- MicroStrategy expands Bitcoin holdings with huge purchases, boosting its portfolio.

- Bitcoin price surges to new highs, fueled by MicroStrategy’s bold buying strategy.

- MicroStrategy funds Bitcoin investments through share sales, continuing its investment plan.

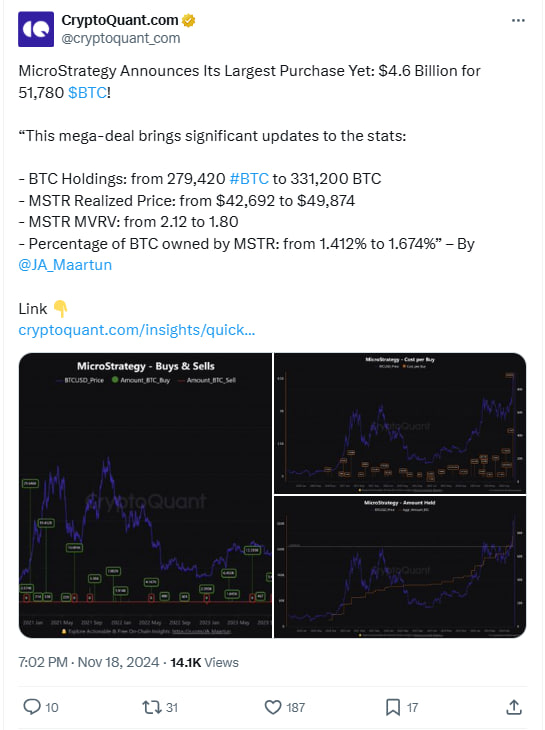

MicroStrategy just made history with one of the largest Bitcoin purchases ever, buying 51,780 BTC for $4.6 billion. Even more remarkable, the entire purchase was executed within just one week at an average price of $88,627 per Bitcoin.

This latest purchase brings MicroStrategy’s total Bitcoin holdings to 331,200 BTC, up from their previous 279,420 BTC, at an average cost basis of $49,874 per coin.

The Market Value to Realized Value (MVRV) ratio shifted from 2.12 to 1.80, showcasing the impact of this high-volume purchase on its portfolio metrics. Notably, MicroStrategy now owns approximately 1.674% of the circulating Bitcoin supply, up from 1.412%.

MicroStrategy’s Bitcoin Acquisition Strategy

MicroStrategy funded this purchase through share sales. Between November 11 and 13, the company sold 13.6 million shares, raising $4.6 billion.

Despite the scale of this transaction, MicroStrategy still has $15.3 billion in shares available for sale, according to SEC filings. Earlier this year, MicroStrategy acquired 27,200 BTC for $2 billion at an average price of $74,463 per coin.

These assets have already reaped a profit of close to $200 million, underlining the effectiveness of its systematic approach to leveraging capital for Bitcoin investments.

Bitcoin Price Surges

MicroStrategy’s latest move coincided with Bitcoin breaking the $90,000 level for the first time on November 12, later reaching $92,400. Currently, Bitcoin’s price stands at $89,782.54, reflecting a weekly gain of 9.74% despite a minor daily dip of 0.84%.

Read also :MicroStrategy to Invest $42B More in Bitcoin

With a market cap exceeding $1.77 trillion and a 24-hour trading volume of $59.6 billion, Bitcoin continues to show robust activity.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.