- Private Advisor Group LLC reduced its holdings in Coinbase Global by 19.8%.

- However, other institutional investors have been adding to their stakes in Coinbase.

- Consequently, the firm stock received mixed reviews from analysts.

According to the latest filing with the Securities and Exchange Commission (SEC), Private Advisor Group LLC has reduced its holdings in the US-based crypto exchange Coinbase Global by 19.8%.

This information was captured in a report by MarketBeat on Saturday, noting the firm now owned 16,730 shares of the crypto exchange’s stock after selling 4,135 shares. Notably, Private Advisor Group LLC’s holdings in Coinbase Global were worth $592,000 at the end of the most recent reporting period. The decrease in the group’s holdings could indicate a lack of faith in the crypto firm, leading to further selling pressure on the stock.

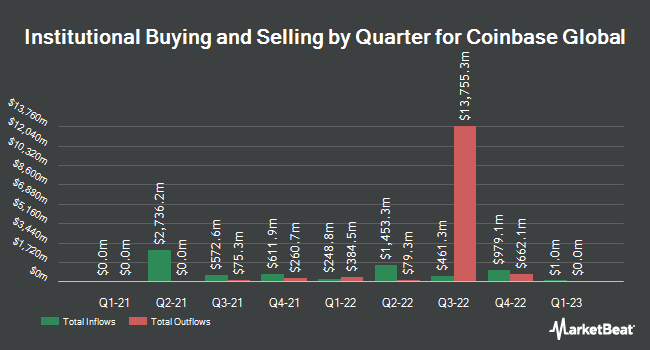

However, other institutional investors have been adding to their stakes in Coinbase. First Trust Advisors boosted its holdings in Coinbase Global by 329.7% in the third quarter. Similarly, Northern Trust Corp boosted its holdings in Coinbase Global shares by 320.1% in Q2.

Furthermore, California Public Employees Retirement System acquired a new stake in Coinbase, while Legal & General Group Plc boosted its stake by 211.5% in the second quarter. Hedge funds and other institutional investors own 46.41% of the company’s stock.

According to the report, insiders continue to buy and sell Coinbase’s shares despite the selling pressure. It revealed that insiders purchased 34,662 company stock valued at $1,837,055 and sold 304,098 shares valued at $16,537,363.

Overall, the news surrounding Coinbase Global is mixed. While some institutional investors have added to their holdings, others have reduced their stakes. Consequently, Coinbase Global stock has received mixed reviews from analysts, and the consensus target price is relatively high.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.