- Liquid staking has become the biggest sector in DeFi with $20 billion in TVL.

- Lido accounted for 75% of total ETH staked in staking protocols.

- Ethereum recorded 13,595 new deposits amounting to 408k ETH in June.

According to Bloomberg’s latest article published on September 5, the crypto liquid staking sector is very close to touching its all-time high value back in early 2022. Data from DeFiLlama confirmed that the total value of assets locked within liquid staking services has surged by 292% since hitting a low point in June 2022, during a period of crypto market turmoil. Currently, the TVL of assets in liquid staking services stands at $20 billion.

With this surge, liquid staking has overcome lending to become the largest sector in decentralized finance (DeFi), allowing users to trade, lend, and borrow using blockchain software.

A report by DappRadar shows that liquid staking balances experienced significant growth during the months of March and April 2022. Moreover, Lido saw the highest rise, accounting for almost 75% of the total ETH staked in liquid staking protocols. Bloomberg also noted that liquid staking protocols including Lido and Rocket Pool took a downturn due to the TerraUSD stablecoin crisis, further worsening a $2 trillion decline in the crypto market.

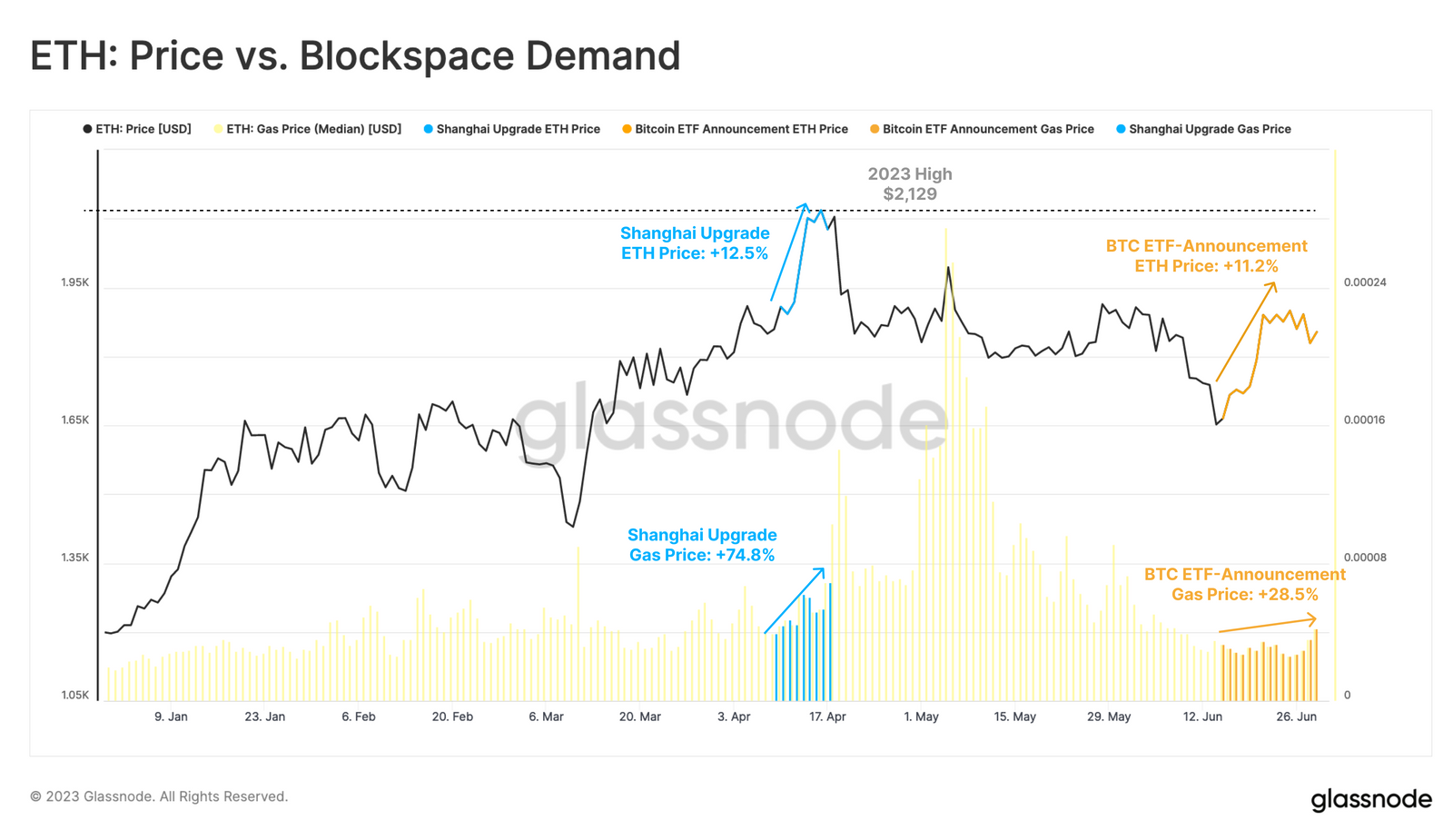

The article attributed the growing popularity of staking to Ethereum’s Shanghai hardfork, which enabled users to withdraw staked ETH from the Ethereum consensus mechanism. However, instead of withdrawals, the market observed massive growth in deposit activity, as revealed by the crypto data platform Glassnode. On June 2, 13,595 new deposits, equivalent to over 408,000 ETH were recorded.

Bloomberg articulated that users who choose to lock up their Ether tokens to support the operation of the Ethereum network currently receive an annual return of approximately 4% in the form of additional coins.

Experts such as crypto analytics firm Messari’s research analyst Kunal Goel believe that liquid staking protocols “represent lower risk and haven’t yet had any hacks or exploits.” Hence, traders feel comfortable with these services amid a regulatory crackdown that has taken over the crypto industry in the US.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.