- Michael Saylor claims Strategy Inc. (MSTR) can withstand an 80-90% drop in Bitcoin price.

- The CEO cited low leverage (10-15%) and over $50 billion in equity as key safety buffers.

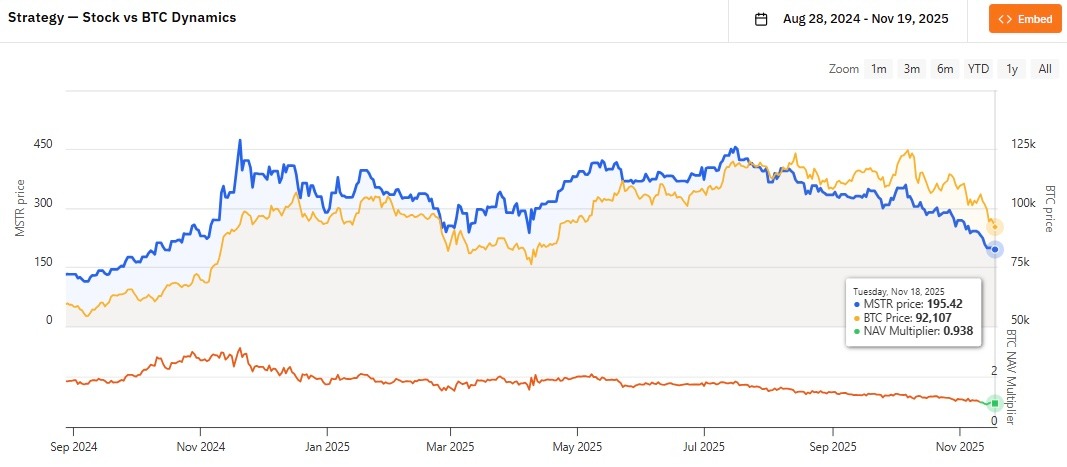

- This defense comes as MSTR trades at a discount to its NAV for the first time in 2025.

Michael Saylor has issued a staunch defense of Strategy Inc.’s (MSTR) balance sheet in a Fox Business interview, when the CEO claimed his company can withstand a catastrophic 80-90% drop in Bitcoin’s price. He insisted the firm’s operational model remains solid despite recent market volatility.

Why is Saylor Confident in Strategy’s Bitcoin Plan

According to Saylor, Strategy has strong backing from highly liquid institutional investors. Saylor said that the company can survive 80-90% Bitcoin crashes and still pay shareholders their dividends.

“Our leverage is in the level of 10-15% going towards zero right now, which is extremely robust,” Saylor said.

Saylor noted that Strategy is one of the most capitalized companies in the crypto industry, with over $ 50 billion in equity backed by highly liquid creditors. He added that the company expects the Bitcoin price to appreciate 30% per year for the next 20 years.

Related: Saylor Buys $835.6M Bitcoin Dip as Political Risk Sinks Price to $90K

As such, Saylor remains confident that the company will manage to pay its shareholders a 10% dividend yield. Interestingly, Saylor said that Strategy will remain in business for as long as Bitcoin appreciates 1.25% per year.

Additionally, Saylor noted that a Strategy can remain in operation for 80 years if the Bitcoin price stopped going up, 0% gains per year.

Closer Look at the Company’s Performance

Strategy has continued to acquire more Bitcoins on a weekly basis. The company has been selling its different equities to global institutional investors in a bid to acquire more BTCs.

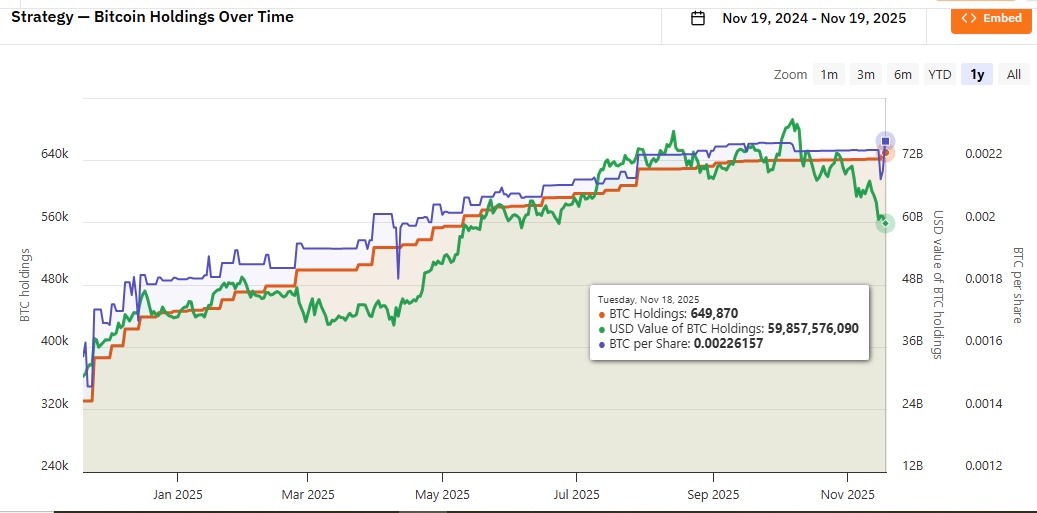

Earlier this week, Strategy announced its acquisition of 8,178 more Bitcoins, valued at around $835.6 million. As such, the company now holds 649,870 BTCs, currently valued at about $59.8 billion.

The company has attracted significant attention recently after its multiple of Net Asset Value (mNAV) dropped below 1 for the first time in 2025. At press time, the company’s mNAV hovered around 0.938, as its market cap was around $56.15 billion compared to its Bitcoin holding value of about $59.8 billion.

Bigger Picture

According to Natalie Brunell, a prominent Bitcoin educator, the flagship coin is well-positioned to continue growing to a $100 trillion market value in the coming decade. Brunell said Bitcoin has gained mainstream attention due to its unique properties, thus will likely reach $1 million per coin in the next ten years.

As such, Brunell backed Strategy’s Bitcoin plan since more investors have understood the value of turning fear into opportunity. She said that Bitcoin is a 100-year asset and not a day-trade investment. Moreover, more central banks have joined institutional investors in the race to accumulate more Bitcoin.

Related: Bitcoin Price Rebound Prospects as BTC Mined Crosses 95% of 21 Million Cap

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.