- Since mid-July, MATIC has been trading in a range between $0.72 and $1.03.

- Bulls were strong enough to push past the bearish order block at $0.93.

- MATIC is currently trading at $0.9522 after a 5.54% increase in price.

Ever since mid-July, Polygon (MATIC) has been trading in a range between $0.72 and $1.03 with the mid-range value lying at $0.88. A sweep of ragne lows then provided a positive reaction, setting the next target for the crypto at $1.05.

This target could now be within reach for MATIC as the crypto was able to surge to the bearish order block at $0.93. The bulls were strong enough to push past this block to emphasise their bullish intent.

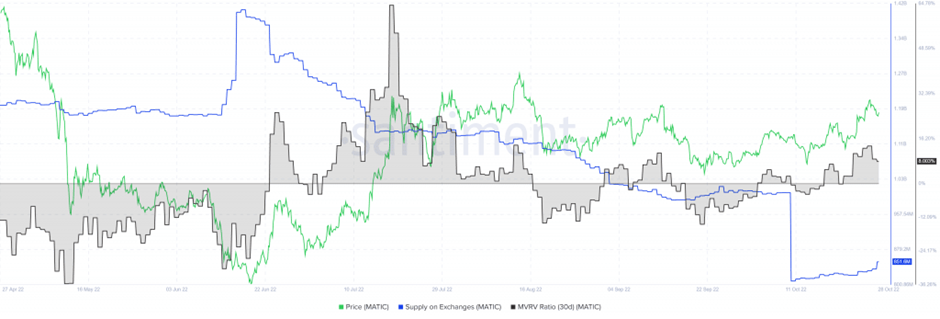

Data from Santiment indicates that the 30-day MVRV for MATIC has been unable to climb past 14% since August of this year. Over the last few days, the MVRV was, however, able to climb to as high as 13.5% before once again falling back.

It seems that as the MVRV climbs, more and more people could be tempted to sell MATIC to then make a profit. This could slow down or completely halt rallies for the altcoin.

Although this metric does not indicate a reversal in trend, it could suggest that the token is not being moved to exchanges in large amounts. If anything, it signals a wave of selling around the corner.

According to CoinMarketCap, MATIC is currently trading at $0.9522 after a 5.54% increase in price over the last 24 hours. In addition to the altcoin being in the green for the day so far, MATIC is up by more than 15% over the last week.

MATIC’s 24 hour trading volume, on the other hand, is in the red by over 21% to now stand at $383,437,527.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.