After rebounding from mid-year lows, Onyxcoin (XCN) is showing signs of a broader trend reversal. With technical indicators turning constructive and a key breakout confirmed, the coming years could present strategic opportunities for both traders and long-term holders.

Onyxcoin’s Journey to 2030: A Price Prediction Timeline

Table of contents

- Onyxcoin’s Journey to 2030: A Price Prediction Timeline

- Onyxcoin (XCN) Price Prediction 2025

- Onyxcoin (XCN) Price Targets 2025–2030

- Onyxcoin (XCN) Price Prediction 2026

- Onyxcoin (XCN) Price Prediction 2027

- Onyxcoin (XCN) Price Prediction 2028

- Onyxcoin (XCN) Price Prediction 2029

- Onyxcoin (XCN) Price Prediction 2030

- Conclusion

Onyxcoin (XCN) Price Prediction 2025

Onyxcoin price today is holding near the $0.0162 mark, having rebounded from June lows around $0.0127. The broader trendline resistance from the multi-month falling wedge has been breached on the daily chart, signaling potential trend reversal for 2025.

The RSI on daily chart currently sits above 57, indicating moderate bullish momentum, while MACD has flipped positive with a fresh crossover.

On the weekly chart, XCN is forming a long-term symmetrical triangle. If the breakout sustains above $0.0188 (Fib 0.618), bulls could push toward $0.0225 before year-end. However, strong supply near the $0.0207–$0.0220 zone remains a near-term cap. Support lies at $0.0140 and $0.0125.

Onyxcoin (XCN) Price Signals and Indicator Overview (1y)

Technical indicators for 2025 show a strengthening setup. The EMA ribbon on the daily chart is flattening, with price now trading above the 20/50 EMAs and nearing the 100 EMA around $0.0156. The Bollinger Bands have started expanding after a tight consolidation, often a precursor to a breakout move.

Onyxcoin price has reclaimed the supertrend support on the daily, flipping short-term bias to bullish. The Parabolic SAR dots are trailing below the candles, supporting upward continuation.

The Fibonacci retracement from the May swing high suggests targets at $0.0188 (61.8%) and $0.0205 (78.6%) as key bullish checkpoints.

Onyxcoin (XCN) Price Targets 2025–2030

| Year | Potential Low ($) | Potential Average ($) | Potential High ($) |

| 2025 | 0.0125 | 0.0180 | 0.0225 |

| 2026 | 0.0110 | 0.0200 | 0.0270 |

| 2027 | 0.0140 | 0.0235 | 0.0310 |

| 2028 | 0.0170 | 0.0265 | 0.0360 |

| 2029 | 0.0210 | 0.0305 | 0.0420 |

| 2030 | 0.0250 | 0.0350 | 0.0500 |

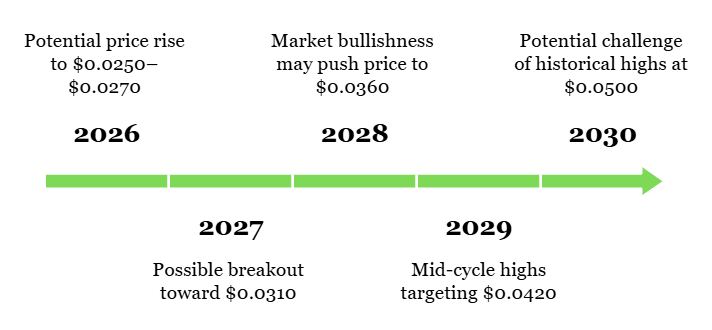

Onyxcoin (XCN) Price Prediction 2026

By 2026, XCN price could benefit from sustained network growth and a maturing bullish structure. If price reclaims and holds above the $0.0250–$0.0270 range, longer-term investors may step in. However, macro volatility and token unlocks may cause dips to $0.0110 before recovery resumes.

Onyxcoin (XCN) Price Prediction 2027

In 2027, historical chart symmetry suggests a potential cup-and-handle pattern breakout. If Onyxcoin maintains structural integrity above $0.0200, a push toward $0.0310 could materialize. Momentum indicators may continue to signal long-term accumulation zones above $0.0140.

Onyxcoin (XCN) Price Prediction 2028

As adoption scales and overall sentiment improves across altcoins, Onyxcoin may ride the wave of broader market bullishness in 2028. With volume increasing, price could gravitate toward the $0.0360 mark, especially if institutional interest expands. Dips may remain protected above $0.0170.

Onyxcoin (XCN) Price Prediction 2029

The year 2029 could be pivotal for reaching mid-cycle highs. A confirmed bullish channel targeting $0.0420 may take shape as long as the asset stays above $0.0250. Bullish divergence on weekly MACD, if repeated, could mirror past acceleration phases.

Onyxcoin (XCN) Price Prediction 2030

Looking toward 2030, Onyxcoin has the potential to challenge its historical highs and re-enter price discovery if ecosystem upgrades or listings drive demand. A high around $0.0500 is plausible, with the average expected to stabilize near $0.0350 amid increased volatility and market maturity.

Conclusion

Onyxcoin’s technical landscape has shifted from heavy selling to base-building, with key indicators suggesting a maturing trend reversal. While volatility will remain part of its journey, the gradual rise in support levels, bullish momentum on key indicators, and breakout formations imply that XCN price may offer multi-year upside potential through 2030. Traders and long-term investors should watch for sustained closes above $0.0200 and protective floors at $0.0125–$0.0140.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.