- Kaiko attributed the unexpected turnout to concentrated sell-offs.

- MANTA hit $220 upon listing on Bithumb but crashed to $1 in a few minutes.

- Last week, the Manta Network team orchestrated a two-day ICO via the Binance Launchpool.

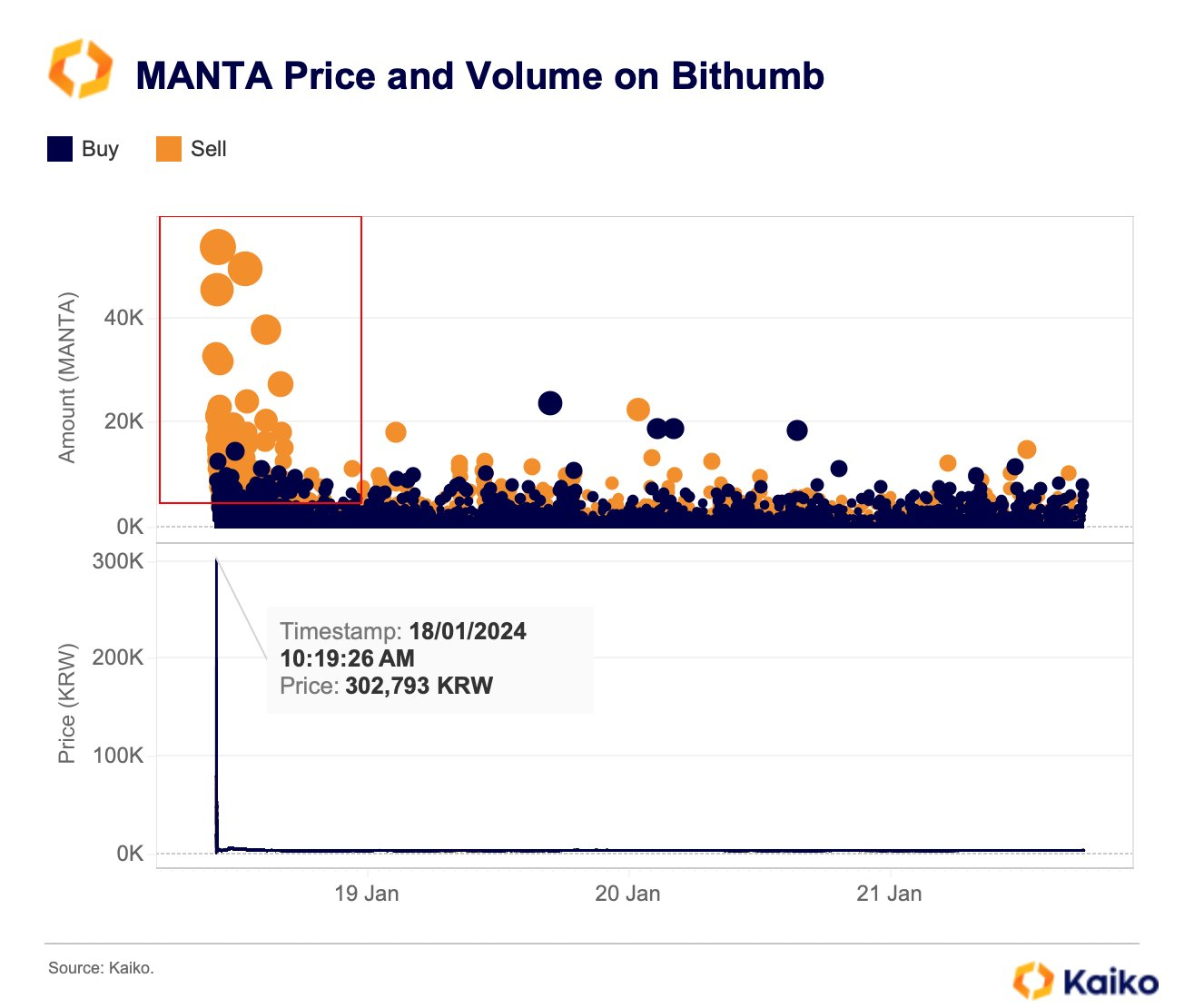

Well-known market intelligence and analytics platform Kaiko has recently drawn attention to the price action of MANTA, the native token of the recently launched crypto project, Manta Network. Specifically, Kaiko disclosed that MANTA had surged astronomically to $220 upon listing on the Bithumb exchange. However, what followed the extraordinary uptick was a similarly dramatic crash to below $1 in a few minutes.

The market intelligence platform attributed the unexpected turnout to “heavy selling,” as holders dumped the token after its initial coin offering (ICO) terminated.

MANTA token chart showing concentrated sell volume on January 18 | Kaiko

Notably, last week, the Manta Network project team orchestrated an ICO via the Binance Launchpool. The initiative offered crypto market participants the opportunity to farm the MANTA token between January 16 and 18. Specifically, the team offered participants 3% of MANTA’s maximum supply – equivalent to 30,000,000 tokens.

Upon concluding the schedule, MANTA was listed on various centralized exchanges, including KuCoin, Binance, and Bithumb. Data from the Binance trading platform suggested the token listed at $0.05. Subsequently, it attained a $3.3 threshold a few minutes later.

However, the situation on Bithumb was markedly different as the asset attained 302,793 KRW ($220) on the Korean exchange, having listed at about 1,826 KRW ($1.37). In other words, MANTA had grown by approximately 16,000%, only to crash 99% later to below $1.

CoinMarketCap data suggests MANTA has a prevailing market value of $2.77 at the time of reporting, reflecting a 15% gain over the past day. It is noteworthy that Manta Network is a versatile ecosystem for Web3, allowing users to create and launch decentralized applications based on Solidity.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.