’s the Bigger Market Picture?

The priority and choice between LINK and ONDO ultimately come down to investors’ preferences. Furthermore, both projects have robust fundamentals and are on the cusp of becoming fully legalized in the United States through the CLARITY Act.

However, ONDO is for investors with higher risk tolerance compared to LINK, which has matured over the years of development and adoption.

Related: Chainlink Price Prediction: LINK Open Interest Cools Off as Traders Rebuild Positions Slowly

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.