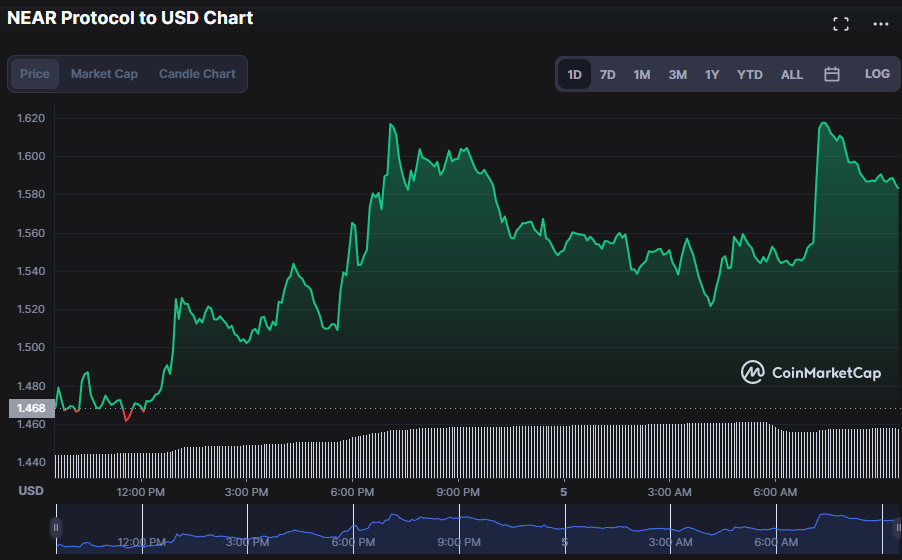

- Bulls pushed NEAR price up to a new intraweek high of $1.62.

- Technical indicators suggest bull grip that has the upper hand

- The NEAR market bears capitulate as bulls storm in.

By continuing upward, the price of NEAR Protocol (NEAR) disproved the prior downward trend that had taken it to $1.46. The day belonged to the bulls, who were successful in raising the price from yesterday’s closing level of $1.55 to today’s $1.58.

The market capitalization surged by 5.89% to $1,327,455,884, and the 24-hour trading volume increased by 106.35% to $300,388,446 as a result of this upturn. With investor demand driving prices higher in the NEAR market, this trend indicates that there is purchasing pressure.

Keltner bands are rising on the 4-hour time frame for the NEAR price, with the top band at $1.552 and the bottom band at $1.343. This shift is consistent with the rising bands, suggesting that the bull trend might continue. When the price climbs above the upper Keltner band, a green bullish candlestick forms, showing that bulls still have the upper hand and raising the chances for additional price gains.

The rising aroon’s superior position above the descending aroon adds support for the optimistic scenario being projected for the NEAR market. This bullish forecast is supported by the orange line being at 92.86% and the blue line being at 28.57%.

In addition, the sentiment in the NEAR market is supported by a Bull Bear Power (BBP) trend in the positive area with a rating of 0.175. Its current downward trend, though, suggests the market might falter from this advance.

The Chaikin Money Flow (CMF) and the Elder Force Index (EFI) have both trended upward, with values of 0.16 and 85.326k, respectively. As of press time, this trend suggests that bulls rule the market, but their movement south warns traders to be on the lookout for a gloomy turnaround.

If bulls are able to keep control of the NEAR market, then technical indicators suggest that more gains are likely.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.