- Bybit’s 21 new MNT trading pairs boost liquidity and spark strong market demand.

- MNT price surges 18% in 24 hours with trading volume hitting $706 million high.

- RSI signals overbought levels, raising chances of a short-term MNT price correction.

Mantle (MNT) rallied after Bybit introduced its 2.0 roadmap, which included the listing of 21 new MNT trading pairs. The move significantly expanded liquidity and opened fresh market demand.

Bybit also rolled out a “HOLD & Earn Stablecoins” campaign that rewards users holding MNT and XUSD from a $60,000 prize pool, adding to bullish sentiment around the token.

MNT Jumps 18% on Surging Volume

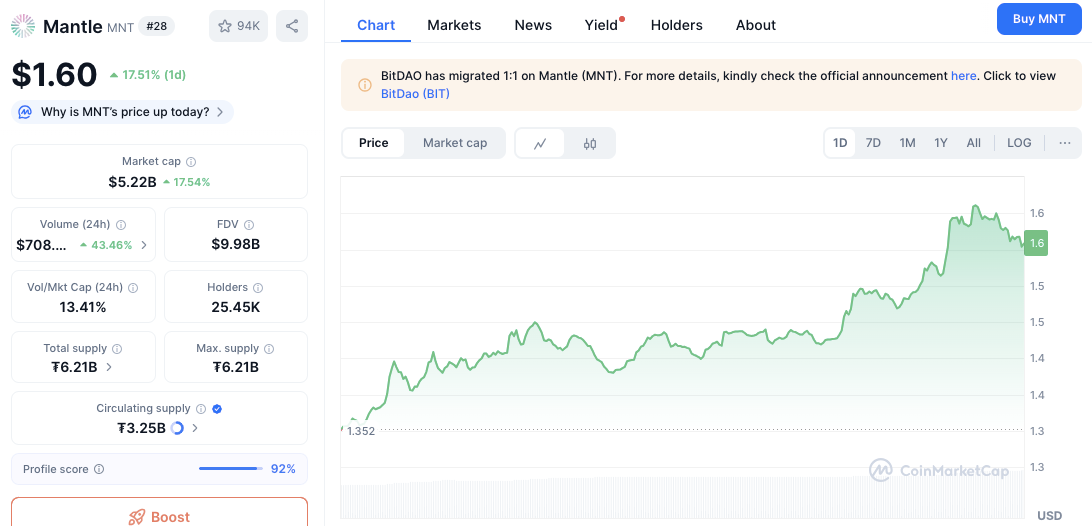

At press time, MNT is trading at $1.61, reflecting an impressive 18.23% increase over the last 24 hours.

Trading activity spiked as volume jumped 42.91% to $706.1 million, showing heightened investor participation.

The price trend has shown a clear upward shift, with MNT rising from a low of $1.35 to its current price of $1.61. This increase suggests that bullish sentiment is dominating the market.

Support at $1.35, Resistance Capped at $1.61

On the technical side, Mantle now trades against clear boundaries. The $1.35 zone has emerged as a reliable support level, where buyers previously stepped in to absorb selling pressure. On the upside, MNT faces resistance at $1.60–$1.61, a range that has capped momentum over the past sessions.

Related: Mantle (MNT) Price Prediction 2025-2030: Can MNT Reach New Highs?

If Mantle decisively breaks above this resistance, traders expect room for substantial upside. A failure to hold above the $1.61 ceiling, however, could trigger a retreat toward $1.35. This tight setup has placed Mantle on watchlists as market participants weigh the next move.

Indicators Point to Bullish Momentum, But RSI Warns of Overheating

Momentum signals remain bullish. The MACD readings, 12-period at 0.0328 and 26-period at 0.0485, show buying pressure firmly in play, with the signal line sitting above the MACD line. This alignment suggests that the token could extend its climb if buyers maintain control.

Still, the Relative Strength Index (RSI) at 75.71 flags caution. An RSI reading above 70 often points to overbought conditions, hinting that Mantle’s rally may be running hot.

While this doesn’t break the bullish trend, it increases the odds of a short-term pullback as traders lock in profits. Longer term, the overall outlook remains constructive so long as Mantle holds key support levels and liquidity continues to grow.

Related: Mantle (MNT) Price Prediction 2025, 2026, 2027, 2028-2030

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.