- Older Bitcoin wallets (3-10 years) are moving coins to Binance at the highest rate since July.

- Despite the on-chain “sell” signal, the BTC price has held stable, indicating quiet redistribution, not a panic sell-off.

- Analysts suggest whales are repositioning, either for tax-advantaged ETFs or to diversify into other blockchain projects.

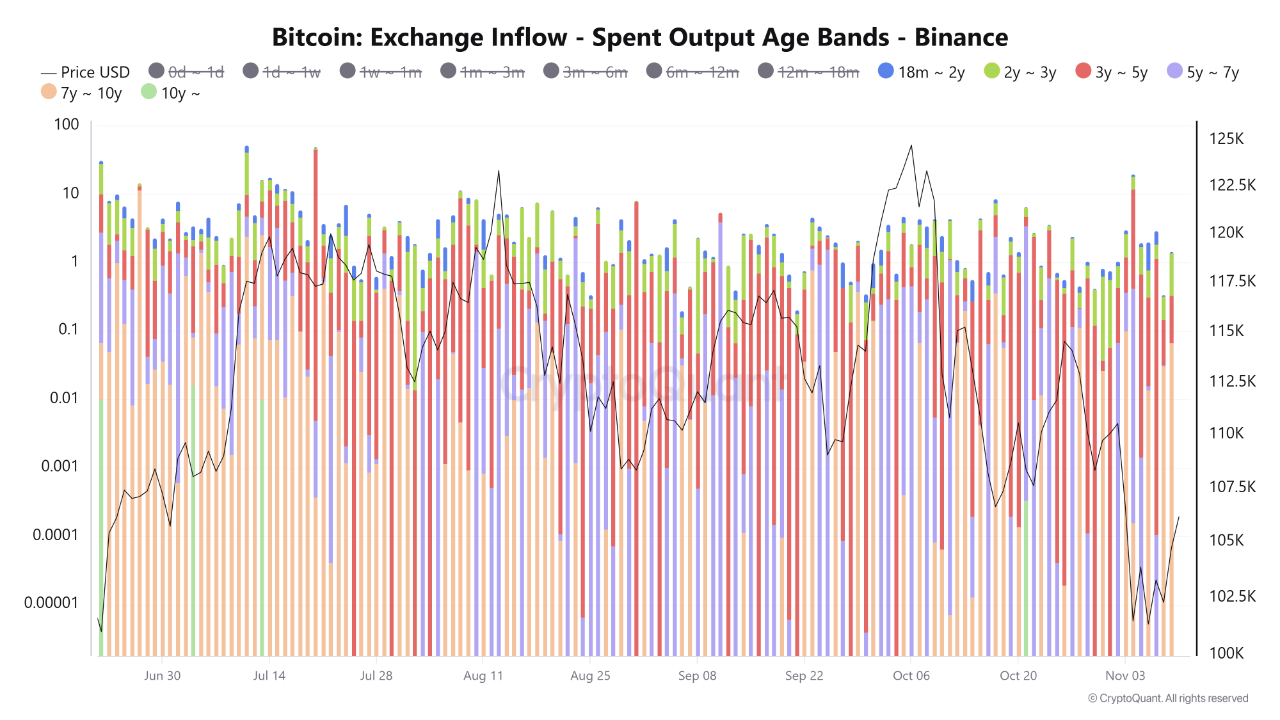

Analysts at CryptoQuant report a significant on-chain shift in November. Older Bitcoin wallets are recording their highest transfer activity to Binance since July. This movement coincides with the broader market correction seen over the past week.

The “Exchange Inflow – Spent Output Age Bands” indicator spiked sharply on November 4, led by coins aged between five and seven years, followed closely by those in the three-to-five-year range. These age groups typically represent large investors who tend to move coins only when preparing for significant market shifts.

Data shows renewed activity from the seven-to-ten-year age band, a group that has remained largely dormant since the previous cycle. Historically, when these older coins move, it marks a major turning point.

However, as per CoinMarketCap data, Bitcoin’s price has held steady near $106,000, indicating that the market is undergoing quiet redistribution rather than panic selling.

Related: What Next For Bitcoin Price as Strategy Raises STRE Offering to $715M?

Whales Repositioning, Not Panicking

According to Dr. Martin Hiesboeck, head of research at Uphold, long-term Bitcoin holders may be shifting their holdings to exchanges for strategic reasons. “There are several reasons why OG crypto holders are selling,” Hiesboeck explained.

The first, he stated, is to buy them back in the form of ETFs, which offer incredible tax advantages under current US rules. He added that some veteran holders are diversifying into blockchain-focused projects that promise higher returns.

“The second reason is that they have realized that the real revolution isn’t Bitcoin but Blockchain, which is being used in every industry.”

As pointed out by Lookonchain, early Bitcoin arbitrage trader Owen Gunden recently shifted 11,000 BTC to an exchange, completing his final transfer of 3,549 coins on Sunday, selling all his BTC holdings.

Cooling, Not Collapsing

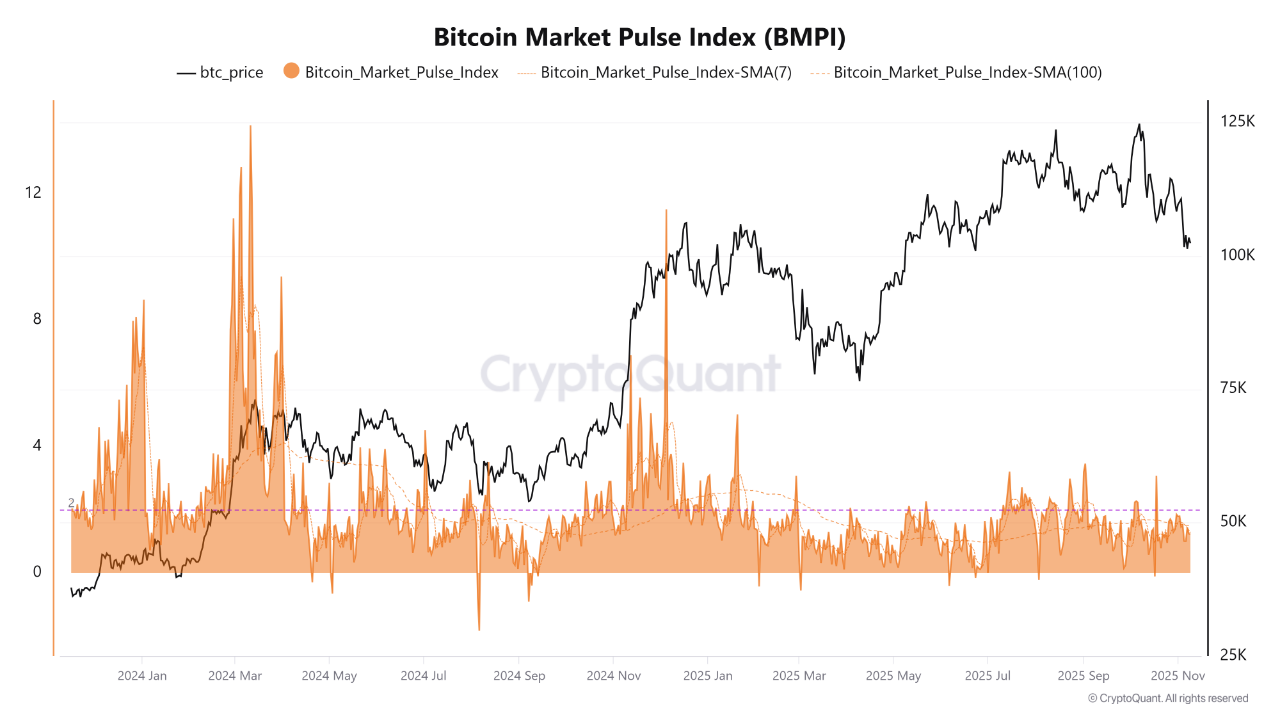

Meanwhile, the Bitcoin Market Pulse Index (BMPI), a metric combining exchange inflows, adjusted SOPR, hash price, and funding rates, shows that the market is cooling to a neutral zone rather than collapsing.

CryptoQuant analysts describe the current phase as a healthy mid-cycle reset, adding that the market is cooling, not collapsing, showing a healthy reset before the next expansion. The data shows that speculative leverage has declined, miner profitability remains stable, and funding rates are subdued, all symbols of consolidation rather than capitulation.

Related: Crypto Market Faces Volatile Week As Tariff Dividend, Shutdown End And Fed Liquidity Collide

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.