- Bullish LQTY price prediction ranges from $2.539 to $2.857.

- LQTY price might also reach $4 this 2023.

- LQTY’s bearish market price prediction for 2023 is $0.486.

Liquity is a decentralized borrowing protocol that enables users to draw loans against Ether tokens used as collateral. Unlike other platforms, Liquity offers interest-free liquidity and a low collateral ratio, making it more efficient for borrowers. Additionally, Liquity guarantees a hard price floor and a governance-free algorithmic monetary policy that ensures censorship resistance.

If you are interested in the future of Liquity (LQTY) and would like to know the price analysis and price prediction of LQTY for 2023, 2024, 2025, 2026, and up to 2050, keep reading this Coin Edition article.

Table of contents

- Liquity (LQTY) Market Overview

- What is Liquity (LQTY)?

- Analysts’ View on Liquity (LQTY)

- Liquity (LQTY) Current Market Status

- Liquity (LQTY) Price Analysis 2023

- Liquity (LQTY) Price Prediction 2023-2030 Overview

- Liquity (LQTY) Price Prediction 2023

- Liquity (LQTY) Price Prediction 2024

- Liquity (LQTY) Price Prediction 2025

- Liquity (LQTY) Price Prediction 2026

- Liquity (LQTY) Price Prediction 2027

- Liquity (LQTY) Price Prediction 2028

- Liquity (LQTY) Price Prediction 2029

- Liquity (LQTY) Price Prediction 2030

- Liquity (LQTY) Price Prediction 2040

- Liquity (LQTY) Price Prediction 2050

- Conclusion

- FAQ

Liquity (LQTY) Market Overview

HTTP Request Failed... Error: file_get_contents(https://pro-api.coinmarketcap.com/v2/cryptocurrency/quotes/latest?slug=liquity): Failed to open stream: HTTP request failed! HTTP/1.1 429 Too Many RequestsWhat is Liquity (LQTY)?

Liquity is a decentralized borrowing protocol that enables users to draw loans against Ether tokens used as collateral. The platform pays out loans using LUSD tokens, a USD-pegged stablecoin that can be redeemed at any time against the underlying collateral at face value. Users need to maintain a minimum collateral ratio of 110%, and their Trove account keeps track of their ETH and LUSD debt.

Liquity uses the Stability Pool to maintain the system’s solvency by acting as the liquidity source to repay debt from liquidated Troves and ensuring that the total LUSD supply remains backed up. Stability providers fund the Stability Pool by transferring LUSD, and they gain a pro-rata share of the liquidated collateral while losing a pro-rata share of their LUSD deposits over time.

Unlike other platforms, Liquity offers interest-free liquidity and a low collateral ratio, making it more efficient for borrowers. Additionally, Liquity guarantees a hard price floor and a governance-free algorithmic monetary policy that ensures censorship resistance. The platform incentivizes early adopters and frontends through its secondary token, LQTY, which rewards stability providers, users depositing LUSD to the Stability Pool, frontends facilitating those deposits, and liquidity providers of the LUSD:ETH Uniswap pool.

Existing collateralized debt platforms charge recurring fees for borrowing, which can have an indirect impact on monetary supply and be ineffective in the short term. Furthermore, over-collateralization makes the borrower’s capital inefficient, and collateral auctions and fixed-price selloffs have turned out to be inefficient by design.

Crypto-backed stablecoins are usually subject to higher price volatility than traditional currency-backed stablecoins due to the lack of direct arbitrage cycles, and they rely on a soft peg mechanism that is less effective. Liquity addresses these issues by offering interest-free liquidity, a low collateral ratio, and a hard price floor, making it a more efficient borrowing platform.

Analysts’ View on Liquity (LQTY)

Investors are going bullish on LQTY that the coin might reach $3 soon.

A crypto analyst is mentioning LQTY as a gem in this tweet, with the hope that the coin might reach its highest soon.

Liquity (LQTY) Current Market Status

According to CoinMarketCap, Liquity (LQTY) is hovering at $0.8509 at the time of writing, with a total of 93,370,844 LQTY in circulation. LQTY has a 24-hour trading volume of $23,898,226, with a 104% increase. And during 24 hours, the price of LQTY surged by 2.37%.

The most popular exchanges to trade Liquity (LQTY) are Binance, Coinbase, Uniswap, KuCoin and Gemini. Let’s continue with our LQTY price research for 2023.

Liquity (LQTY) Price Analysis 2023

LQTY ranks 255 on CoinMarketCap’s list of the biggest cryptocurrencies by market capitalization. Will LQTY’s most recent improvements, additions, and modifications help its price rise? First, let’s focus on the charts in this article’s LQTY price forecast.

Liquity (LQTY) Price Analysis – Bollinger Bands

The Bollinger Bands is a technical analysis tool that is used to analyze price movement and volatility. Bollinger Bands (BB) utilizes the time period and the stand deviation of the price. Normally, the default value of BB’s period is set at 20. The upper band of the BB is calculated by adding 2 times the standard deviations to the Simple Moving Average (SMA), while the lower band is calculated by subtracting 2 times the standard deviation from the SMA. Based on the empirical law of standard deviation, 95% of the data sets will fall within the two standard deviations of the mean.

The candlesticks are currently trading near the top half of the Bollinger Bands after trading in the bottom half of the indicator. LQTY was facing many falls over the long-term period. The surge that LQTY is experiencing could be a sign of recovery. The Bollinger bands may continue to remain stable for some time, however, any signs of bands expanding could be seen through the BBW.

Liquity (LQTY) Price Analysis – Relative Strength Index (RSI)

The Relative Strength Index (RSI) is a momentum indicator utilized to find out the current trend of the price movement and determine if it is in the oversold or overbought region. Traders often use this tool to make decisions about when to buy or sell the tokens. When the RSI is often valued below or at 30, it is considered an oversold region, and a price correction could happen soon. Moreover, when the RSI is valued above or at 70, it is regarded as the overbought region, and traders expect the price could fall soon.

The RSI is currently valued at 63.44 and moving closer to the SMA after hitting the oversold region. There is a high chance that the RSI may cross the SMA and fall below it. This could signal that LQTY may face a bearish trend. However, if the RSI signals a bullish divergence, then, the candlesticks may start climbing once again.

Liquity (LQTY) Price Analysis – Moving Average Convergence Divergence (MACD)

The Moving Average Convergence Divergence (MACD) indicator can be used to identify potential price trends, momentums, and reversals in markets. MACD will make the reading of a moving average cross easier. The MACD indicator is calculated by subtracting the long-term EMA (Exponential Moving Average) indicator from the short-term EMA. Normally, the default values for the MACD are set at 12-day EMA, 26-day EMA, and 9-day EMA. Moreover, MACD is considered a lagging indicator as it cannot provide trade signals without any past price data.

After a subsequent fall, green bars started to form on the MACD confirming LQTY’s bullish sentiment. The MACD formed a double top as it initially did after experiencing a surge twice. However, currently, the green bars on the MACD is currently reducing, which could be a sign that the bullish trend could be reducing. Moreover, the MACD line is pointed downwards which could be a sign that it could fall down for some time.

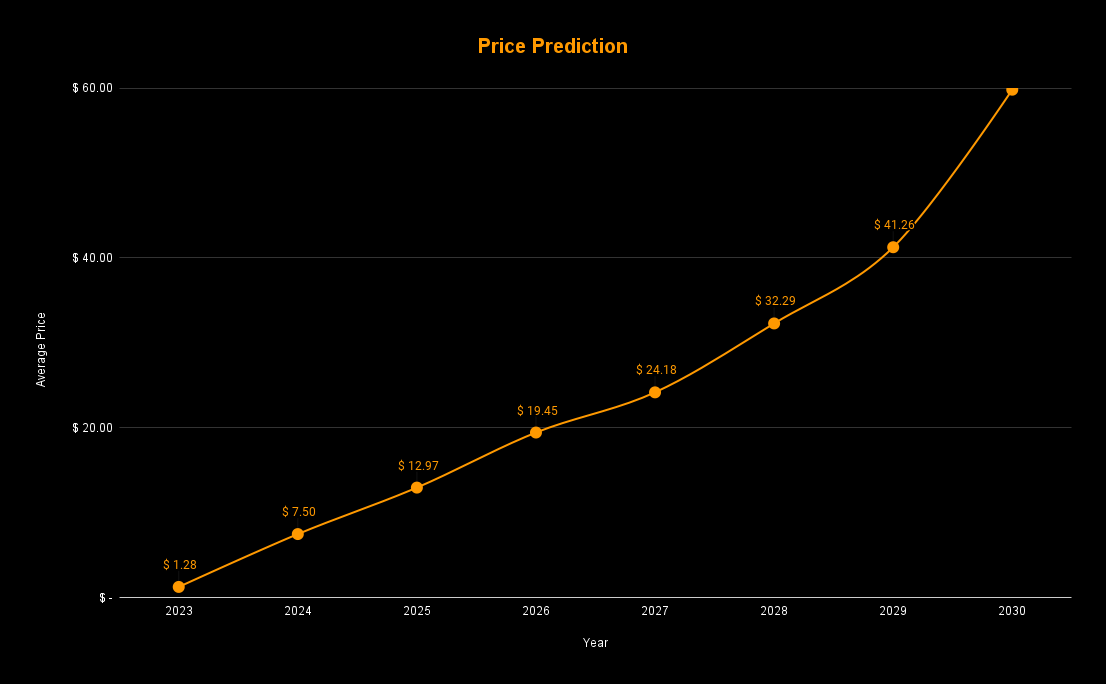

Liquity (LQTY) Price Prediction 2023-2030 Overview

| Year | Minimum Price | Average Price | Maximum Price |

| 2023 | $0.486 | $1.28 | $2.85 |

| 2024 | $6.9 | $7.50 | $8.37 |

| 2025 | $10.48 | $12.97 | $14.54 |

| 2026 | $17.37 | $19.45 | $21.73 |

| 2027 | $22.57 | $24.18 | $26.72 |

| 2028 | $25.17 | $32.29 | $36.28 |

| 2029 | $35.88 | $41.26 | $45.90 |

| 2030 | $55.01 | $59.80 | $63.94 |

| 2040 | $131.11 | $138.58 | $140.38 |

| 2050 | $316.89 | $329.56 | $330.29 |

Liquity (LQTY) Price Prediction 2023

Looking at the charts, the candlesticks earlier were trading near the $0.777 level which is the critical zone for LQTY. Earlier, a similar sentiment was observed when the altcoin faced a fall and fell to the first level. However, the candlesticks rose up and jumped to the second level. A similar trend may be expected as it follows a similar trade pattern. If this hypothesis tends to be accurate, there may be a high chance that the candlesticks will trade in the second level.

Meanwhile, the forecast for LQTY remains to be bullish and is expected to reach beyond the level of $2.539. The bearish price prediction for LQTY ranges from $ 0.486 to $0.359. However, on the off chance, that LQTY experiences an extremely bullish sentiment again, there is a high possibility that it trade beyond the level of $4.49.

| Bullish Price Prediction | Bearish Price Prediction |

| $2.539 – $2.857 | $0.359 – $0.486 |

Liquity (LQTY) Price Prediction 2023 – Resistance and Support

The candlesticks are currently close to the support of the chart. Moreover, it is clear that LQTY also faced a subsequent drop from Resistance 2 this year. If LQTY experiences a bullish period once again, it has the potential to reach its extreme bullish area at the $4 level. LQTY has the potential to reach resistance level 3 if it continues to experience a bullish period. When LQTY passes through each Resistance, each level could become a new Support level.

Liquity (LQTY) Price Prediction 2024

The cryptocurrency market is known to repeat history, and most cryptocurrencies follow the Bitcoin trend. With 2024 as the year of the Bitcoin halving, there will be many sentiments toward the market, which is always bullish. We can expect the price of Liquity (LQTY) to react positively to the news and trade at around $8.3 by the end of 2024.

Liquity (LQTY) Price Prediction 2025

The effect of any Bitcoin correction is experienced in the following year from recent history. If LQTY ends in 2024 for $10 or more, we can expect the price of LQTY to grow in 2025. This could make LQTY trade at $14.5 or more in 2025, considering investors will be bullish.

Liquity (LQTY) Price Prediction 2026

With the rise in cryptocurrency adoption in the mainstream, we can expect a possible market reversal in 2026 to have little impact on the recent gains in the price of LQTY. Hence, Liquity could end in 2026 at around $21.7 or more.

Liquity (LQTY) Price Prediction 2027

The most bearish market is followed by market consolidation in the next year. If the year 2026 turns out to be bearish for LQTY, we could expect the market to stabilize in 2027 and even trade higher. Hence, it is possible to see LQTY trade at around $26.7 in 2027.

Liquity (LQTY) Price Prediction 2028

Liquity will likely trade above its 2025 price prediction of $120 in 2028 due to the Bitcoin halving. With the powerful sentiment of investors to buy more cryptocurrencies, a buy pressure could be seen in the market, which will make LQTY trade at around $36 in 2028.

Liquity (LQTY) Price Prediction 2029

The most impact of a bullish sentiment resulting from Bitcoin halving is mainly experienced in the coming year. We can expect the price of LQTY to break more psychological resistance and trade around $45 by the end of 2029. Also, LQTY is highly likely to break its all-time high value.

Liquity (LQTY) Price Prediction 2030

The impact of cryptocurrency adoption could stabilize the market by 2030, sustaining the bullish gains of the previous years. Hence, we can expect the price of LQTY to trade above $63 by the end of 2030. Also, LQTY is highly likely to break its all-time high value.

Liquity (LQTY) Price Prediction 2040

LQTY is predicted to surpass more psychological resistance levels and trade around $140 by the end of 2040, potentially even surpassing its all-time high value.

Liquity (LQTY) Price Prediction 2050

By the year 2050, the widespread adoption of cryptocurrencies is predicted to stabilize the market and maintain the previous bullish gains. As a result, we can anticipate LQTY to trade above the $330 mark towards the end of 2050.

Conclusion

To summarize, if investors continue to show interest in LQTY and add these tokens to their portfolio, then, it could continue to rise up. LQTY’s bullish price prediction shows that it could pass beyond the $2 level in 2023. Moreover, LQTY could surpass the $330 level by the end of 2050.

FAQ

Liquity is a decentralized borrowing protocol that enables users to draw loans against Ether tokens used as collateral. The platform pays out loans using LUSD tokens, a USD-pegged stablecoin that can be redeemed at any time against the underlying collateral at face value. Users need to maintain a minimum collateral ratio of 110%, and their Trove account keeps track of their ETH and LUSD debt.

LQTY can be traded on many exchanges like other digital assets in the crypto world. Binance, Coinbase, Uniswap, and Gemini are currently the most popular cryptocurrency exchanges for trading LQTY.

Since LQTY provides investors with several opportunities to profit from their crypto holdings, it seems to be a good investment in 2023. Notably, LQTY has a high possibility of surpassing its current ATH in 2023.

LQTY is one of the few active crypto assets that continue to rise in value. As long as this bullish trend continues, LQTY might break through $6 and reach as high as $10. Of course, if the current market favoring crypto continues, it will likely happen.

LQTY is expected to continue its upward trend as one of the fastest-rising cryptocurrencies. We may also conclude that LQTY is an excellent cryptocurrency to invest in this year, given its recent partnerships and collaborations that have improved its adoption.

The lowest LQTY price is $0.533, attained on November 13, 2022, according to CoinMarketCap.

LQTY was launched on April 5, 2021.

LQTY was founded by Robert Lauko.

The maximum supply of LQTY is 100,000,000 LQTY.

LQTY can be stored in a cold wallet, hot wallet, or exchange wallet.

LQTY price is expected to reach $2 by 2023.

LQTY price is expected to reach $8.3 by 2024.

LQTY price is expected to reach $14 by 2025.

LQTY price is expected to reach $21 by 2026.

LQTY price is expected to reach $26 by 2027.

LQTY price is expected to reach $36 by 2028.

LQTY price is expected to reach $45 by 2029.

LQTY price is expected to reach $63 by 2030.

LQTY price is expected to reach $140 by 2040.

LQTY price is expected to reach $330 by 2050.

Disclaimer: The views and opinions, as well as all the information shared in this price prediction, are published in good faith. Readers must do their research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.