- OPEN surges 170% in a day, highlighting extreme volatility and investor interest.

- Key support at $1.00 and resistance near $1.70–$1.75 guide short-term trends.

- Open interest spikes 338%, signaling active trader positioning and potential swings.

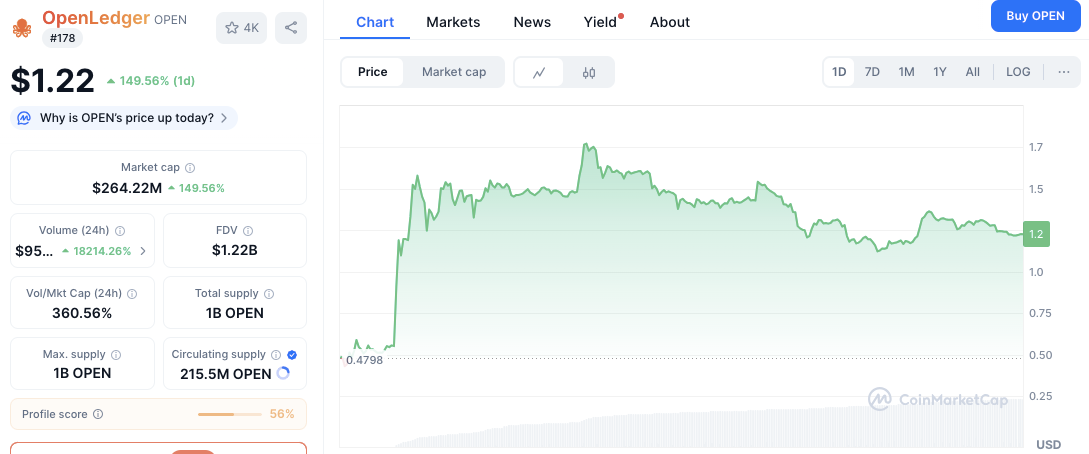

OpenLedger (OPEN) just put on a masterclass in volatility, exploding by over 170% in a single day to hit $1.21. The cryptocurrency’s market capitalization now sits at $262.45 million, fueled by heightened trading activity exceeding $94 million in the past 24 hours.

With a relatively low circulating supply of only 215.5 million tokens, this kind of explosive move has traders on high alert for what comes next.

Price Trend Analysis and Key Levels

The price initially broke out from roughly $0.48, quickly climbing above $1.70, signaling a sharp bullish momentum. Sellers stepped in around the $1.70–$1.75 zone, forming a temporary peak and prompting a retracement. Currently, OPEN is consolidating between $1.20 and $1.50, a critical range to monitor for trend continuation.

Immediate support stands at $1.00, a psychological level that could prevent further downside. If selling pressure intensifies, the $0.75–$0.80 range serves as the next major support. On the upside, reclaiming $1.50 could reignite bullish momentum, while breaking above $1.70–$1.75 would challenge the previous high and potentially signal further gains.

Are the Technicals Flashing Warning Signs?

Technical readings offer a nuanced picture. The MACD line remains below the signal line, with a negative histogram, indicating that sellers currently dominate. Specifically, the MACD sits at 0.15488 versus a signal of 0.28878, showing a bearish crossover.

Related: KuCoin Lists OpenLedger (OPEN), an AI Blockchain for Data and Model Monetization

Meanwhile, the RSI is at 42.23, suggesting the asset is neither overbought nor oversold. This neutral reading implies that OPEN has room to move in either direction, though the slight bearish leaning should caution traders against assuming immediate upward momentum.

Why the Derivatives Market is the Real Story

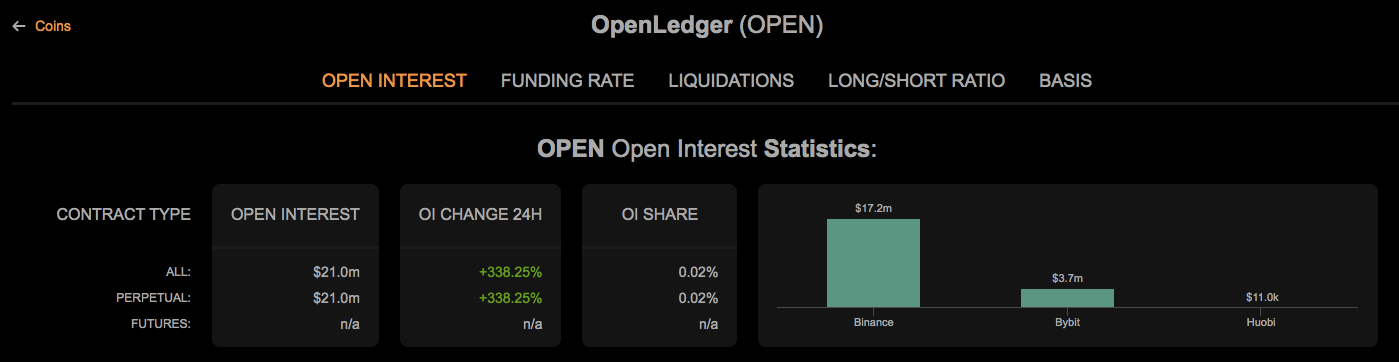

Open interest for OPEN perpetual contracts underscores the market’s enthusiasm. Total open interest has jumped to $21 million, reflecting a 338.25% increase in just 24 hours.

Binance holds the largest share at $17.2 million, followed by Huobi at $11 million and Bybit at $3.7 million. Such a dramatic rise signals that traders are actively positioning themselves, creating potential for both rapid gains and sudden price swings.

Related: OpenLedger (OPEN) Price Prediction 2025, 2026, 2027–2030

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.