- BONK faces a 36.01% drop in derivatives trading volume, signaling volatility, with long positions seeing $739.59K in liquidations.

- Pepe’s price decline of 7.15% and $5.47 million in liquidations highlight instability, with mixed sentiment across major exchanges.

- WIF’s trading volume dropped by 30.31%, and open interest fell by 12.66%, showing cautious market behavior amid ongoing volatility.

Meme coins continue to surge in popularity, hyping up the entire crypto market with their unique appeal and frequent price swings. BONK, PEPE, WIF, and BRETT are the latest examples, experiencing major market shifts recently. However, this increased volatility means traders should be careful.

BONK Price Drops Amid Decreased Market Activity

BONK is trading at $0.000022, with a 24-hour volume of $493.06 million. The meme coin has seen a 9.76% decrease in price over the last day. BONK’s market cap sits at $1.57 billion, with a circulating supply of 70.82 trillion coins.

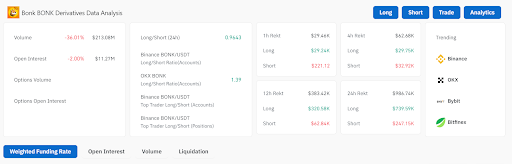

Trading volume in the BONK derivatives market has fallen 36.01% to $213.08 million. Open interest has also declined by 2% to $11.27 million. The long/short ratio shows mixed market sentiment. While Binance traders seem neutral, OKX traders are slightly bullish. However, long positions have suffered, with $986.74K in liquidations in the last 24 hours, $739.59K of which were longs. This volatility and bearish sentiment suggest traders should proceed with caution.

Pepe Faces Market Decline

Pepe, priced at $0.000009, has dropped 7.15% in the past 24 hours. With a market cap of $3.94 billion and a 24-hour trading volume of $1.25 billion, the token has a circulating supply of 420.69 trillion coins.

Read also: Meme Coin Mania: Pepe (PEPE) Outperforms Dogecoin and Shiba Inu

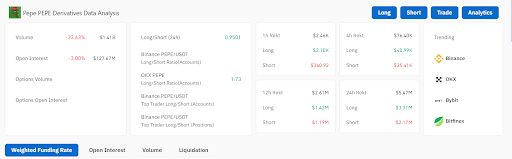

Trading volume in the Pepe derivatives market has dropped 33.63% to $1.41 billion. Open interest also fell by 3% to $127.67 million. Sentiment across exchanges is mixed, with Binance leaning slightly bearish, while OKX appears more bullish with a long/short ratio of 1.73. Pepe has had $5.47 million in liquidations, with $3.31 million in long positions and $2.17 million in shorts, adding to the evidence of market instability.

WIF Faces Declining Volume and Open Interest

WIF, trading at $2.22, has fallen 7.13% in price, with a 24-hour trading volume of $684.61 million. The token’s market cap is $2.21 billion, and its circulating supply is 998.84 million coins.

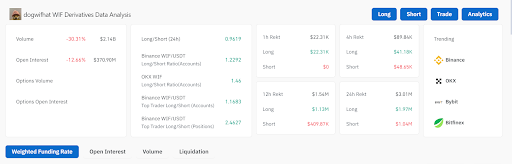

In the derivatives market, WIF has seen a 30.31% decline in trading volume, which is now at $2.14 billion, and open interest has fallen by 12.66% to $370.90 million. The long/short ratio is relatively balanced at 0.9619, showing cautious trading sentiment. However, both Binance and OKX traders seem slightly bullish, with Binance showing a 2.4627 long/short ratio. Liquidations in the past 24 hours were $3.01 million, with $1.97 million from long positions.

Brett Sees a Price Decline Amid Reduced Trading Volume

Brett, priced at $0.085042, has decreased by 1.36% in the last 24 hours. Its market cap is $842.79 million, with a circulating supply of 9.91 billion coins. It has a 24-hour trading volume of $44.31 million.

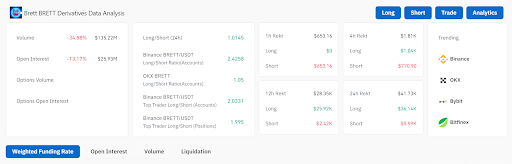

Trading volume in the BRETT/USDT derivatives market has fallen 34.88% to $135.22 million. Open interest also fell by 13.17% to $25.93 million. Binance traders appear notably bullish, with a long/short ratio of 2.4258, showing a strong preference for long positions. Liquidations over the past day totaled $36.14K, mostly from long positions.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.