- Michael Burry posted his first X message since 2023, warning of a financial market bubble

- His warning coincides with a crypto market decline and $488M in Bitcoin ETF outflows Thursday

- Burry’s bearish words contrast his firm’s recent $522M rotation into bullish call options

Michael Burry, the investor who foresaw the 2008 housing collapse, resurfaced on X today, posting his first message since April 2023. Known for his role in The Big Short, Burry warned that financial markets are once again in a bubble, adding that “the only winning move is not to play.”

The post, referencing the 1983 film WarGames, carried a tone of restraint rather than panic. Burry suggested that although markets appear overextended, sitting out may be the most rational decision.

Posting under the name “Cassandra Unchained,” Burry drew inspiration from Greek mythology — Cassandra, the priestess cursed to make accurate but ignored predictions.

His header image, Satire of Tulip Mania by Jan Brueghel the Younger, echoes his longheld warnings about speculative manias, referencing the 1600s Dutch tulip bubble.

Related: Michael Burry Shorts Stock Market With $1.6 Billion Worth Put Options

Does Burry’s Portfolio Match His Bearish Warning?

While known for his bearish positions, Burry’s recent portfolio filings show a strategic shift. In mid-2025, his firm, Scion Asset Management, replaced $186 million in bearish put options with $522 million in bullish calls across nine stocks.

These include Estée Lauder, Lululemon, Alibaba, and JD.com, signaling a nuanced rather than outright pessimistic outlook. According to Business Insider, Scion’s holdings expanded from seven to fifteen positions between March and June.

Peter Mallouk, CEO of Creative Planning, noted that Burry had “gone from a strong conviction bet on a sector fall to a broad-based bet the bull run will continue.”

Burry’s Warning Coincides With $488M ETF Outflows

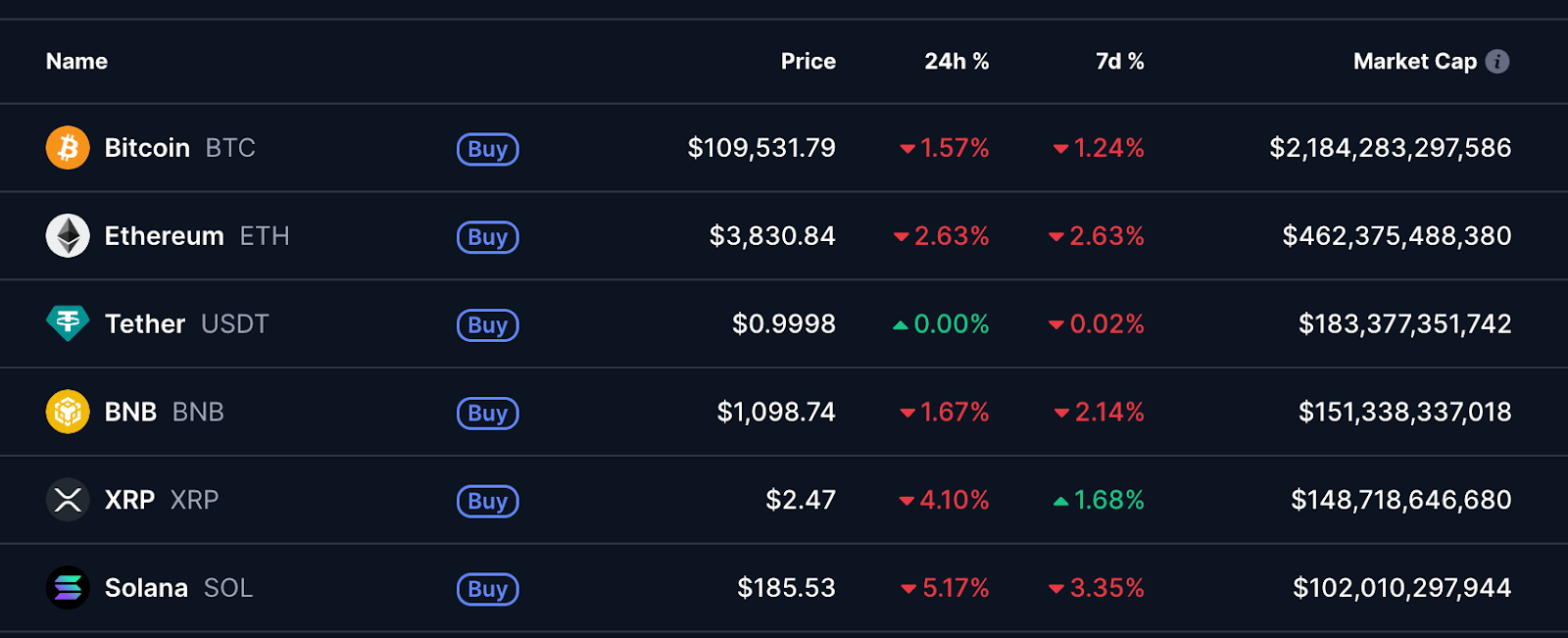

Burry’s post comes as the crypto market experiences a broad-based decline. Bitcoin trades at $109,642 after touching $116,400 earlier this week, marking a 4.5% loss over the past month.

Still, Bitcoin remains the only top-10 cryptocurrency near record levels. Major tokens such as Ethereum, Solana, and XRP continue to trade more than 40% below their peaks.

ETH hovered around $3,865, facing resistance near $3,950–$4,200. Ethereum has posted 3.5% and 7.5% losses over the past day and month, respectively. XRP follows a similar pattern but recorded 1.7% and 5.6% gains over the past day and two weeks, respectively.

Notably, the total crypto market cap stands at $3.7 trillion, representing a 1.9% decline over the past day. Meanwhile, the 24-hour trading volume sits at $192 billion, reflecting reduced activity as major cryptocurrencies turn red.

Related: Michael Burry Predicts 2008-Level Economic Crisis as Crypto Falls

The ongoing dip follows the U.S. Federal Reserve’s expected 25-basis-point rate cut, which met traders’ expectations. Markets, however, reacted more strongly to news that quantitative tightening will end in December.

As a result, market sentiment has turned more cautious, with the Crypto Fear and Greed Index dropping to 34 from 43 the previous month.

Meanwhile, Bitcoin ETFs saw $488 million in outflows on Thursday, led by BlackRock, Fidelity, and Ark. Ethereum ETFs incurred $184 million in outflows, reflecting a decline in investor confidence despite the Fed’s policy shift.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.