- Santiment tweeted their latest insights report for Litecoin (LTC) yesterday.

- The report suggested that the introduction of LTC20 caused the number of micro LTC addresses to surge.

- At press time, LTC was trading at $80.33 following a 2.66% gain in the previous 24-hours.

The blockchain intelligence firm Santiment shared their latest insights report for Litecoin (LTC) in a tweet yesterday. The post follows the massive spike in active addresses on the Litecoin network, and comes 3 months prior to the network’s next halving event in August.

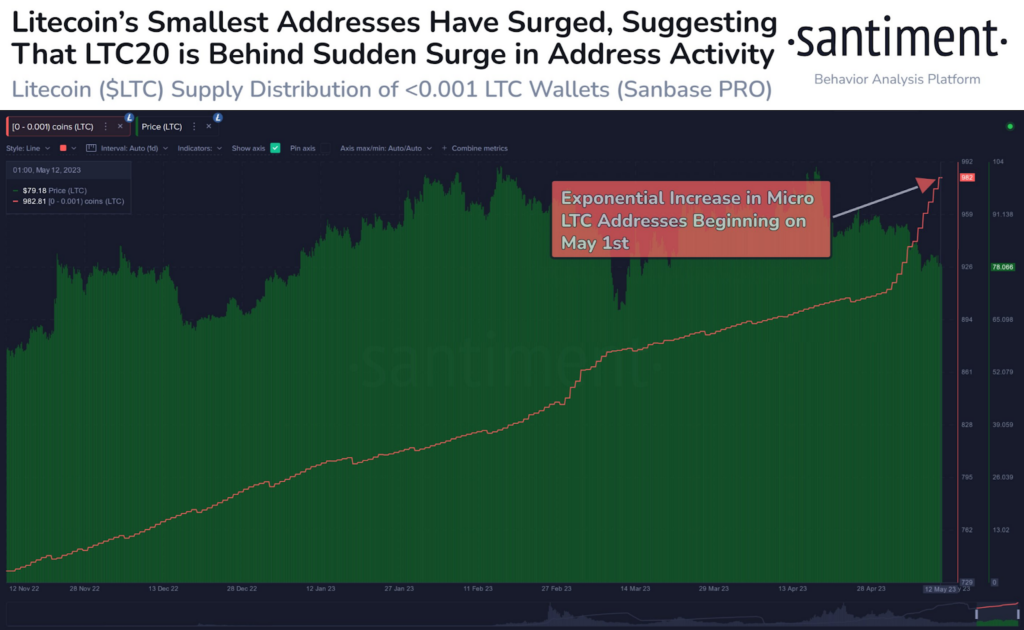

This spike in active addresses has ultimately resulted in increased network activity, as well as a change in supply distribution, the tweet added. Notably, there has been an exponential increase in micro LTC addresses, which are addresses with less than 0.001 LTC, since 1 May 2023.

In their report, Santiment attributed the increase in micro wallets on the Litecoin network to the introduction of LTC20 – an experimental standard for non-fungible tokens (NFTs). This assumption was made given the fact that the increase in active addresses on the network occurred during a time when LTC20 was a trending topic within the LTC community.

At press time, LTC was trading at $80.33 following a 24-hour gain of 2.66% according to CoinMarketCap. The altcoin was able to outperform Bitcoin (BTC) as well, and was up against the market leader by 0.48%. Unfortunately, LTC was outperformed by Ethereum (ETH) and was down 0.39% against the leading altcoin.

LTC was also trading close to its daily high of $80.74, which suggested that LTC’s price may print a new daily high in the following hours. Meanwhile, its 24-hour low was at $77.85. With its market cap of approximately $5.85 billion, LTC was ranked as the 13th biggest project. This placed it behind TRON (TRX) and ahead of Binance USD (BUSD).

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.