- NYSE cleared the Bitwise Solana Staking ETF; trading starts after government reopens

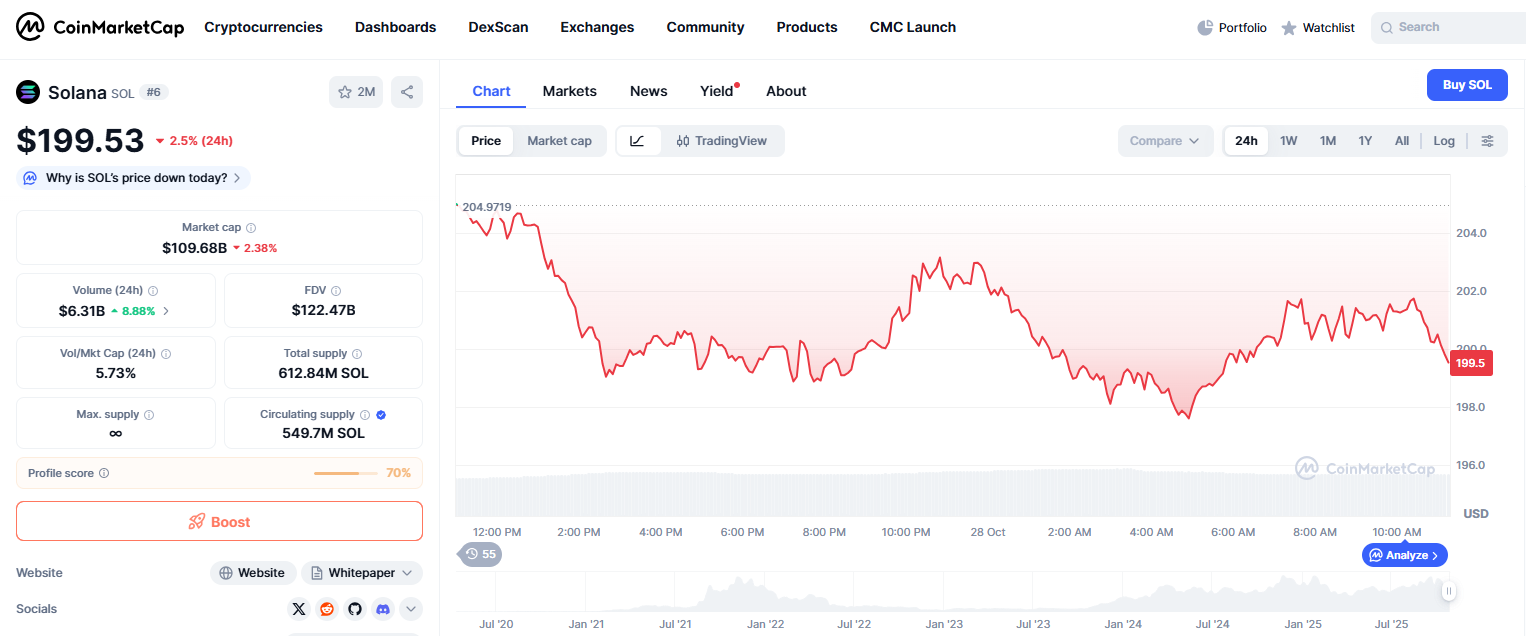

- SOL hovered near $198 to $200 with $205 as the trigger toward $210 to $220

- Volume rose 77% to $7.14 billion; support sits at $190 and $185

The New York Stock Exchange approved the listing of the Bitwise Solana Staking ETF, adding regulated exchange-traded exposure to Solana’s network. The certification was filed with the SEC, and trading will begin once the government reopens. The product targets investors who want Solana exposure with a staking yield wrapper inside a brokerage account.

Why institutions care about a staking wrapper

Bitwise’s design gives investors Solana price exposure plus staking rewards inside a fund structure.

The fund structure lowers operational friction for firms that do not run validators or manage keys. The launch extends the pattern seen with Bitcoin and Ethereum funds as traditional managers add regulated crypto vehicles.

Related: Can Solana Hit $250 by Halloween? Hong Kong ETF Approval Provides Fresh Catalyst

SOL Price Nears $200 Breakout Point ($205 Resistance) on ETF News

Solana’s market performance reflects this growing institutional narrative and renewed optimism. The price has climbed over 8% in the past week, pushing towards the psychologically important $200 mark and currently trading near $199.50.

The immediate technical hurdle lies squarely at $205. This level represents significant resistance, likely containing sell orders from previous attempts to move higher. A decisive breakout and close above $205 is seen by analysts as the key trigger for the next leg up.

Successfully clearing this resistance could rapidly open the door to the $210–$220 zone, and potentially accelerate momentum towards the $250 area, a major psychological target.

Technicals Turn Bullish: Can SOL Clear $205 for a Run Towards $250?

Supporting the bullish case is a surge in market activity and positive indicator readings. Trading volume jumped a reported 77% to $7.14 billion, signaling strong conviction behind the recent price move.

Momentum indicators are also aligning favorably:

- MACD: Has reportedly turned positive, with its histogram expanding, indicating building bullish momentum.

- RSI: Currently hovers near the neutral 50 mark, suggesting the price is not yet overbought and has significant room to run higher if the $205 resistance breaks.

If Solana can maintain its footing above $190 and decisively conquer the $205 barrier, potentially catalyzed by the building excitement around the Bitwise ETF launch, the technical setup appears conducive for a continued rally toward higher targets.

Related: Hong Kong Approves ChinaAMC Solana ETF As 23 U.S. Spot Filings Stack Up

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.